By Bruce Beaubouef, Managing Editor

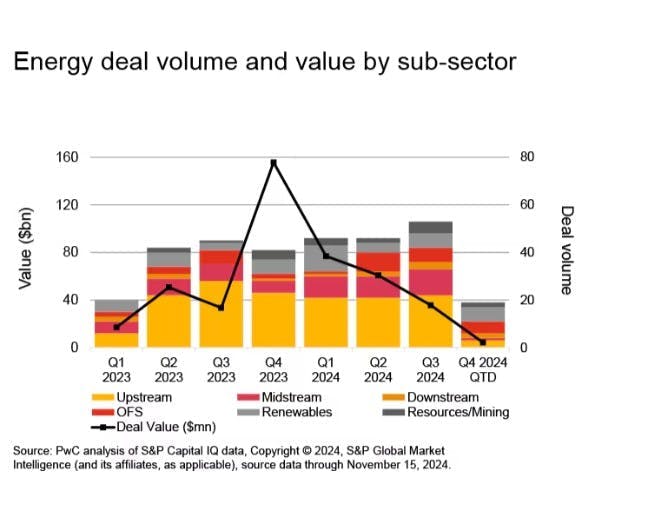

A new report issued by PwC says that the effects of upstream global megadeals over the past year “have profoundly reshaped the energy sector.”

The report, entitled “Energy: US deals 2025 outlook,” indicates that industry consolidation, which has already transformed the upstream market, is now occurring among midstream and oilfield services firms, creating both opportunities and the need for change in the sector. “This across-the-board consolidation is also driving growth and innovation in the industry,” says PwC.

However, PwC says that there are several challenges that energy executives must navigate, including shifts influenced by geopolitics, government initiatives and a focus on energy security and sustainability.

Other mergers and acquisitions (M&A) trends in the sector include:

- Strategic buyers are streamlining operations and honing core competencies to enhance financial performance.

- The mining and minerals subsector is experiencing ongoing consolidation and deals aimed at securing critical supplies, such as nickel, cobalt, and graphite, in support of growing manufacturing demands of solar panels, batteries for storage, and electric vehicles (EVs). Investments are growing, with recycling also expected to play a significant role.

- Geopolitical tensions and uncertainty around OPEC+ production cuts are likely to influence oil prices. Conflicts in Europe and the Middle East could add further risks to oil supplies.

The “big takeaway” from the report is that the new Trump administration is expected to continue focusing on “traditional” energy sources, with PwC predicting a surge in oil and gas M&A alongside continued renewable investments as data centers drive up energy demand.

Key trends in 2025 will include:

- Record oil production: Despite regulatory hurdles under the Biden administration, US oil production hit an all-time high in August, signaling further growth potential. The new administration's policies may include increasing energy production through expanded drilling, reducing regulation, and scaling back renewable energy initiatives.

- Strategic buyers dominate: A wave of consolidation is sweeping the midstream sector, with strategic buyers outpacing private equity firms.

- LNG poised for growth: The anticipated end to the LNG permit pause could unlock significant M&A activity and infrastructure investments.

- “All-of-the-above” approach: Even with an expected focus on fossil fuels, the US is adopting a diversified strategy to meet growing demand, driven by data centers. This includes investments in oil, natural gas, nuclear, coal, and renewables.

The PwC report can be found here.