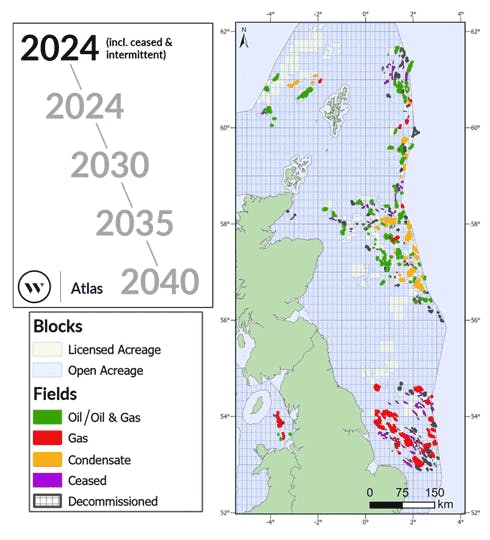

Exploration holding steady offshore Norway, UK still faces uncertainty

Norway’s offshore production should increase to 4.2 MMboe/d following the startup of seven new field and four brownfield developments, according to a recent Westwood Global Energy Group report.

The projects contain total estimated recoverable reserves of 1.1 Bboe. Equinor’s Johan Castberg project in the Barents Sea is the largest, and it should go online shortly following numerous schedule delays.

The government’s introduction of temporary tax terms in 2020-2022, brought on by the COVID-19 crisis, spurred many of the current developments. However, Westwood only expects three new greenfield projects to be sanctioned in 2025, with combined reserves of about 225 MMboe.

Norway faces declining production later in the decade, although the rate should be slowed through investments in existing facilities, new developments and results from sustained exploration.

At the same time, balancing this activity with supply chain inflation will be critical to safeguarding project economics, Westwood’s analysts believe.

This year the consultants expect 44 exploration wells to be spudded offshore Norway with pre-drill resources of about 3.2 Bboe. Many are deferrals from 2024, due to rig schedules.

Related content:

Heavy focus on near-field exploration in latest offshore Norway license awards

The Norwegian Energy Ministry has offered 20 E&P companies interests in 53 production licenses under Norway’s 2024 pre-defined areas (APA) offshore leasing round.

Efficiency measures boost gas, oil production offshore Norway

Gas production across the Norwegian Continental Shelf last year reached a new high of 124 Bcm, according to the Norwegian Offshore Directorate.

Operators plan 15 wells in both the northern North Sea (all close to existing infrastructure) and in the Norwegian Sea, where the pre-drill resources are three times higher. And three of those wells are potentially high impact.

Eight exploration wells are planned in the Barents Sea, and four more are appraising a volume of at least 145 MMboe.

In the much more subdued UK offshore sector, where only three exploration wells and one appraisal well were drilled last year, there is the chance of a slight recovery in 2025.

Westwood is tracking 10 potential exploration wells that could be targeting 545 MMboe pre-drill, but at the same time, many may not be sanctioned due to the UK’s fiscal environment.

All the planned exploration wells are in the central UK North Sea, except for the Dabinett well in the southern sector. Three appraisal wells may be drilled to assess a volume of about 230 MMboe.