Tracy Dulle • Houston

United States

Royal Dutch Shell is the apparent high bidder on 275 lease blocks in the Feb. 6 US Outer Continental Shelf Lease Sale 193 in the Chukchi Sea, offshore northwest Alaska. Shell’s high bids totaled $2.1 billion.

“I am pleased with our results at Sale 193,” says David Lawrence, Shell executive VP of exploration. “We are committed to exploration for new oil and gas in high potential basins. Our entry into the Chukchi Sea, combined with our lease holdings in the Beaufort Sea, further solidifies our position in Alaska, which has the potential to become a new heartland for Shell.”

North Sea/Europe

The Kvitebjørn field in the North Sea is back onstream after the pipeline from Kvitebjørn to Kollsnes was shifted out of position and damaged by a ship’s anchor in 2007.

According to the company, the pipeline has sufficient technical integrity and is qualified for temporary operation. The Petroleum Safety Authority Norway has been monitoring the situation.

The pipeline repairs are weather dependent and are scheduled for the summer season. Production at Kvitebjørn has been resumed, and gas from Visund and Kvitebjørn is now being transported to Kollsnes.

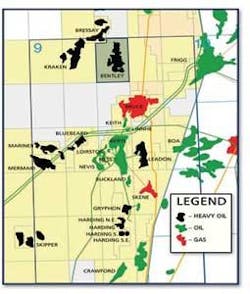

Xcite Energy’s 9/3b-5 appraisal well on the Bentley field was drilled to 4,105 ft (1,224 m) TD and encountered heavy oil bearing Paleocene Upper Dornoch formation sands. The well test met all of the company’s principal objectives, including confirming the characteristics of the reservoirs and obtaining productivity data.

The characteristics of the reservoir were confirmed as:

- High porosity and permeability unconsolidated sandstone

- Temperature of over 103º F

- Depth to top of reservoir 3,712 ft (1,131 m)

- No gas cap.

Xcite Energy has seen positive results from the 9/3b-5 appraisal well on the Bentley field.

Based on these results, Xcite believes comm- ercially viable production rates are achievable through horizontal well technology coupled with artificial lift, including submersible pumps. The company intends to plan for the next phase of the development process which will include EOR techniques.

Based on the success of 9/3b-5, the company also intends to re-process the 3D seismic data over the block to confirm the results of its recent 3D interpretation.

The Bentley heavy oil field is on block 9/3b (license P. 1078). Xcite Energy holds 100% working interest. Bentley has been drilled by three of the four previous wells on block 9/3b: 9/3-1 (Amoco, 1977), 9/3-2A (Conoco, 1983), and 9/3-4 (Conoco, 1986). This is the fifth well on the block.

Eni Norge AS has concluded drilling of appraisal well 6507/2-4 on the 6507/2-2 discovery in the Norwegian Sea.

The well proved gas and condensate 4.5 km (2.8 mi) from the discovery well. The appraisal well indicates that the total size of the discovery is within the range of 12-19 Bcm (424-671 Bcf) of recoverable gas and 0.8-1.1 MMcm (28-39 MMcf) of recoverable condensate. The well was not tested, but extensive data collection and sampling were carried out. According to the company, results are encouraging for future development.

This is the fourth exploration well in production license 122.

Middle East

The Syrian Ministry of Oil and Mineral Resources and the Syrian Petroleum Co. have approved commercial development of the Khurbet East field, according to Emerald Energy Plc.

Field development is intended to begin immediately to establish production from the shallow Cretaceous Massive reservoir as soon as an early production facility (EPF) can be installed. An EPF capable of processing 10,000 b/d of oil is expected to be operational by 4Q 2008.

Engineering and construction of the EPF was scheduled to begin in 1Q 2008. The first phase of development will consist of the construction and installation of the EPF, and the drilling of up to three wells, Emerald says.

Khurbet East was discovered in 2Q 2007 with the Khurbet East No.1 well. Two appraisal wells have been drilled and tested since, with Khurbet East No.2 flowing 710 b/d of oil from a 10-m (33-ft) section and Khurbet East No. 3 flowing 3,420 b/d of oil from the full section of the Massive reservoir.

Emerald holds a 50% interest in block 26 through its subsidiary SNG Overseas Ltd. Gulfsands Petroleum Syria Ltd. is operator and holder of the remaining 50% interest.

BP Egypt has discovered gas at record depths in the Nile Delta. BP says the Satis discovery is in the North El Burg Offshore, Nile Delta concession, 50 km (31 mi) north of Damietta.

The red dot indicates where BP Egypt has discovered gas at the Satis in the North El Burg Offshore in the Nile Delta.

The well was drilled with theConstellation II jackup rig in a water depth of 90 m (295 ft) to a Nile Delta record depth of more than 6,500 m (21,325 ft) and is the first significant high-pressure/high-temperature, offshore Oligocene discovery.

According to BP, the parties to the North El Burg offshore concession agreement are: BP (operator, 50%) and IEOC (50%), the affiliate of Italy’s ENI in Egypt.

West Africa

Drilling has begun on the Aje 4 well offshore Nigeria, according to Providence Resources.

AJE Partners include: Yinka Folawiyo Petroleum (operator), Chevron Nigeria Deepwater (technical advisor), Vitol Exploration Nigeria, Energy Equity Resources Aje, and P.R. Oil and Gas Nigeria.

The AJE 4 well is being drilled using Transocean’sDeepwater Pathfinder drillship with operations expected to take up to nine weeks.

Sterling Energy says an appraisal well was to be drilled on the Banda discovery in Mauritania at the end of 1Q 2008 by theAtwood Hunter. It then is scheduled to drill two development wells and three workovers on the 50 MMbbl Chinguetti field during 2Q 2008. The company hopes to more than double field production, which in 4Q 2007 averaged 12,300 b/d of oil. Petronas has completed the acquisition of Woodside’s interests in Mauritania, including Chinguetti, and has taken over as field operator.

Asia

CNOOC Ltd.’s LiuHua (LH) 11-1 oil field in the eastern South China Sea, has fully restarted production. The field is operating steadily and producing 23,000 b/d of oil.

LH 11-1 started temporary production on June 27, 2007. During the process, all its 25 wells, which had been suspended for more than a year, successfully re-opened, CNOOC says.

LH 11-1 suspended production following typhoon Chan Chu in May 2006, when parts of its production facilities were damaged.

CNOOC Ltd.’s Bo Zhong (BZ) 34-1 oilfield in Bohai Bay in northeastern China has successfully come onstream two months ahead of schedule. More than 4,800 b/d of oil are currently being produced from seven wells.

The development facilities of BZ 34-1 include one central platform and one wellhead platform.

According to the ocean drilling program plan, there are more than 20 producing wells in BZ34-1, and other wells will come onstream in 2008. The peak production of the field is expected to reach 12,000 b/d of oil.

Roc Oil (China) Co.’sMurmanskaya jackup is drilling the Wei 6-12E-1 exploration well on a stratigraphic-structural prospect 1.7 km (1.1 mi) east of the Wei 6-12S-1 oil discovery in the Beibu Gulf, offshore China.

Wei 6-12E-1 is the second of the planned three well exploration/appraisal drilling programs in block 22/12.

Participating interests in the block 22/12 joint venture are Roc Oil Co, operator with 40%; Horizon Oil Ltd., 30%; Petsec Petroleum, 25%; and Oil Australia Pty Ltd., 5%.

Australia

Roc Oil (WA) Pty Ltd. has begun a two-well exploration/appraisal drilling program in WA-286-P, in the North Perth basin, offshore Western Australia.

TheWilCraft jackup drilling rig commenced drilling the Lilac-1 exploration well on Feb. 3 in 33 m (108 ft) of water approximately 2.5 km (1.6 mi) east of the Dunsborough-1 oil and gas discovery made in the permit in June 2007.

Roc Oil has begun a two-well exploration/appraisal drilling program in WA-286-P, in the North Perth basin.

Lilac-1 is expected to reach a TD of 1,435 m (4,708 ft) below the rotary table in mid-February 2008. On Feb. 4, it was preparing to run 13 3/8-in (34-cm) casing, Roc says.

Following the drilling of Lilac-1, the Frankland-2 appraisal well, also in WA-286-P, is scheduled. The two-well drilling program was expected to be completed by the end of February 2008.

Participating interests in the WA-286-P joint venture are Roc Oil with 37.5%; AWE Oil (Western Australia) Pty. Ltd. with 27.5%; ARC (Offshore PB) Ltd. with 30%; and CIECO Exploration and Production (Australia) Pty. Ltd. with 5%.

Apache Corp. reported its first offshore discovery from its 2008 exploration program.

The Brulimar-1 on Australia’s Northwest Shelf encountered 113 ft (34 m) of net pay in the Upper Triassic Mungaroo sandstone. Brulimar-1 is the fourth consecutive exploration success in the Apache-operated WA-356-P block; Apache owns a 65% interest in the block in a joint venture with Kufpec.

“The Brulimar-1 is a significant discovery because it continues to validate our use of advanced geophysical techniques to identify specific stratigraphic targets and accurately predict reservoir thickness before we drill a well,” says G. Steven Farris, Apache’s president and CEO.

In Australia, Apache is planning to drill 52 wells, including 32 exploration wells, in 2008. The schedule includes four additional exploration wells on the Julimar-Brunello trend and Apache’s first exploration program in the Gippsland basin off the coast of the southeastern state of Victoria. The first of Apache’s eight wells, the Wasabi-1, was scheduled to spud around Feb. 1.