Judy Maksoud • Houston

Europe

ConocoPhillips recently received approval from the UK Department of Trade and Industry to develop the Saturn Unit area in the southern North Sea.

First gas production from Saturn is expected in 4Q 2005 at an initial gross rate of 75 MMcf/d. Production is expected to increase to 170 MMcf/d within a year following start-up.

The Saturn Unit area lies in blocks 48/10a and 48/10b of the UK continental shelf, 23 mi north of the Lincolnshire Offshore Gas Gathering System (LOGGS). Initially, the development will consist of three wells from a normally unattended six-slot wellhead platform, located over the suspended appraisal well in 82 ft of water. A 27-mi, 14-in. gas export pipeline will tie the platform back to new reception facilities to be added to LOGGS.

ConocoPhillips Ltd. operates the Saturn Unit area with 42.9% interest.

OAO Lukoil subsidiary, OOO Lukoil-Kaliningradmorneft, started commercial production at the Kravtsovskoye D-6 field in the Baltic Sea in early 3Q.

A geological survey indicates recoverable reserves of 9.1 million tons. Investments in field construction totaled nearly $264 million.

Drilling is performed from an offshore ice-resistant stationary platform manufactured at OOO Kaliningradmorneft steelworks. This is the first production platform in the Russian offshore that was designed and manufactured domestically. The platform construction is part of the 10-year federal development program for the Kaliningrad region, approved by a government resolution in December 2001.

One producing well has been drilled, and drilling is underway at the second well. Twenty seven wells are planned.

OOO Lukoil-Kaliningradmorneft expects to produce 70,000 tons of crude before year-end. By 2007, crude production will reach 600,000 tons.

Asia-Pacific

Santos Ltd. and ConocoPhillips – already joint venturers in the giant Bayu-Undan liquids and LNG projects – have joined forces to explore another Timor Sea prospect. Santos announced that its subsidiary, Santos Offshore Pty Ltd., has concluded a farm-out arrangement with ConocoPhillips' subsidiary, ConocoPhillips Australia Exploration Pty. Ltd., to participate in exploring a major gas prospect in the NT/P61 license area in the Timor Sea.

ConocoPhillips will earn 60% equity and become operator of the NT/P61 exploration permit area under the terms of the arrangement. It will fund elements of the permit area work program including the Caldita 1 well (previously shown by Santos as the Melville prospect).

Santos, which was granted the NT/P61 exploration permit in 2001 as 100% equity holder and operator, will retain a 40% interest in the permit area. The agreement is subject to approval by relevant authorities.

The NT/P61 permit area covers over 5,300 sq km and is adjacent to the Evans Shoal gas field in which Santos operates with 40% equity.

It is 390 km from the Bayu-Undan liquids and LNG fields in which Santos and ConocoPhillips have an existing joint venture relationship.

Central Asia

Eni has a new discovery in the North Caspian production-sharing agreement (NC PSA) contract area offshore Kazakhstan.

The first exploration well on the Kairan prospect encountered hydrocarbon-bearing intervals and will be evaluated for commercial viability. Kairan is the fifth discovery on the NC PSA following Kashagan, Kalamkas, Kashagan Southwest, and Aktote. Kairan is 25 mi east of Kashagan.

Drilling on Kairan-1 was carried out from an artificial island. The well was drilled to 12,630 ft TD in 2003, then suspended because of icy weather conditions. Testing began in March 2004.

Eni operates the NC PSA with 16.67% interest.

Development offshore Kazakhstan now includes a new drilling facility. National Oilwell was awarded a letter of intent for designing and constructing a drilling facility for Agip Kazakhstan North Caspian Operating Co.'s (Agip KCO) "D" Island project in the Kashagan field.

The project includes two complete harsh environment land drilling rigs and all of the drilling support equipment. The harsh-environment rigs are specially designed to drill on artificial islands in the North Caspian Sea, where winter conditions are challenging.

This project specifies 3,000-hp rigs capable of drilling 25,000-30,000 ft. The rigs must be movable fully erected from one well location to the next via rail.

The rigs will be assembled and commissioned at National Oilwell facilities in Houston with equipment and products coming from the company's plants in Norway, Canada, China, and the US. Rig shipment is scheduled for 3Q 2005.

Middle East

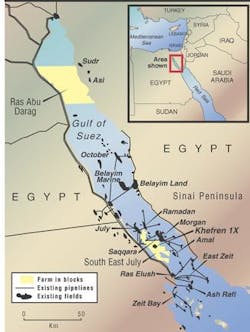

Santos Ltd. has expanded into its first North African exploration venture with a farm-in into a joint eight-well exploration program in the Gulf of Suez offshore Egypt.

Santos has farmed in to two concessions in the Gulf of Suez offshore Egypt.

null

Santos agreed to acquire a non-operated equity position in three exploration concession agreements, two of which are offshore. The offshore portion of the farm-in covers 1,173 sq km.

Santos' participation will earn equity in the Ras Abu Darag concession and South East July concession in 40-60 m of water. The first well, Khefren 1X, was planned for mid July in the South East July block.

Africa

Dana Petroleum has farmed in to block 8 offshore Mauritania. Wintershall AG has agreed to pay all of Dana's costs through the end of the current exploration period, including acquisition, processing, and interpretation of a major 3D seismic survey. Wintershall will be assigned a 38.5% interest in the block 8 PSC.

Dana will operate the PSC with 41.5% interest. Partners include Wintershall with 38.5%, Hardman Resources with 18%, and Roc Oil with 2%.

Following the recent Pelican gas discovery in block 7, Woodside Mauritania Pty Ltd. exercised its option to become a coventurer in the block 7 PSC.

Dana's next exploration well offshore Maur- itania will target the Petrel prospect in block 1, which could hold 400-800 MMbbl of oil.

Amerada Hess Corp. has received government approval to develop Northern block G offshore Equatorial Guinea.

The integrated development plan for the Okume, Oveng, Ebano, and Elon reservoirs calls for a combination of two TLPs set in 900 ft and 1,750 ft of water and four fixed platforms set in 150-230 ft of water. The company will drill 29 producing wells. The plan also provides for 16 water-injection wells and two gas-injection wells to maintain reservoir pressure and enhance oil recovery.

Production from the fields will be gathered at a central processing facility in the shallow-water Elon field. A 24-km undersea pipeline will connect the facility to the Sendje Ceiba FPSO, which is now processing, storing, and offloading crude production from the nearby Ceiba field.

The partners will invest $1.1 billion over the life of the development.

Kosmos Energy's Ghanaian affiliate, Kosmos Energy Ghana HC, has signed its first major contract for West African acreage with a petroleum agreement for the West Cape Three Points block offshore Ghana.

The 1,957-sq-km block lies in the Gulf of Guinea's Tano basin 8 km from the Ghanaian coastline. Kosmos and its partners will conduct a 1,000-sq-km 3D seismic survey later this year.

Pan-Ocean Energy Corp. Ltd. had a discovery on the exploration well EAVOM-1, on the Avouma prospect 16.5 km south of the company's producing Etame field offshore Gabon, West Africa.

EAVOM-1 is the second discovery made on the Etame permit this year.

Mediterranean

BP Egypt had a new gas discovery in the Western Nile Delta. The Polaris 1 exploratory well is the second discovery in the West Mediterranean Deep Water concession, following Ruby in 2002. Polaris 1 is 75 km northwest of Alexandria in 1,162 m water depth.

The well tested and flowed gas at a rate of 26.5 MMcf/d from a Mid-Pliocene age slope channel play at a depth of 2,178 m.

Americas

Recent drilling offshore Cuba has been somewhat disappointing, but won't arrest exploration.

Repsol YPF contracted Ocean Rig's Eirik Raude semisubmersible to drill the first ultra-deepwater well off the northwest coast of the island in the Gulf of Mexico in June.

Unfortunately, the well produced uncommercial hydrocarbons. Yamagua 1 is the first well to be drilled on one of six blocks awarded to Repsol by the Cuban government in December 2000. Under its contract, Repsol is to drill in all six of the offshore blocks.

Sherritt International, a Canadian mining and energy company, recently purchased four deepwater blocks, N16, N23, N24, and N33, that adjoin Repsol's acreage. Sherritt's blocks span 2 million acres, and the company is now analyzing 3D seismic data gathered over its holdings.

According to Ernie Lalonde, Sherritt's vice president of investor relations and corporate affairs, the company is preparing to drill its deepwater acreage.

"We are the largest producer onshore Cuba, accounting for over half of Cuba's oil production," Lalonde says.

Interestingly, the onshore production actually comes from shallow-water fields that are produced via directional drilling from onshore rigs.

According to Lalonde, Cuba has an objective of being self sufficient for power generation. Sherritt is hoping to expand its production and is looking to its deepwater acreage for potential.

China pushes for production

CNOOC Ltd. hit oil late in 2Q with wildcat well Huizhou (HZ) 26-3 in the Pearl River Mouth basin of the South China Sea.

HZ 26-3-1 lies 170 km southeast of Hong Kong. It was drilled to 3,780 m TD in 110 m water depth.

Zhang Guohua, senior vice president of exploration, says, "Positive exploration results through independent activities in the area will help maintain the eastern South China Sea as a core production basin for CNOOC. Successes of this nature fuels further exploration interests in the area."

CNOOC owns 100% interest of the discovery.

At about the same time, CNOOC brought its Qikou (QK) 18-2, a new oil field in the Western part of Bohai Bay onstream.

The field produced more than 2,800 b/d from five wells.

Located about 6 km southwest of the producing field QK 18-1, QK18-2 is part of the Boxi oil field.

In late July, the company announced that shallow-water field Caofeidian (CFD) 11-1/11-2 in the western part of Bohai Bay came onstream ahead of schedule. Gross production is expected to reach 15,000-20,000 b/d within the next several months. Peak production is expected to reach 40,000 to 45,000 b/d of oil by mid-2005.

The Hai Yang Shi You 112 FPSO is producing the field. The first phase of the development includes one 48-slot wellhead gathering platform and one 24-slot wellhead platform.

Kerr-McGee operates the field with 40% interest. CNOOC Ltd. Holds 51% interest, while Ultra Petroleum subsidiary Sino-American Energy Corp. owns the remaining 9%.

CNOOC Ltd. is actively exploring and developing four offshore areas, covering Bohai Bay, Western South China Sea, Eastern South China Sea, and East China Sea.