Erha field scheduled for 2006 production

Judy Maksoud

International Editor

Working in diverse areas of the world impacts finding and development costs, creating critical challenges for inter-national oil companies. Exxon Mobil Corp. has risen to the challenge in West Africa and is making progress toward bringing its discoveries into production.

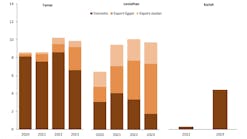

Deepwater volume growth remains strong in West Africa. For Exxon, growth over the next few years will include reserves from the Bosi, Yoho, Erha, and Shell-operated Bonga fields, as well as others where ExxonMobil is a stakeholder. Bonga is the industry's first deepwater development offshore Nigeria.

A milestone

The Exxon-operated Yoho field came onstream in 2002. Subsidiary, Mobil Producing Nigeria Unlimited, introduced an early production system (EPS) to Yoho to produce the field nearly two years ahead of scheduled production. Full-field start-up is scheduled for late 2004 and will include additional wellhead platforms, a central production platform, a living quarters platform, and a floating storage and offloading (FSO) vessel, which will replace the FPSO. Target peak production is 150,000 b/d.

Rex W. Tillerson, senior vice president, ExxonMobil, commented on the Yoho development at the Goldman Sachs Global Energy Conference 2004. "The commencement of Yoho construction activities, including the first deployment of an EPS in West Africa, represents an important milestone for ExxonMobil in Nigeria," Tillerson said. "The ability to advance production, as we will do with Yoho by over two years, not only improves the project's economics, but also meets the government's objective of increasing production capacity."

The next step

Erha will be ExxonMobil's next field to come onstream offshore Nigeria.

ExxonMobil affiliate Esso Exploration and Production Nigeria Ltd. (EEPN) confirmed the Erha deepwater oil and gas discovery in OPL 209, 100 mi southeast of Lagos in December 1999.

Target production rate for Erha is 210,000 b/d of liquids. The project will cost an estimated $2.6 billion and is scheduled to begin production in early 2006.

Construction began on Erha in October 2002. The project features a flexible design that will position it for use as a strategic hub on future OPL 209 deepwater developments.

Plans for field development center around an FPSO with 24 subsea wells: 15 production wells, four gas injection wells, and five water injection wells. Once production is underway, oil will be offloaded via a single point mooring offloading buoy.

Initial annual average production is targeted at 150,000 b/d of oil. Gas will be re-injected to maximize oil recovery and eliminate routine flaring.

The FPSO will have a hull measuring 285 m long, 63 m wide, and 32 m high and will carry 24,000 metric tons of production modules and living quarters. The vessel will have 2.2 MMbbl of storage capacity and an initial production capacity of 165,000 b/d of oil.

Bouygues Offshore, a company owned by Saipem, won the contract to supply the Erha FPSO in November 2002. The FPSO is scheduled to arrive on the Erha field in 2005, in line with planned start-up in early 2006. Engineering and procurement services will be performed in France and Nigeria.

ExxonMobil has invested in several blocks, including OPL 209 offshore Nigeria.

null

In April 2003, Saipem SA and EEPN awarded classification work for the new vessel to Det Norske Veritas. DNV will classify the hull and mooring system of the FPSO. The project will be a cooperation among DNV stations in Norway, Houston, Ulsan, Pusan, and Singapore.

The hull will be built at Hyundai Heavy Industries' (HHI) yard in Ulsan, South Korea. It is expected to be completed by 4Q 2004, when it will be towed to the Singaporean Sembawang yard for topside integration. The plan is to have the vessel ready for offshore commissioning at the Erha field by the end of next year.

EEPN has also awarded construction and fabrication contracts valued at more than $1.1 billion for the offshore facilities. Some of the contracts were awarded to local contractors and suppliers.

Nigerian companies will carry out engineering, fabrication of FPSO topsides, assembly of wellhead manifolds and components, fabrication of the surface buoy and offshore piles, jointing of pipe and installation of pipe coating, marine transportation and other logistical services and components such as the flare tower and structural modules, and system integration testing of all subsea equipment.

In Nigeria, EEPNL and other ExxonMobil subsidiaries hold interests in six deepwater blocks covering 3.2 million acres. EEPNL interests in deepwater discoveries in Nigeria include 20% interest in Bonga and Bonga Southwest in OML 118, 20% in Bolia in OPL 219, 47.5% in Chota in OPL 220, and 30% in Usan in OPL 222. Esso operated OPL 209 from 1993 and held 56.25% interest in the license. Shell Nigeria Exploration and Production Co. Ltd. (SNEPCO) held the remaining 43.75%.