Regional conflict putting pressure on Israel’s offshore gas producers

Upstream activity offshore Israel has remained relatively stable despite the current regional conflict, according to Rystad Energy.

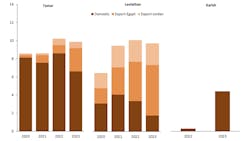

The country’s gas production increased by 15% last year and is set to grow by 5% this year, supported by growing volumes from Energean’s Karish field.

While Energean and others are working on plans for about $2 billion in greenfield investments for various offshore projects over the next two years, Karish and the Katlan development could both be at risk if tensions escalate.

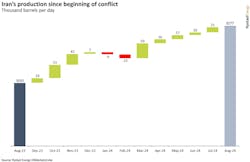

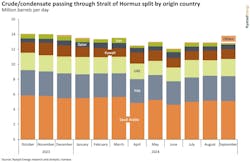

If the conflict remains largely a proxy war, there may not be major assaults on oil and gas infrastructure in Iran or Israel such as pipelines, storage facilities or refineries.

There could, however, be an impact on the maritime border agreement for the eastern Mediterranean Sea that Israel and Lebanon signed in October 2022. That gave Israel full rights to Karish and Lebanon to the Qana field.

Rystad believes escalating tensions could lead to cancellation of this agreement, and that could impact both production from Karish and Israel's gas exports to Egypt and Jordan.

Reduced output from Karish (all reserved for Israel’s domestic market) could be offset by increased production from the offshore Tamar and Leviathan fields, both operated by Chevron.

Karish and Karish North, containing about 88 Bcm of 2P reserves, are the bedrock of Energean’s operation following its sale of its Croatian, Italian and Egyptian E&P interests earlier this year.

The company also plans to start gas production by 2027 from the offshore Katlan fields (Athena and Zeus), both close to Karish and the maritime border with Lebanon. However, escalation in unrest could delay startup, Rystad suggested.

Karish was shut in for a short period following the Oct. 7 Hamas attack last year, although no direct assaults followed on the facilities.

But if the Karish field is attacked at some point, that could put pressure on exports from Tamar and Leviathan to neighboring countries. That could also impact Jordan and Egypt, both of which are heavily dependent on Israeli gas, according to Rystad. Both countries have been hit recently by power blackouts.

Other oil and gas investors may also postpone their development plans. Following the Oct. 7 incident, UAE and bp decided to suspend their offer of a jointly 50% stake in Israeli E&P company NewMed Energy, a partner in Leviathan.

Rystad does not anticipate any further M&A announcements or investment activity in Israel under this scenario, until the conflict has been resolved.