Independent gets largest offshore block ever

Jeremy Beckman

Editor, Europe

Exploration drilling could soon resumeoff northern Korea, after a 15-year gap. This follows the recent signing of a production sharing agreement between the government of the Democratic People’s Republic of Korea (DPRK) and the London-based independent Aminex. The acreage awarded is the most extensive offered to date to one company, covering the entire West Sea basin in northern Korean waters, part of the East Sea offshore basin, and three onshore basins.

Over the past decade, numerous foreign oil companies have been granted smaller concessions, only to exit after limited work programs. Most were frustrated either by limited funds or the scale of data-gathering required to build on earlier exploration by Korean institutes and Soviet contractors. These exercises, conducted mainly in the 1980s and early 1990s, suggested strong potential for commercial hydrocarbon discoveries, particularly in the seas either side of the mainland.

Now, however, the DPRK is making a concerted effort to foster new activity to ease the country’s energy crisis. This situation was brought on during the 1990s through a combination of dwindling indigenous coal stocks and the withdrawal of subsidies on oil and gas imports following the break-up of the former Soviet Union. The country lacks the resources needed to pay for oil and gas at current prices - hence the recently proposed uranium enrichment program, which led to emergency talks between North Korea, its neighbors, and the US.

Production agreement

Aminex’s relations with the DPRK date back to an encounter with a Korean delegation in London in 1998. “They were on a fact-finding mission to see how the oil industry worked in Europe,” says the company’s CEO Brian Hall. “We had a good meeting, which resulted in our technical staff visiting Aberdeen to review their data sets.”

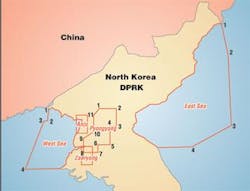

Map shows acreage currently licensed to Aminex.

Three years later, after on-off contact, “our communications ceased,” says exploration manager Mike Rego. “But late in 2003, they approached us again, asking if we would be interested in coming back to re-examine the West Sea. This led to our signing a 20-year petroleum agreement in Pyongyang in the summer of 2004, with our nine-year production sharing agreement (PSA) being formalized this August.”

The latter carries an obligation in the first three-year period to drill one well and acquire new seismic.

Under the terms of the petroleum agreement, Aminex has been working with Korean technicians to promote exploration, partly through a review of existing data. Additionally, it has helped the Koreans create a legal framework for licensing, in line with international business practice. At the Koreans’ suggestion, the current PSA has been drawn up in accordance with Swiss law, with any future licensing disputes to be resolved by a court in Switzerland.

Aminex will also be entitled to a 10% carried interest in any wells drilled by other companies as a result of its work, and it will receive a 2.5% royalty on any hydrocarbons produced as a result of new drilling.

With the PSA negotiations finally concluded, Aminex should gain greater access to existing data sets to further its own programs. Offshore, most of the exploration to date has been in relatively shallow water in the West Sea (generally less than 90 m depth throughout), the results suggesting an oil play analogous to the fields in Bohai Bay on the Chinese side of the median line. Soviet-managed teams undertook limited gravity magnetic and seismic surveys in the Korean sector in the1970s, followed by a much wider-ranging 2D shoot by Geco Prakla in 1981.

“Based on this seismic, the Koreans started drilling shortly afterward in 70-m water depth,” says Rego, “using a Romanian jackup, again operated by a Soviet crew. However, these first wells were stratigraphic, all producing primarily oil shows, with some gas.” Altogether, 13 wells were drilled in the West Sea during 1981-1989, the most productive of which flowed oil to the surface at 325 b/d. A follow-up well encountered 30° API oil in the Cretaceous, after a drillstem test.

No attempts were made to analyze these findings further. Rego offers an explanation: “With the guarantee of subsidized oil from the Soviet Union, there was probably not much of an incentive to continue drilling. Also, at that time the Soviets typically ran ‘drilling brigades’, a practice which didn’t permit completion of exploration wells for production purposes, as they were considered to be works of scientific research. Perhaps the Koreans implemented a similar regime.”

From 1989 onward, the DPRK invited foreign companies to try their luck. Among the early entrants was Australia’s Leeward Petroleum, while the UK’s Robertson Research and Royal Holloway College in London performed geochemistry studies. “But some of these companies were really start-up outfits with one geologist,” says Hall, “depending on farm-outs to larger companies to do the work, which did not materialize.”

Among the first serious explorers were Soco and the Swedish independent Taurus, which took out licenses on three blocks in the West Sea in the 1990s. Taurus shot 1,100 km of 2D seismic in 1997 and reprocessed some of the existing data. Around the same time, Canadian company Cantek, acting as a consultant to the DPRK, estimated oil in place in the West Sea at 5-40 Bbbl, with 2-13 Bbbl recoverable. Taurus came to a similar conclusion about the oil potential, Hall says, based on leads mapped from the old and new seismic. “However, they could not attract partners,” Rego adds, “so none of the prospects got drilled.”

In 2000, Veritas shot a 2,000-km 2D survey for the DPRK from a base in Singapore, again in the central part of the West Sea. The results were processed and interpreted largely by the Koreans. “Their team identified several high-grade prospects,” Hall says, “but we believe the survey was shot on a restricted budget; as yet, we haven’t had volumetric estimates from the Koreans.”

Petronas was the last to attempt a survey in the West Sea, acquiring 120 km of 2D seismic in 2003 before pulling out, possibly to avoid a maritime border dispute with China, speculates Rego.

The East Sea area extends from the demarcation zone with South Korea north to the Russian border. After initial geophysical studies by a Soviet-run team in the early 1980s, 2D seismic was first acquired in 1986, followed three years later by a much more wide-ranging 8,000-km 2D survey mapping a 10x20 grid along the shelf down to a 2x2 grid over the shallower waters of the shelf in the western embayment between Hungnam to the north and Wonsam to the south.

Two wells were drilled in the East Sea during 1989-91, the first as a stratigraphic well, the second to test a potential seismic anomaly identified on the new data set. “Both had shows of oil and gas,” says Rego, “although a basalt layer accounted for the anomaly.”

Separately, a piston-coring program run by Russians found oil shows.

In 1997, another Australian independent, Beach Petroleum, took a concession in the East Sea, acquiring 1,000 km of 2D seismic. Based on this and the re-interpreted Russian surveys, Beach identified 17 leads, all in the vicinity of the two wells, although none were tested. The larger structures were mapped in water depths approaching 200 m. The general conclusion was that the sector is oil-prone, although gas has been discovered and developed off the southeastern coast of South Korea.

Aminex’s onshore concessions cover the Anju, Jaeryong and Pyongyang basins. Again, exploration here has been very limited; some stratigraphic wells were drilled, primarily to delineate coalfields in the 1970s, one of which flowed oil from the Anju basin, following deepening.

In 1996, a Belarus crew drilled the country’s first authentic onshore exploration well, but without the benefit of prior seismic. Aminex has found further onshore oil and gas seepages, which it has typed geochemically, matching the samples positively to the same source rocks as those present in the West Sea that were responsible for the oil tested during the 1980s drilling program. The company plans a similar exercise for East Sea samples, following the handover of new data by the Koreans.

Obtaining relevant data sets has in general taken time, but the flow should quicken now that the PSA has been signed. In fairness to the Koreans, Rego says, their own formulations were upset in the 1990s when a fire at the Sukchong oil and gas institute damaged some of the exploration data archives.

“Other problems their technicians face include a lack of money to buy the latest computer hardware and gaining access to the latest seismic processing software. All this has held them back from developing the drilling and seismic processing capability they would like to build up.” Most of the current practical technical expertise has been acquired by Korean engineers seconded to work abroad, for example in Libya.

“We would like to bring some of them to the UK for work experience,” Rego adds. “The industry professionals that we have met in Korea are very well-educated. Over the past year, we have made a number of visits to Pyongyang, taking our own technical consultants to work with their technicians and to help them evaluate the data.”

Aminex will continue reprocessing existing data before acquiring new seismic, probably next spring, initially over prospective acreage in the shallow water of the West Sea.

“For the shallow water Anju basin extension margins close to the West Coast, we may need to contract a specialist vessel,” Rego says. “As for the East Sea, we’re waiting for the Koreans to provide access to the Russian-acquired data from the late 1980s. Interpreting this might additionally help us attract other oil companies as partners. On the other hand, there’s also a very strong case to be made for shooting new seismic over all the areas covered to date, as acquisition technology has improved so much in the intervening years.”

On the West Coast, potential offshore support sites are limited. The most likely location, according to Rego, would be NamPo on the Taedong River. However, drilling could also be managed from a base in China.

The East Sea coastal ports offer more options. Assuming the seismic program proceeds as planned, Aminex hopes to be in a position to drill its first well in West Sea by the end of 2006, followed perhaps by a well in the East Sea six months later. One problem could be logistics, if the US government discourages involvement by American-owned contractors.

“I believe that one reason the Koreans approached us is that we are a small company,” Rego explains, “and they wanted to learn with us as operations progressed. Had they brought in a major company, the Koreans could not have been sure that they would get its full attention, particularly while the international situation remains tense and unpredictable. Large companies have a habit of pursuing their own ways of working, which can exclude the use of local expertise. Aminex, being smaller in size, is more flexible and already integrating the work of Korean specialists with its own.”•