Jeremy Beckman - Editor, Europe

Exploration drilling could soon resume off the Seychelles after a gap of 21 years. Two companies recently signed separate production agreements covering a total of 38,000 sq km (14,672 sq mi), and both are keen to drill. Later this year, the Seychelles government plans to offer a further 70,000 sq km (27,027 sq mi) in an offshore licensing round.

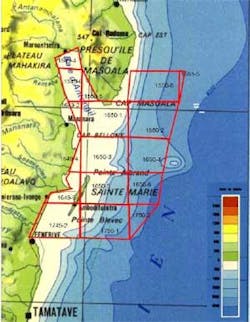

Avana has applied for acreage off Madagascar's east coast.

Unlike previous phases of exploration, the islands now are viewed as part of an extensive source rock system in the western Indian Ocean with strong hydrocarbon potential. This region, stretching from Kenya to Madagascar, and also encompassing Mauritius and the Comoros Islands, is the strategic focus of one of the Seychelles concession holders, East African Exploration (EAX), and its partner Avana Petroleum.

Last November the Seychelles national oil company awarded Dubai-based EAX 15,000 sq km (5,791 sq mi) across three non-contiguous offshore tranches. This followed a two-year study of 43,000 sq km (16,602 sq mi) of largely shallow-water acreage and 3,650 km (2,268 mi) of new long-offset 2D seismic acquired by EAX’s sister company, Upstream Petroleum Services (UPSL).

The three tranches comprise Area A (7,510 sq km or 2,900 sq mi) and Area B (6,808 sq km or 2,628 sq mi) in the northern half of the Seychelles plateau and Area C (680 sq km or 262 sq mi) in the south. UPSL also has taken a 13.5% interest in the 20,000-sq km (7,722-sq mi) southern plateau area licensed to Houston-based Petroquest International, in exchange for managing Petroquest’s first-year work program. UPSL recently acquired 2,500 line km (1,553 mi) of 2D seismic and has an option to increase its stake in the license.

According to EAX, wells drilled by Amoco on the Seychelles plateau in 1980-81 recorded significant oil shows. Analysis by UPSL suggests a strong similarity to numerous Lower Mesozoic oil shows and discoveries throughout East Africa. The shows also match the character of most of the tar balls washed up on the Seychelles islands, and this, combined with oil show data from a water well on Coevity Island, indicate a large Lower Mesozoic source system.

EAX chose Area B because of further potential analogies with Bombay High and the Cambay basin in western India, although there are no wellbores to draw on in the northwest section of the Seychelles plateau.

The islands underwent several tectonic phases associated with the splitting of the east and west Gondwana land masses, the latest occurring at the end of the Cretaceous when India broke apart from the Seychelles plateau. EAX/UPSL has mapped several sealing units, including regional lower Palaeocene clays and marine ash deposits. The Karroo sands are encased in shales, and thick shale successions also are present through Jurassic and Cretaceous intervals.

EAX’s minimum work program involves compilation of a further 2,000 line km (1,243 mi) of seismic and one well by October 2012. The company’s links with the islands were strengthened last August when the state-owned Seychelles Petroleum Co. (Sepec) acquired a 10% interest in EAX’s parent Black Marlin Energy. The country already has a petroleum industry which generated $4 billion in revenue last year, mainly from a fleet of five tankers and the re-exportation of petroleum products.

Heavy oil springboard

EAX’s partner Avana has its main office in the Madagascan capital Antananarivo, with a representative office in London. Aside from the Seychelles, the company is pursuing E&P interests off northern Madagascar and other little explored plays in the western Indian Ocean.

Avana’s CEO Sam Malin.

CEO Sam Malin is best known as the founder of Madagascar Oil, which is developing the country’s giant onshore heavy oilfields Bemolanga and Tsimiroro. Recently, Total was brought onboard as a farm-in partner and operator, with the aim of achieving large-scale production from Bemolanga.

Three years ago, Malin established the Avana group of companies, which has interests in West Africa and the wider western Indian Ocean region. Its interests range from bio-fuels and property to exploration for uranium and graphite on Madagascar.

Malin’s career in the oil and gas industry began as a geologist at Dome Petroleum in Calgary, focussing on established plays in the prairies of Alberta. He then worked for Arthur D Little and Standard & Poor’s before taking a post as a consultant in an upstream project in 1993-94 to analyze from technical and economic angles two old gas wells offshore northwest Madagascar.

“This was my first exposure to the offshore sector, and through that I learned about Madagascar’s untapped onshore heavy oil. Those fields were discovered by Malagasy herdsmen – big lakes of oil which had been known about for centuries.”

After 10 years pursuing finance from various sources Malin eventually raised $250 million for Madagascar Oil to initiate a development.

“By dint of where my career has taken me, I know the Africa margin better than elsewhere. During the mid-1990s I became familiar with the opportunities in the western Indian Ocean, and learned about the tar balls washed up on the Seychelles beaches. Prior to EAX’s review, people claimed these had come from sunken U-boats or Japanese vessels in the area flushing their bilge tanks.

“Several wells were drilled around the islands, the most recent by Enterprise Oil in ultra shallow water 1988. That was a disappointment, turning the industry off the Seychelles. But Enterprise did not drill its preferred target because the rig would not work in the water depth. Instead they turned to a second choice target, in basalt, and the result was zero. However, various earlier wells did have hydrocarbon shows.”

Work program

Prior to teaming up, Avana and EAX had independent negotiations with the Seychelles government, according to Malin. Barry Rogers of EAX was formerly exploration manager at Madagascar Oil, and this facilitated the current partnership.

In-house, Avana has a 12-strong team of what Malin calls “multi-taskers,” most based in Madagascar, with specialist studies devolved to consultants.

“We are also fortunate to have access to a seismic acquisition/G&G company in UPSL. They have a strong capability in shallow water – they can shoot seismic in estuarine environments, transporting equipment on trucks and driving to lakes, where they can then tow cables up to 8.1 km [5.03 mi] long.”

Prior to the recent license awards, he adds, “there was a fair amount of seismic data on the Seychelles. EAX also had done a lot of regional work throughout the East African margin, including geochemical studies. The most recent seismic survey was the 3,650 line km (2,268 mi), 2D grid compiled by UPSL for our consortium, which was shot just after we were allocated our production areas in 2007. We have also reprocessed the old data, some of it acquired by Amoco, which is of variable quality.

“Based on that and other data, we defined certain leads and prospects within our current license areas, all in shallow to ultra shallow water. For the time being, geochemical analysis continues, but we plan to acquire more 2D data and almost certainly some 3D seismic. We want to boost our confidence in prioritizing our prospects before putting a well down.”

Regional potential

Closer to the East African mainland, TGS NOPEC and, more recently, GTX have been acquiring speculative seismic data around the volatile Comoros Islands, another country under review for exploration. “The islands’ rebel president was removed by the forces of the African Union,” says Malin, “so we have been negotiating with the Union-installed government on the main island of Grande Comore. The most prospective areas in the Comoros are offshore, and near to that island.

“Geologically, most people would view the Comoros as potentially difficult, due to the combination of deepwater and extensive volcanics. However, Chevron’s Rosebank discovery close to the Faroe Islands has flowed oil in a similar setting. The other point is that Comorian waters contain some known sedimentary basins, but we don’t know how extensive they are.

“Another country where we are looking at offshore acreage is Madagascar, again with EAX and with Australian company Gippsland Offshore. Despite the recent internal problems, another licensing round is on the cards. We are reviewing opportunities off the north and east coast. ExxonMobil has permits on the northwest side. If they find oil there, or more likely gas, that will strengthen the attractions of the northern area.

“The acreage we are looking at, however, is an area of sensitivity, as it overlaps waters frequented by cetaceans (whales and dolphins). So we have been working with non-governmental organizations to determine whether we should or should not be active in this region. The Seychellois are also concerned about the impact of exploration on tourism, and their government has been imposing strict operating requirements on companies such as ours.”

Recently, the Seychelles agreed a joint maritime development zone with Mauritius, to the south, and this is another territory on Avana’s radar, says Malin. “Mauritius is connected to the Mascerane Ridge, a section of an ancient continent below sea level. Again it’s interesting as a sedimentary basin.”