US Interior Department announces largest offshore lease sale in US history

Offshore staff

WASHINGTON – As part of President Trump’s ‘America-First Offshore Energy Strategy,’ Deputy Secretary of the Interior David Bernhardt announced that the department will offer 77.3 million acres offshore Texas, Louisiana, Mississippi, Alabama, and Florida for oil and gas exploration and development.

The region-wide lease sale, which is the largest in US history, is scheduled for March 21, 2018, and will include all available unleased areas in federal waters of the Gulf of Mexico. In 2017, offshore leases helped the Department raise a billion dollars more in revenue for the year than was made off energy revenues in 2016.

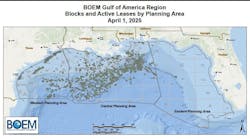

Lease Sale 250, scheduled to be livestreamed from New Orleans, will be the second offshore sale under the national outer continental shelf (OCS) oil and gas leasing program for 2017-2022. It will include about 14,776 unleased blocks, located from three to 231 miles offshore, in the Gulf’s Western, Central and Eastern planning areas in water depths ranging from nine to more than 11,115 ft (three to 3,400 m).

Excluded from the lease sale are blocks subject to the congressional moratorium established by the Gulf of Mexico Energy Security Act of 2006; blocks that are adjacent to or beyond the US Exclusive Economic Zone in the area known as the northern portion of the Eastern Gap; and whole blocks and partial blocks within the current boundary of the Flower Garden Banks National Marine Sanctuary.

The department says that the lease sale terms include stipulations to protect biologically sensitive resources, mitigate potential adverse effects on protected species, and avoid potential conflicts associated with oil and gas development in the region.

Additionally, BOEM has included appropriate fiscal terms that take into account market conditions and ensure taxpayers receive a fair return for use of the OCS. These terms include a 12.5% royalty rate for leases in less than 200 m water depth, and a royalty rate of 18.75% for all other leases issued pursuant to the sale, in recognition of current hydrocarbon price conditions and the marginal nature of remaining Gulf of Mexico shallow-water resources.

02/19/2018