Moving into the new year, economic indicators point to higher offshore spending by oil and gas operators as the price of oil trends steadily upward, a good sign for the oil services sector in general and offshore drillers in particular.

In a recent analysis, Deutsche Bank said it sees the long-term (five year) picture as bullish for oil prices. Gauging demand, Deutsche Bank foresees around 5.8 MMb/d of demand growth over the next five years, but only 4.6 MMb/d of supply growth.

OPEC countries, says Deutsche Bank, are less aggressive in investment than major oils, only investing at around one-fourth of the level of intensity. At the same time, OPEC's own demand growth, from rapidly growing populations using subsidized oil, threatens to cause OPEC net exports to start falling from 2014 onwards. Near term, Deutsche Bank notes, demand is soft in Europe, weakening in China, and tepid in the United States. At the same time, Saudi Arabia says it is producing over 10 MMb/d, Libya is coming back faster than expected, Iraq is closing in on 3 MMb/d, Nigeria volumes are at a three-year high, and Kuwait is at an all-time high.

"That sounds like a calculus for $60/bbl oil," their analysis notes, "yet we are at $100/bbl+ Brent. The situation strikes as potentially bullish for oil over the next year – Saudi now needs to defend $100/bbl oil for fiscal reasons, and the seasonal picture is near its nadir. For now, we have a "Goldilocks" oil market that has found equilibrium at $100+/bbl but remains $15-20/bbl below demand destruction, the point where integrated multiples peak then decline due to an unsustainable price."

In short, the price forecast looks strong mid-term but not high enough to bring havoc on national economies and thus "kill the goose."

Upstream spending ahead

Meanwhile, IHS says that 2010 upstream capital spending for 221 oil and gas companies was up by 47% to $558 billion, pushed higher mainly by US and Latin American acquisition moves.

The "IHS Herold 2011 Global Upstream Performance Review" notes that the significant increase in capital spending was primarily due to a seven-fold increase in acquisition spending to $125 billion, which was up from nearly $18 billion in 2009. Most of this spending occurred in the United States and in South and Central America, which each saw total upstream spending increases of approximately 130% to $195 billion and $91 billion, respectively.

Worldwide oil and gas reserves grew by 3% in 2010 to 286 Bboe, which matched the growth rate for 2009, while US reserves increased 10% to 51 Bboe in 2010. Oil and gas production grew 5%, with gas output growing slightly faster than oil, noted the Upstream Performance Review.

According to IHS, approximately 10% of world- wide proved acquisition spending in 2010 was targeted toward deepwater reserves, while another 11% was devoted to proved unconventional reserves. However, the lion's share of spending in both of these areas is still highly focused on non-proven resources.

It was not all good news, however. Costs inevitably rise along with more spending, and reserve-replacement and finding-and-development costs rose by approximately 50% in 2010 to $16.45/boe and $18.25/boe, respectively, IHS says, primarily due to the surge in unproved acreage purchases, which have no reserve additions associated with them.

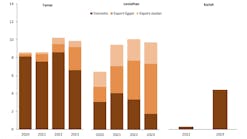

Still another bullish forecast, this one by Douglas-Westwood, sees drilling and workover expenditure across the Middle East and North Africa increasing by more than $10 billion to reach $27.9 billion by 2014. That's the conclusion of Douglas-Westwood's "Middle East & North Africa Oilfield Services Market Report 2010-2014."

The report offers onshore and offshore drilling expenditure and workover forecasts for Algeria, Egypt, Iran, Iraq, Kuwait, Libya, Oman, Qatar, Saudi Arabia, Syria, UAE, and Yemen – revealing particularly strong growth from offshore Iran. It also illustrates historic and forecast oil and gas production across the region, the number of wells drilled and actively producing, and drilling rig requirements associated with new activity.

Bottom line: more good news for the oil services sector, particularly offshore.

Topsides conference in New Orleans

The Topsides, Platforms & Hulls Conference & Exhibition, to be held in New Orleans Jan. 31-Feb. 2, will expand on the successful program and events of the 2011 conference.

Last year's Topsides, Platforms & Hulls conference attracted 634 attendees from eight countries, and 22 US states. In an onsite survey, 94% of attendees indicated Topsides, Platforms & Hulls met or exceeded their expectations.

Following the successful launch of the conference last year in Galveston, the Advisory Board has put together another outstanding program for this year's event. The 2012 conference focuses on sharing industry experiences through case histories and lessons learned, presented by those who have participated in the projects and activities discussed. The conference organizers encourage all delegates to participate in the presentations by asking questions, adding comments, and sharing experiences.

Technical sessions will cover topics such as:

- Project Review & Lessons Learned

- Feasibility & Concept Selection

- Concept Selection/Detail Design

- Operations

- Construction/Transportation/Installation.

And a closing panel discussion on decommissioning and redeployment.

The conference provides networking opportunities for attendees to share technology and address issues with experts in their respective fields and to gain an understanding of the changes that are taking place within those technologies.

The Bureau of Ocean Energy Management, Gulf Coast Region, has released the sale day statistics for OCS sale 218 involving the western Gulf of Mexico. This is the first such sale since the Macondo incident.

Twenty companies placed 241 bids on 191 of the total of 3,913 blocks offered. The sum of the high bids was $337,688,341.

The Top 10 single highest bids are:

- 1. ConocoPhillips Co., Keathley Canyon 95, $103,200,000

- 2. Maersk Oil Gulf of Mexico Two LLC, Garden Banks 537, $8,640,816

- 3. Maersk Oil Gulf of Mexico Two LLC, Garden Banks 582, $8,640,816

- 4. Anadarko US Offshore Corp., East Breaks 637, $8,294,880

- 5. Maersk Oil Gulf of Mexico Two LLC, Garden Banks 530, $7,777,816

- 6. Exxon Mobil Corp., East Breaks 772, $7,750,535

- 7. BP Exploration & Production Inc., Keathley Canyon 441, $7,122,619

- 8. BP Exploration & Production Inc., Keathley Canyon 397, $5,692,619

- 9. BP Exploration & Production Inc., Keathley Canyon 7, $4,912,619

- 10. Exxon Mobil Corp., Alaminos Canyon 612, $4,750,535.

The Top 10 companies based on total number of high bids are:

- 1. ConocoPhillips Co., 75 bids, $157,816,740

- 2. Exxon Mobil Corp. 50 bids, $63,293,750

- 3. Maersk Oil Gulf of Mexico Two LLC, 12 bids, $36,010,792

- 4. BP Exploration & Production Inc., 11 bids, $27,458,809

- 5. Plains Exploration & Production Co., 10 bids, $12,870,000

- 6. Anadarko US Offshore Corp., 7 bids, $19,317,210

- 7. Ecopetrol America Inc., 7 bids, $6,000,000

- 8. Shell Offshore Inc. 3 bids, $4,951,858

- 9. Apache Corp., 3 bids, $1,693,927

- 10. Castex Offshore Inc., 2 bids, $4,200,000.

Offshore Articles Archives

View Oil and Gas Articles on PennEnergy.com