A staff report

Even with the return of high oil and gas prices, deepwater operators and producers are looking for ways to make the most of their current assets and expand output at existing fields. While subsea compression systems are not new, they are increasingly favored as the best means of accelerating production, boosting recovery, and delivering fast returns on investment.

Subsea compression systems also offer greater energy efficiency and a reduced CO2 footprint. The energy savings potential increases with tieback distance, water depth, and complex production assurance challenges.

Adding compression compensates for the losses generated in the production line between the subsea wells and the topside host. Subsea compression’s role in unlocking gas resources and improving the economics of subsea gas development is becoming more critical with the increasing focus on sustainability.

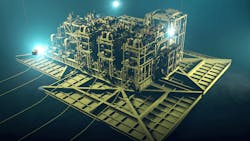

The Jansz-Io Compression (J-IC) project offshore Western Australia is one key example of this trend. The Jansz-Io field, 200 km (124 mi) offshore in 1,350 m (4,429 ft) of water, came onstream in late 2015, a part of the wider Chevron-operated Gorgon development. Last year, Chevron and its partners in the Gorgon joint venture committed to the $4-billion J-IC project to help ensure continued supplies of gas from the Jansz-Io field to the three LNG trains and a domestic gas plant on Barrow Island. This is a modification of the Gorgon development, involving construction and installation of a 27,000-metric ton, normally unattended floating field control station; 6,500 metric tons of subsea compression infrastructure; and a 135-km (84-mi) subsea power cable connected to Barrow Island.

The subsea gas compression system will include a compression station with three compressor modules and two subsea pump modules; all-electric control systems and actuators; other structures including mud mats; an HV electrical power distribution system; spare modules; and various associated tooling.

Aker Solutions will supply the subsea compression technology under a $808-million contract. The company started work on the FEED for the project in 2019. Chevron expects construction and installation activities to take around five years to complete. Gorgon Stage 2 will supply gas to the Gorgon plant from four new Jansz-Io and seven new Gorgon wells.

Recently, Chevron awarded Daewoo Shipbuilding & Marine Engineering (DSME) a $551-million contract to build the field control station (FCS) for the Jansz-Io Compression project offshore Australia. The FCS will be built at the Okpo Shipyard in Geoje. It is expected to be completed by 3Q 2025. The normally unattended floating FCS will send power from shore to the subsea compression station.

Separations technology is also a key part of this emerging deepwater development strategy.

Aker Solutions has contracted Tracerco to supply separator level measurement instruments for the J-IC project. Tracerco redesigned its Tracerco Profiler system for the program, claiming that this is the sole separator liquid level, oil/water interface level and process control measurement system qualified for subsea use.

Equinor’s “subsea factory” at its Åsgard gas field is another key example. Located in the Norwegian North Sea, the Åsgard field became the world’s first operational subsea gas compression facility in 2015. Equinor commissioned the equipment because the natural pressure in Åsgard’s reservoirs would otherwise have been too low for stable flow. Aker Solutions supplied and installed the original two-train Åsgard subsea gas compression system, which has since operated with an uptime of close to 100%.

Since then, Aker says that it has been working Equinor to extend operations at the Åsgard field. Under a co-operation with MAN Energy Solutions, the existing compression modules are undergoing refurbishment and upgrading so that the system can handle a higher compression. The goal is to enhance production and extend the field’s life as the reservoir pressure declines.

Recently, Equinor awarded Aker Solutions an EPC contract to provide a fifth subsea compression module at the Åsgard complex. This will be a copy of the fourth module awarded previously to the company, and will be built partly re-using existing equipment. Aker says that it will perform most of the engineering at its offices in Fornebu in the Oslo area, with fabrication taking place at the company’s yard in Egersund. The module should be ready for delivery in August 2024 and will be installed at the offshore location without interruptions to production.

The Åsgard field is 200 km (124 mi) offshore in water depths of around 240-310 m (787-1,017 ft). Gas moves to markets in mainland Europe via a pipeline to Kårstø, with around 11 bcm/yr supplied to European customers.

Plans are also underway for additional gas compression at the Ormen Lange field in the Norwegian Sea. Last fall, Norske Shell and its partners submitted a development plan for a wet gas subsea compression project at the Ormen Lange field. The project is designed to unlock an additional 30-50 bcm of natural gas, increasing Ormen Lange’s overall gas recovery rate from 75 to 85%. The gas will be exported through Langeled, a 1,200-km (746-mi) pipeline from Nyhamna to Easington, UK, and linked to the Norwegian gas export system to continental Europe.

OneSubsea will deliver a wet gas compressor system that Subsea 7 will install on the seabed at 900 m (2,953 ft) depth close to the wellheads. The 120-km (75-mi) distance from the onshore processing and export facility at Nyhamna to the installations sets a new world record for subsea compression power step-out, Shell claims.

Separations technology

Moving processing and separations technology to the seabed has been another key component of cost-effective subsea development strategy. With subsea processing facilities, deepwater producers can achieve gas/oil/water separation on the seabed, thereby transferring the bulk of the production facilities to the seabed, and thereby lower separator pressure and topsides footprint, which in turn lowers cost.

In Brazil, Petrobras has been working to advance high-pressure separation technology for deepwater production in the presalt Santos basin. Many of the hydrocarbon reservoirs in the presalt area contain fluids with a high gas-to-oil ratio and high CO2 content. The conditions often require large production facilities with complex gas processing equipment, thus constraining the facility’s oil processing and storage capacities. In these scenarios, Petrobras believes that the application of its high-pressure, dense-phase separation technology HISEP can enhance production by enabling the separation and reinjection of a large part of this CO2-rich associated gas in the seabed as a dense fluid. This would then reduce the need for large gas processing plants topsides, which in turn can extend the oil production plateau and accelerate production.

As operator of the Libra block consortium, Petrobras has started contracting suppliers to design, construct, install, and test its HISEP technology. The contracting process follows conceptual evaluations and pilot tests onshore, in which the company and its suppliers conducted studies and performance validations for the subsea pumps that will reinject CO2-rich gas into the reservoir. Petrobras aims to select its preferred manufacturer by August 2022, with the equipment then installed in 2025.

Petrobras says that the HISEP technology could open up deepwater and ultra-deepwater oil production in regions featuring reservoir fluids with a high gas-to-oil ratios and CO2 content. HISEP is designed to increase oil production by freeing up space that would otherwise be occupied in the topsides gas processing plant.

Pilot testing is planned for the Mero 3 area in the Libra block in the presalt Santos basin offshore Brazil, which is due to start production in 2024. After two years of testing, and with the technology proven, it could be deployed in other areas off Brazil such as Libra Central and Jupiter. Once proven, it should also be possible to develop offshore production platforms with smaller and less complex gas processing plants, Petrobras added, with lower construction and operating costs.