Offshore staff

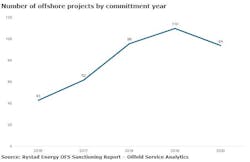

OSLO, Norway – Rystad Energy forecasts $210 billion expenditure globally on offshore oilfield services next year, as 100 new projects potentially go forward.

This follows four consecutive years of declining revenues for offshore services contractors.

“The uptick in new projects in 2017, 2018 and now 2019 will be enough to turn revenue growth positive to mid-single digits as offshore capex is set to increase due to the recent years of capital commitments,” said Audun Martinsen, head of oilfield service research at Rystad Energy.

Next year’s new projects carry combined greenfield commitments of around $120 billion, Rystad claimed.

Despite the recent swings in the oil price, operators still plan to spend more next year and move forward on project sanctioning, with more than 85% of projects on course for sanction likely to generate returns above 10% even at current oil prices.

This is because development costs have come down by 30% since 2014. Unit prices in 2018 were at levels not seen by the offshore market since 2006, the analyst added.

“Couple that with one of the most profitable years for E&P in decades in 2018, and the recentproduction cut agreement by OPEC and Russia – offshore operators want to focus on field development again,” Martinsen said.

In terms of value for next year’s projects, 30% is in the Middle East, 25% in South America, 15% in both Africa and Asia, and the remainder in Europe and North America combined.

12/18/2018