Bruce Beaubouef • Houston

The DnB NOR Markets research firm has released its “Offshore Supply Sector Update,” with detailed analysis of several offshore supply service and vendor companies. In general, the study finds that fundamentals in the offshore supply sector have improved since 3Q 2010. Going forward, the firm says that it expects to see pick up in rates and activity.

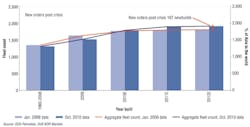

DnB NOR Markets says that newbuild vessel orders post-crisis not alarming.

DnB NOR Markets says its investment case is anchored on relatively comfortable oil price level; growth in E&P spending in 2010/2011; not overly aggressive incremental newbuild orders in 2011 and 2012; and existing newbuild rigs (OSVs needed to support these units) coming into the market in 2010-2012.

The firm says that it still sees an oversupply situation, with excess vessel capacity in the market, but adds that it expects higher demand to absorb this enlarging fleet. It also says that it expects to see higher demand for specialized vessels, instead of multi-purpose large vessels, due to the higher rates required to earn decent returns on these vessels.

Petrobras awards $3.46 billion in FPSO contracts

Petrobras, together with partners BG, Galp Energia, and Repsol, and through its Tupi-BV and Guará-BV affiliated companies, has signed two contracts totaling $3.46 billion with the Brazilian company Engevix Engenharia S.A. for the construction of eight FPSO hulls to be used in the first phase of the production development for the pre-salt area in the Santos basin.

Petrobras says the units are part of the new strategy for the construction of production units designed to simplify projects and standardize equipment. Producing identical hulls in series will accelerate the construction phase and allow economies of scale and cost optimization, the company says.

Each FPSO will be able to process up to 150,000 b/d of oil and 6 MMcfd of gas. All are expected to start operating by 2017 and to reach the production targets set in Petrobras’ business plan for the pre-salt area. The company expects the FPSOs to add about 900,000 b/d of oil to domestic production when operating at maximum capacity.

The hulls will be built at the Rio Grande Naval Pole (state of Rio Grande do Sul), with local content expected to reach around 70%. The first steel shipments will take place in January 2011, and hull constructions will start in March. The first two hulls will be delivered in 2013, and the others in 2014 and 2015.

Of the eight units, six will be operated by the consortium formed for block BM-S-11, where the Tupi and Iracema areas are located. The two others will be operated by the consortium formed for block BM-S-9, where the Guará and Carioca fields are located.

Seadrill commits to further drillships

Seadrill has contracted Samsung to build up to four new ultra-deepwater drillships at its yard in South Korea.

The first two drillships are firm orders due for delivery in 1Q and 2Q 2013. The project price per rig is estimated at just below $600 million – this includes a turnkey contract with the yard, project management, drilling and handling tools, spares, capitalized interest, and operations preparations. The option for two further drillships must be declared during 1Q 2011.

The new drillships will be operable in water depths up to 12,000 ft (3,657 m), and will provide a hook load capability of 1,250 tons. Main target areas are the Gulf of Mexico, Brazil, and West Africa. Seadrill adds they will be the first newbuilds outfitted with a seven-ram configuration of the BOP stack.

Seadrill says it has opted to expand its fleet because of the current strength of the offshore drilling sector, the return it believes these investments can deliver, and the financial flexibility created by its contract backlog ($11.5 billion).

COSCO delivers new heavy-lift vessel

COSCO Corp.(Singapore) Ltd. says it has delivered a newbuild 30,000 dwt heavy-lift carrier vessel. The buyer is a joint venture of China and Poland. TheChipolbrok Star is 199.8 m (656 ft) long, 27.8 m (91 ft) wide, 15.5 m (51 ft) high, has a draft of 10.3 m (34 ft), and navigation speed of 10.2 knots.

SeaDragon I sets Singapore construction marks

TheSeaDragon I ultra-deepwater semisubmersible drilling rig, the largest ever completed in Singapore, set several milestones for Jurong Shipyard, the company says.

SeaDragon I, the first of two Moss Maritime CS50 MK II design DP-3 vessels ordered by SeaDragon and to be managed by Vantage, is the first in its class to be built from a six-column bare-deck hull, according to the Sembcorp Marine subsidiary Jurong Shipyard.

The semi is harsh-environment capable, and can drill to 35,000 ft (10,668 m) and operate in 10,000 ft (3,048 m) water depth. Delivery is scheduled for early next year following final commissioning and acceptance testing.

Floatel takes second accommodation semi

Keppel FELS has delivered its second semisubmersible accommodation rig to Floatel International, 63 days ahead of schedule.

TheFloatel Reliance is contracted to Petrobras for five years, with operations due to start early in 2011. The rig will be wet-towed from Singapore to Rio de Janeiro, with the journey set to take up to 65 days.

Rowan takes first of three N-Class jackups

Keppel FELS has deliveredRowan Viking, the first of three KFELS N-Class jackups it is building for Rowan Co.s. The rig, based on the proprietary KFELS N-Class design, is the largest jackup constructed in Singapore.

The KFELS N-Class jackup, which has an overall height of 568 ft (173 m), and extendable to 598 ft (182 m), is designed to operate in harsh weather conditions in water depths ranging from 400-500 ft (122-152 m), 40% deeper than the capability of traditional units in benign waters.

It can drill to subsurface depths of 35,000 ft (10,668 m), which Keppel FELS says is 15% deeper than standard harsh environment jackups.

The KFELS N-Class jackup also can be configured to drill in two positions concurrently, 26 ft (7.9 m) apart. This capability allows the jackup to accept process modules for production activities while performing drilling activities at the secondary cantilever position.

Construction of the other two new rigs, theRowan Stavanger and Rowan Norway, is on schedule with deliveries scheduled for 1Q and 2Q 2011.

Offshore Articles Archives

View Oil and Gas Articles on PennEnergy.com