Norwegian drillers aiming to capitalize on rig rates, imaging advances

Majors see opportunities in established and frontier plays

Jeremy Beckman

Editor, Europe

Norway is one of the few hotspots at present for offshore exploration drilling. Activity is increasing across the shelf, despite relatively modest returns, as E&P companies fulfil their license commitments, with more higher-spec rigs entering the arena at relatively low day rates. Three of the sectors’ major players provided updates on their current drilling programs and future goals during presentations at the recent Offshore Northern Seas exhibition in Stavanger.

Lundin Norway confirmed successful results from appraisal drilling of its basement Rolvsnes oil discovery in the Utsira High region of the North Sea. The main aim had been to demonstrate commercial flow rates from a horizontal well drilled 2,500 m (8,202 ft) through fractured basement reservoirs, similar to those producing in the northern part of the company’s nearby Edvard Grieg field.

During a 10-day test, the well flowed up to 7,000 b/d (constrained), with analysis suggesting good reservoir connectivity and strong aquifer pressure support. An extended test will likely follow to improve understanding of the reservoir’s long-term production behavior. However, results so far appear to have de-risked similar on-trend prospects on an adjacent license, where an exploration well is planned next year on the Goddo prospect. Lundin Norway assesses prospective resources from the Rolvsnes/Goddo area at 250 MMboe.

The company was the prime mover behind the recent wave of development in the Utsira High region after applying new concepts to discover Edvard Grieg and the giant Johan Sverdrup field, which previous drilling had failed to identify. Now it is looking to transfer another new technique, first tested last year in the Barents Sea, to uncover more potential oil on the Utsira High.

CGG’s Geo Coral, the streamer vessel at work on the 2017 LN170001 Loppa High campaign in the Barents Sea, towing 14 seismic cables, each 7 km long. In the distance is the source vessel Geo Caspian. (Courtesy CGG/Lundin Norway)

Lundin Norway has discovered oil in three fields in the southern Norwegian Barents Sea, including Gohta and Alta on the Loppa High, but according to the company’s Senior Geophysicist, Per Eivind Dhelie, speaking to Offshore, structures in this region tend to be karstified carbonates with sink holes in shallow to intermediate subsurface depths that are hard to image on seismic. During 2014 and 2015, the company re-processed a large volume of seismic over the area using modern broadband technology, but the results remained unsatisfactory. The problems appeared to be a combination of noise interference and a lack of near-offset fold inherent in the conventional towed streamer arrangement.

One solution suggested was ocean bottom seismic (OBS), but this would have been impossible over the 2,000-sq km (772-sq mi) area under review. As alternatives, the team proposed some form of ‘movable OBS data,’ or a new type of configuration in which the towed streamers would be placed under the sources and in water depths of 40-50 m (131-164 ft), five times greater than the conventional norm. And the sources would be positioned not at the front or tail of the streamers, where the noise was greatest, but in the middle.

In mid-2014, Lundin Norway approached CGG to develop a solution. Over the next seven months, the contractor embarked on an exercise involving all its relevant divisions to completely re-think established practice for towed streamer acquisition, including the vessel steering and recording systems. Eventually the two companies, with funding from the Norway Research Council, devised TopSeis, a ‘split-spread,’ source-over streamer configuration with access to full azimuth zero offsets combined with proprietary processing algorithms, designed to provide much enhanced near-offset coverage.

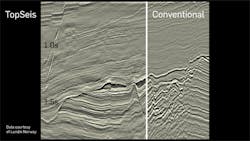

During 2015-16, CGG performed initial trials with a vessel offshore Gabon, followed by a large 3D test over the Frigg field in the North Sea with the cables lowered into the water. Results were still not entirely satisfactory, and this led to further design changes to the sources and streamers. The first commercial full-scale survey was conducted in summer 2017 over a 2,000-sq km (772-sq mi) area covering various licenses in the southern Barents Sea (LN17001 TopSeis Loppa High). According to Dhelie, the improvement in data quality was startling.

“TopSeis is generally well suited to ‘shallower’ water – i.e. less than 500 m [1,640 ft] – because in this setting with conventional towed streamer seismic, you do not record enough near offset data,” he explained. “This is due to the practice of employing ‘wide and efficient’ tow spreads with many cables spread out, with the sources towed directly behind the vessel quite far in front of all the streamer cables. The shallower it gets, the bigger this inherent problem is with conventional streamer seismic.

Data comparisons taken from the 2017 Loppa High campaign. (Courtesy CGG/Lundin Norway)

“TopSeis places the wide-tow sources in the center and atop all the sensors, allowing you to record both negative-, positive-, and zero-offset full azimuth data for the first time ever in a marine-towed streamer arrangement. The small, compact, triple wide-tow sources allow the efficiency of a 300-400 m [984-1,312 ft] vessel sail line separation to be maintained, with all the associated benefits. And because we use 50-m streamer separation with the triple wide-tow sources, we can achieve both a very good and nearly uniform near offset coverage and 8.33 m [27.3 ft] natural xline bin spacing with 6.25 m [20.5 ft] inline spacing.

“This incredible high resolution seismic data should also be able to image the fractures in basement better than legacy seismic. However, the fractured basement across the Utsira area is at a subsurface depth of 1,900 m [6,233 ft], so further testing would be beneficial.”

Following an enthusiastic response to the Loppa High results by Lundin Norway’s partners in various licenses in the Utsira High, CGG is due to conduct a 200-sq km (77-sq mi) test – ‘TopSeis 2’ – this month covering the Lille Prinsen, Edvard Grieg, Rolvsnes, and Luno 2 fields. According to Dhelie, it will be a full-hexasource set-up with six compact (instead of three) small sources towed ultra-wide. Using an even denser shot interval approaching only 2 seconds will effectively increase the trace count even further while providing 4.16 m (13.6 ft) xline bin size, he commented. “The efficiency of the operation will increase with the super-wide six sources – but the trace density and the sampling will really be unprecedented.” A successful outcome could lead to another survey over a much larger area next year. “I am quite confident on the uptake of TopSeis by operators in other parts of the world too, when they see the data.”

Downsized ambitions

Equinor is looking to drill up to 3,000 new wells across the Norwegian continental shelf (NCS) over the next two decades, said Arne Sigve Nylund, EVP for Development and Production Norway. This is partly to achieve the company’s goal of sustaining its current level of production through 2030, and many of the wells will accordingly be drilled from the company’s existing facilities. But the company is also mindful that after 2022, when Johan Sverdrup Phase 2 in the North Sea and Johan Castberg in the Barents Sea are both onstream, it has no further mega-projects on the line-up.

Future drilling may alter the picture, but as Tim Dodson, the company’s EVP for exploration explained: “Exploration on the NCS is different now. The biggest fields were found mostly in the 1980s and 1990s, and the average size of discoveries has fallen as the basin has matured – so most of the new fields will be developed through existing infrastructure.”

One priority for Equinor over the coming years will be to find new resources for existing gas supply projects, he said, in addition to proving reserves for new developments, and that will entail drilling around 20-30 exploration wells annually. The company’s ‘hit list’ of prospects, he added, is similar in volume terms to the line-up 10 years ago, but the size of the structures is significantly smaller due to the maturity of the basin.

If the company is to find larger fields on the shelf, he continued, it will need to take a chance on costlier, frontier region wells where the risks are higher, but so too are the potential rewards. “In this phase of the NCS’ life, we have to spend money on testing game-changing opportunities.” Typically, these are in complex, stratigraphic traps, but digitalization is speeding up the process of analysis, thereby reducing the geological uncertainty, Dodson said. “What took years to analyze before can now be done in days.”

At the time of ONS, Wintershall was preparing to spud the fourth of five-planned exploration wells this year, one of which has proven around 500 bcf in the deepwater Balderbrå prospect in the Norwegian Sea. The location is around 120 km (75 mi) from the Aasta Hansteen field development, where Wintershall is a partner to operator Equinor. Later this year the company planned to drill Marisko, a 1 tcf-plus prospect, 60 km (37 mi) to the north of Hansteen and in the same subsurface play.

Martin Bachmann, Wintershall’s Executive Board Member for E&P in Europe and the Middle East, said his company and others had been working on a plan for a new area-wide development that would encompass various presently stranded gas fields, including Asterix in the Voering basin, 80 km (50 mi) west of Hansteen, and that a success at Marisko could galvanize the project. The climate for exploration offshore Norway remained favorable, he added, with rig rates still relatively low.