Exploration drilling returns moderate in year to date, Rystad claims

Offshore staff

OSLO – Expenditure on conventional oil and gas exploration could exceed $50 billion this year, the highest since 2019, according to Rystad Energy. But results so far have been disappointing compared to last year’s returns.

In the first half of the year, Rystad estimates total new discovered resources of 2.6 Bboe, 42% down on the first-half 2022 haul of 4.5 Bboe.

The 55 discoveries recorded in the period compared to 80 in the corresponding first six months of last year, with average volumes of 47 MMboe as opposed to 56 MMboe in the 2022 period.

According to the consultants, E&P companies are shifting their sights to more profitable and geologically better-understood regions and are prioritizing the offshore sector, particularly under-explored or frontier areas, to unlock new volumes that could lead to high-risk, higher-cost offshore developments.

In the year to date, offshore has accounted for about 95% of exploration spending but only two-thirds of the total discovered volumes.

“If exploration efforts continue to yield unimpressive results for the remainder of the year, 2023 could be a record-breaker for the wrong reasons,” said Aatisha Mahajan, Rystad's vice president of upstream research.

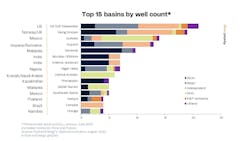

As so often, Guyana’s offshore Stabroek Block is leading the way with newly discovered volumes, with 603 MMboe added in 2023. Next comes Turkey with 380 MMboe, Nigeria with 296 MMboe and Namibia with 287 MMboe.

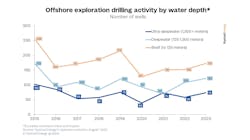

While the offshore discoveries have been relatively evenly spread between ultradeepwater, deepwater and shelf areas, activity is likely to step up in the ultradeepwater market, with a projected increase in well spuds of 27% over 2022.

Rystad forecasts a total of 31 high-impact wells to be drilled in 2023, of which 13 have so far been completed, six are in progress and 12 still to come. Four of the 13 completed wells have encountered hydrocarbons, a 31% success rate; six wells did not encounter hydrocarbons, while results from the other three wells have yet to be disclosed.

The big six majors of Exxon Mobil, bp, Shell, TotalEnergies, Eni and Chevron account for a large share of exploration spending and the conventional discovered volumes, and they will collectively spend an estimated $7 billion this year on exploration, 10% higher than in 2022.

However, more than half of the projected exploration spending in 2023 will come from NOCs and NOCs with international portfolios, Rystad added.

On a positive note, only 23 of the remaining 56 exploration wells on the global line-up are either drilled or expected to be drilled this year, which means that roughly 60% will either be drilled or postponed until 2024. So if returns this year seem disappointing, there could be a rebound next year.

08.02.2023