Offshore staff

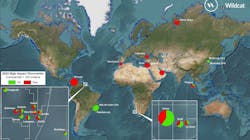

LONDON — Eighty-one high-impact exploration wells were completed globally last year, according to Westwood Global Energy Group.

This was similar to the numbers drilled the previous year. However, the returns were better, with the total discovered resource rising from 7.4 Bboe in 2021 to an estimated 9.2 Bboe in 2022.

In addition, the commercial success rate—the proportion of wells that could lead to a potentially commercial development—rose from 29% in 2021 to 36%.

There were play-opening deepwater discoveries in the Orange Basin offshore Namibia: Venus, operated by TotalEnergies, and Graff and La Rona by Shell, containing potentially more than 3.5 Bboe of discovered oil and gas resources.

After Venus, the second largest discovery in 2022, according to Westwood, was Uchuva in the Guijira Basin offshore Colombia, which proved 3 Tcf to 5 Tcf of recoverable gas.

There were also nine potentially commercial discoveries offshore Guyana and one offshore Suriname, which accounted for ~21% of the total discovered resource.

At the same time, only 19 frontier wells were completed in 2022, although these did deliver a 26% commercial success rate with other potential play openers at Timpan in Indonesia and Anchois-2 offshore Morocco.

In emerging plays, the commercial success rate increased from 28% in 2021 to 46% in 2022, due largely to improved results from drilling offshore Suriname-Guyana as the Exxon Mobil-led Stabroek joint venture focused on the core of the proven play fairway.

There was further follow-on success in the Cretaceous carbonate play in the Eastern Mediterranean with gas discoveries in Cronos and Zeus offshore Cyprus and Israel.

At the same time, the commercial success rate from high-impact drilling in maturing/mature plays decreased from 36% in 2021 to 30% in 2022. Attempts to extend the presalt play in the Santos and Campos basins offshore Brazil were unsuccessful, with further disappointments in the southern Caspian Sea, and no successes from the four high-impact wells drilled off NW Europe.

Westwood calculated that 76 companies participated in last year’s 81 high-impact wells, with the most active high explorers being CNOOC, Exxon and Hess (the Stabroek joint venture partners).

Next came TotalEnergies and Shell, followed by Qatar Energy in sixth place.

Westwood anticipates 75-85 high-impact wells this year, with South America’s Suriname-Guyana Basin and offshore Brazil a continued focus for drillers, and the first deepwater well will be drilled offshore Argentina.

Following a quiet period in North America, more than five high-impact wells should be drilled in the US GoM, along with commitment wells offshore Mexico, and a key frontier basin test in the Orphan Basin offshore eastern Canada.

There should be further wells offshore Namibia and frontier drilling off Morocco, Gabon and Mozambique, and probably five high-impact wells in the Eastern Mediterranean.

01.12.2023