Offshore staff

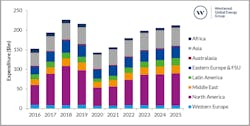

LONDON – Global drilling and well services (DWS) expenditure is forecast to increase year-on-year and reach $213 billion by 2025, according to Westwood Energy’s latest market forecast.

This growth trajectory highlights the improved market sentiment seen so far in 2021, following a very challenging 2020, where DWS expenditure plummeted by an estimated 34% as the combined pressures of the COVID-19 pandemic and the oil price collapse hit the industry.

According to the report, 2021 expenditure of $156 billion forecast represents a small increase on 2020 levels driven by improved commodity prices and demand forecasts, though operators remain cautious.

The World Drilling & Well Services Market Forecast 2021-2025 Q1 predicts total expenditure over 2021-2025 of $950 billion. Year-on-year growth is expected, with spend in 2025 36% higher than 2021. However, spend is expected to remain below 2018 and 2019 levels throughout the forecast.

Global spend will be driven by onshore activity in three countries: the US, China, and Russia. Combined, they account for 62% of total forecast spend, with the US leading with an estimated spend of $323 billion compared to $150 billion for China and $118 billion for Russia.

While the US will still lead spend globally, drilling activity in 2020 was severely reduced on recent years, causing spend to fall by an estimated 48% on 2019, which itself saw a decline of 10% on 2018 following operator capex cuts as the oil price stagnated. US drilling and well services expenditure is expected to grow over the forecast, reaching $75 billion by 2025.

However, it is not expected to return to 2018-2019 levels as operators are expected to remain cautious with drilling campaigns. Plus, the Biden administration’s indication of tougher legislation around oil and gas adds additional uncertainty, the analyst said.

Both China and Russia are expected to experience growth in forecast expenditure compared to the previous five-year period. In China, investment into shale production to meet government mandated targets is expected to drive demand for drilling and well services with spend reaching $32 billion by 2025, 19% higher than 2021.

Meanwhile, Russia will dominate spend in EE and FSU with high levels of drilling activity, to maintain market share and meet export commitments. However, compliance with OPEC+ agreements may hinder drilling growth in the near-term, the analyst pointed out.

Driven predominantly by these three countries, an estimated 96% of all wells drilled are expected to be onshore. Despite this, onshore will account for only 76% of DWS expenditure over the forecast due to: much higher day rates for rig and crew services, longer average days to drill a well, and greater safety requirements for those drilled offshore in comparison to onshore.

Latin American spend is anticipated to grow strongly, driven by continued offshore activity in Brazil and the emergence of Guyana’s oil and gas market, Westwood claimed.

Petrobras, who continues to expand deepwater activities as it divests from other assets, is expected to drill more than 160 subsea wells between 2021 and 2025, with high associated costs due to the depth of the presalt wells. Guyana is also forecast to see high numbers of high-cost subsea wells drilled by ExxonMobil as they continue to develop the discoveries in the deepwater Stabroek block.

Outside of Latin America, high drilling and well services spend is expected in the Middle East from a series of high-profile projects with high grade material requirements, such as Qatar Petroleum’s North Field expansion. Continued projects in Norway and the UK are expected to drive expenditure in Western Europe.

According to the report, rig and crew services are expected to lead with $280 billion forecast over 2021-2025, 29% of total spend. This is expected to be followed by stimulation services, with an estimated 21% of total spend, driven by US activity.

03/22/2021