Offshore staff

LONDON – Ensco plc and Rowan Companies plc have entered into a definitive transaction agreement under which Rowan will combine with Ensco in an all-stock transaction.

The definitive transaction agreement was unanimously approved by each company’s board of directors. The Saudi Aramco partner to theARO Drilling joint venture has consented to the combination.

Under the terms of the transaction agreement, Rowan shareholders will receive 2.215 Ensco shares for each Rowan share. Upon closing, Ensco and Rowan shareholders will own approximately 60.5% and 39.5%, respectively, of the outstanding shares of the combined entity.

The combined company’s rig fleet will consist of 28 floaters (drillships and semisubmersibles) and 54 jackups. Twenty-five of the 28 floaters are ultra-deepwater rigs capable of drilling in water depths of more than 7,500 ft (2,286 m), with an average age of six years.

The 54-rig jackup fleet will include 38 units that are equipped with increased leg length, expanded cantilever reach and greater hoisting capacity. Among its jackup fleet are seven ultra-harsh environment units and nine additional modern harsh-environment rigs.

Ensco shareholders will gain exposure to the ARO Drilling joint venture and ultra-harsh environment jackups, along with a presence in Norway. Rowan shareholders will gain access to Ensco’s relationships with large deepwater customers and wider geographic footprint, which includes a presence in Brazil, West Africa, Southeast Asia and Australia, along with a versatile semisubmersible fleet.

Upon closing, Carl Trowell will become executive chairman, Tom Burke will serve as president and CEO, and Jon Baksht will serve as senior vice president and CFO. The remaining executive management team for the combined company will be named later and will comprise executives from both Ensco and Rowan. In addition, the board of directors will include Trowell and Burke, plus five additional members from Ensco’s current board and four additional members from Rowan’s current board.

The combined company will be domiciled in the UK, and senior executive officers will be in London and Houston.

The transaction is subject to approval by the shareholders of Ensco and Rowan and regulatory authorities, as well as other customary closing conditions. In addition, the transaction will be subject to court approval pursuant to a UK court-sanctioned scheme of arrangement. The transaction is not subject to any financing conditions.

The companies said that they intend to file a joint proxy statement with the Securities and Exchange Commission as soon as possible. They anticipate that the transaction will close during the first half of 2019.

Leslie Cook, principal analyst, Wood Mackenzie said: “What makes a company like Rowan particularly interesting for Ensco is the opportunity to further high-grade their growing portfolio with premium assets and expand their footprint in key markets such as Middle East, Latin America, Europe, and US Gulf of Mexico.

“Once combined, Ensco-Rowan will have the second-largest floating rig fleet, with nearly 90% consisting of generation VI and VII assets. These are the rigs that are most desired by operators globally, as they offer the best capabilities and flexibilities for various deepwater drilling programs around the world.

“The combined company will also become the largest player in the jackup sector. Nearly 40% of the combined portfolio will consist of ultra-harsh and modern harsh-environment assets.”

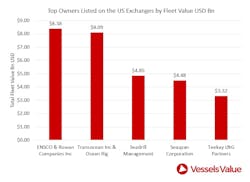

According to analyst VesselsValue, this acquisition makes Ensco the largest MODU owner by value, with a total fleet (live, on order, and joint ventures) worth $8.4 billion. This knocksTransocean from the top spot which it held for a month due to its merger with Ocean Rig.

The analyst added that the Ensco and Rowan merged fleet is now the most valuable publicly listed cargo and offshore fleet listed on the US stock exchange.

10/08/2018