PRODUCTION TECHNOLOGY: Intelligent wells - Low-end and high-end systems, and how they work

As more intelligent well systems are installed in wells onshore and offshore, service companies are getting a clearer idea of how this market will develop in the future. While earlier ideas for how smart well systems would be applied were ahead of their time, simpler systems could mean as many as 80% of the fields offshore will be equipped with some type of intelligent completion in the future.

As much as any recent technological innovation, the advent of smart well systems exemplifies the process of adopting a new technology. While early systems were fraught with problems, more recent applications have had a success rate that the major operators find attractive.

Still, there is a trade-off. The operator can save money down the road by spending money up front, as long as the system installed is reliable, and provides the benefits required. In some cases, it is difficult to know ahead of time exactly what a well will need from an intelligent system. But having the system in the ground provides an operator with different options.

Is less more?

The high up-front cost of smart systems means the technology is not for everyone. A well must have the reserves potential to justify such an investment and, at the same time, be structured in a way that a smart system will increase the recoverable reserves.

In looking at this model, Clark Robison, Product Line Manager for Weatherford, saw an opportunity for his company to change this market model. Robison said he believes the service industry has been caught up in a race toward new technology and lost sight of the simpler solutions that could benefit a broad range of lower-end wells. After joining Weatherford, the first thing Robison did was change the direction of the company's remotely operated completion systems (ROCS) efforts. Rather than competing head to head with others on high-end systems that measure flow, temperature, and pressure downhole, as well as remotely control sliding sleeves, Robison took a basic approach to the solutions. "They were definitely headed down the electro-hydraulic track. I redirected all that," he said.

A critical component to these remote systems is the downhole electronics. These electronics remotely control the movement of sleeves, provide power for, and transmit the data from, the sensors. The electronics also are the most vulnerable part of the intelligent system because the components are heat sensitive. A major part of the technology is designing electronic gauges that can handle the extreme conditions downhole.

Smaller projects

Robison said he realized that, in some cases, there was no option but to install the equipment. With proper testing and design, the equipment will work - this had been proven. The problem is that a high price tag comes with the reliability of downhole electronic components. In many cases, this places the systems out of reach of smaller oil and gas development projects.

"What if they (the electronic components) were eliminated?" was Robison's first thought. He focused attention on an all-hydraulic system that can isolate zones using tried-and-true technology developed for subsurface safety valves decades ago. Such a system wouldn't include downhole flow measurement, or temperature and pressure measurement. But, Robison said, there are other ways to gather this information, and the balance is that when these components are eliminated, the cost of the system plummets and reliability skyrockets.

Robison said he is the first to admit the systems he is talking about are limited. The whole point, he claims, is this limitation. Why install more equipment than is absolutely necessary. There will always be a market for the high-end designs, but those companies who have in-house departments developing permanent downhole gauges are better equipped to compete on these projects.

At the same time, because Weatherford does not have such a division, it is not inclined to include sensors in its designs. If sensors are required, Weatherford could align with a provider and have access to state-of-the-art equipment. The key is to look at these jobs from a less-is-more perspective.

Remotely operated completions

Weatherford believes that this approach will make remotely operated completion systems (ROCS) a viable option for as many as 80% of the wells in the Gulf of Mexico. The basic system uses an electric umbilical to activate hydraulics at the wellhead that can open or close sleeves, effectively isolating flow from different zones.

This allows multiple completions to be performed at the same time and can combine production enhancement activities such as frac/pac for all zones of a well with only one crew mobilization. Because there are no downhole electronics, it is possible to repair or replace any subsea electrical component. Everything below the wellhead is hydraulic.

For flow measurement, Robison said all but one zone can be shut in using the sleeves, so only the single zone is flowing. This flow can then be measured at the surface. This equipment is standard issue on all production platforms and is not only inexpensive to maintain, compared to downhole sensors, but very accurate.

Not all reservoirs will respond well when zones are shut in. This process also interrupts the production stream. Robison's point is that, for some projects, the cost of shutting in is less than the savings of using such a simple intelligent system, and the long-term benefits of remote control. Because this design does not include downhole electronics, there are no pressure or temperature readings downhole. Robison said this is part of the cost savings and reliability.

There are fields where this data may be critical, but for others it is an expense that can be eliminated. He said if needed, such sensors can be installed. For the full-blown package, Weatherford could align with an outside company and provide the flow measurement downhole. The point is there are a number of options that center around the specific requirements of a particular well.

For wells where the downhole sensors can be eliminated, Robison said a robust, reliable all-hydraulic remotely controlled system should be provided. For wells with a production platform installed over them, there are a number of options for downhole sensors that do not require permanent installation. Wireline or slick line could be used to run sensors as could a design that incorporates a downhole tractor to draw the slick line into horizontal wells. These solutions avoid the hazards and cost of installing electronics downhole.

Shattering a perception

Weatherford isn't the only company that has developed and installed all-hydraulic systems. In part that is a benefit, because these other systems have been tried and tested and have a good reputation among operators. A company is more likely to approve an all-hydraulic ROCS with fewer tests, than a custom designed intelligent well system that includes downhole gauges and sensors.

The design, building, testing, and operation of such a system is also expensive. There are a limited number of people qualified to build and operate these systems, Robison said. To compete for the best talent in the industry, in these specific areas, is expensive. Rather than join in the competition for higher end systems, Weatherford has chosen to focus on providing systems that are inexpensive enough to be applied to smaller projects, yet reliable.

To launch this effort, Robison said he approached onshore operators in Bakersfield, California. These producers are operating wells he describes as "the lowest of the low end." The reasoning was that if Weatherford could design a system that would make economic sense for these operators, they would be able to help anyone. The goal was to install a remotely controlled system that could isolate zones so that frac/pacs could be performed on multiple zones with only one mobilization of the service crew. This would enhance production without the additional cost of mobilizing the service company to frac each zone separately.

The company is holding discussions with North Sea and Gulf of Mexico opertors, and there are tests underway on equipment that should be completed by summer. Even in this area, Robison said, Weatherford is being very conservative. "We're not trying to design the end-all, do-all sleeve," he said. This also cuts down on costs.

Assuming the tests are successful, Robison said they will target older shelf wells in the Gulf of Mexico - those that would not traditionally be considered candidates for such advanced technology. "The industry has a perception that has to be shattered," he said.

High-end market status

If Weatherford is after the low-end market, then Halliburton is rapidly pursuing the high-end, high-tech market. With more than 30 SmartWells installed, Halliburton is at the head of a growing market. With early reliability concerns behind it, the company has now shifted its efforts, according to Ian Phillips, Strategic Marketing Director for WellDynamics.

In the spring of last year, Halliburton and Shell International E&P set out to form a joint-venture called WellDynamics. Due to close in April, WellDynamics combines Halliburton's SmartWell intelligent completion technology with Shell's iWell well technology. The goal is to bind together the downhole measurement, inflow control, downhole processing, and communications technologies of the operator and service company.

When PES, now owned by Halliburton, formed a consortium to develop the SCRAMs system (surface-controlled reservoir analysis and management system), it established the goal of measuring pressure and temperature, as well as controlling the flow downhole. SCRAMs, became the company's most sophisticated SmartWell system. Not only does the SCRAMs system accomplish these functions, it features full redundancy.

This redundancy was another feature of early designs, and it is still a major consideration, since it increases reliability. Another priority is the installation of downhole pressure sensors. Those were the two main early interpretations of what a smart well might be, circa 1995. Since then, the development of different ways to control devices downhole has evolved.

Redundancy at cost

The downhole equipment on the SCRAMS system is electro-hydraulic powered and has full redundancy, which makes it extremely reliable, but also increases the cost. In applications where the operator is willing to accept a bit more risk, simpler hydraulic systems can be used to remotely operate the downhole control valves (infinitely variable chokes as well as 4-position sliding sleeves). This does not require redundancy or downhole electronics and as a result is less expensive.

PES has developed a variety of such systems that offer the customer different levels of functionality, which should be matched to the requirements for a particular application. The simplest of these has a single hydraulic line that can apply pressure to operate a ball valve. This is a simple lubricator valve that operates as an open or close device.

The recently developed digital hydraulic system uses three hydraulic lines. By applying pressure to different combinations of these lines, an operator can control up to six distinct downhole devices. While six is a lot more than one, the full-blown SCRAMs can control up to 127 addressable downhole devices.

In the area of data acquisition, Phillips said, a lot of one-off investigations are underway around the world. A combined pressure and resistivity system actually images the fluid flow in the reservoir. This information is used to control the placement of fractures.

The UK company Sensa uses fiber optic lines that give users a temperature profile up and down a well. Most of the data sensing is in what Phillips calls the "early prototype stage." It is roughly three to four years behind the flow control systems. With the exception of pressure gauges, these technologies will have a half-dozen field applications in 2001.

Who needs what

One of the biggest confusions in the market is the short label "SmartWell." This term covers a wide range of applications, and the asset owner needs to be clear on the benefits. Overall, the goal is to get more oil out of the ground. Phillips said there are claims that enhanced recoverable reserves could be as high as 50%, but he says that operators should be confident they can increase reserves recovery before committing to such a system.

Depending on the specific system, well installation prices can vary from $100,000 to $1.5 million. This is an up-front cost that has to be weighed against the potential increased recovery. WellDynamics says it provides operators with application screening services that identify the value proposition for field development options where smart well equipment is proposed.

There also is the question of reliability. While these systems have greatly improved in reliability, there is always a certain level of risk that must be factored into the equation.

Degree of risk

To get a clearer idea of exactly what the relationship is between these systems and improved recovery, Halliburton has teamed with Shell to look at data from the operator's SmartWell systems. "They are pretty comfortable now. The reason they got into this business (WellDynamics) was that they see a huge potential benefit for their assets," Phillips said.

There are basically two objectives to the SmartWell concept, Phillips said, both are essential to getting the most out of the system. The first is understanding the reservoir. It is important to know how the fluid flows through the rock so that the operator knows how to optimize his downhole system.

Along with good reservoir data, the operator needs a reliable control valve system that can make various adjustments. This allows the operator to fine tune production. "It's the sensors that are the underpinning of the system and future infill field development," he said, "but the flow control that actually turns the potential into value."

Developing a deepwater field using traditional completion technology may mean some very expensive intervention down the road. To avoid this, a smart well is clearly the way to go, Phillips said. It offers a straight operational benefit and early cost recovery. When the well is being constructed, an operator may not know which zone to choke back and which to continually produce. By installing the smart system, a producer can realize a savings through increased recoverable reserves.

WellDynamics has installed over 50 systems worldwide, but not all are the high-end, SCRAM systems. Approximately 25% are SCRAM systems, and 30% are basic or mini-hydraulic systems, meaning single hydraulic lines. The other 45% are direct hydraulic systems. These are twin hydraulic line systems. WellDynamics is about to install its first digital hydraulic system in the North Sea.

The Norwegian sector of the North Sea has traditionally been the most enthusiastic market for the high-end systems, according to Phillips. This area has large reservoirs, and a long tradition of trying out new technology. However, with installations worldwide, WellDynamics is confident that the benefits of SmartWells are equally applicable to all reservoir types and locations.

Reassessing demand

While the full-blown, high-end intelligent well systems (multi-position, reservoir parameter sensors, and system diagnostics) were initially thought of by some to be what the operators wanted, this view changed over the past two years.

According to Brian Drakeley, Business Development Manager Reservoir Management Solutions at ABB Offshore Systems, his company is developing a number of fit-for-purpose systems that include simple on-off sliding sleeves, with no sensors. Drakeley said such systems meet the needs of certain reservoirs and also are easier for the operators to sell internally to their asset teams.

Asset teams see these simple, direct hydraulic systems as less risky and less costly. Outside of ABB, Drakeley said other providers have been taking a similar approach, and there is a successful installation and operational track record being built up by these low-end systems, which ultimately can only help with the long-term acceptance of intelligent well technology.

Net-sourced assistance

A joint industry project (JIP) data base, called Intelligent Completions On the Net (ICON), is operated on the internet and contains detailed information on the intelligent systems installed in wells all over the world, as well as details of the product offerings and development activities of the member companies.

The database also includes sensor installations as well as full intelligent well systems including remotely operated downhole valves and chokes. Drakeley said a limited amount of the data is available to service providers, while operator members have full access to the data. The goal of this operator and service company JIP is to allow the customer to rationally evaluate the risk and reward associated with different levels of intelligent completions.

Aside from the reliability question, Drakeley said most of the wells just don't need the full blown, high-end systems that are available. There is a much broader market in terms of number of applications for the simple systems with sliding sleeves and a direct hydraulic link.

In the sensor end of the design, Drakeley said just about any well could make use of permanent downhole temperature and pressure gauges. For subsea applications, it is assumed downhole gauges will be permanent, whether they are electronic or fiber-optic based. Operators feel that the benefits of such systems, for subsea wells, justify the cost.

Looking to the future, Drakeley said ABB is developing its own line of permanent downhole fiber optic sensing solutions. The first ABB downhole pressure and temperature fiber optic measurement system installation in a live well took place in March 2000.

While the initial cost of installing such systems may be higher, Drakeley points out that fiber optic sensors remove electronics from the downhole array. This increases the intrinsic reliability of the system, and may ultimately result in more robust, less expensive systems, as volume usage increases. One of the fibers can take readings from multiple points in the well.

Micro-seismic

In addition to pressure and temperature measurement, Drakeley said ABB sees a market for the permanent installation of a fiber optic system that additionally provides micro-seismic data. Drakeley said such a system would allow for improved production management (altering the production/injection flow rate of zones using downhole chokes based on the real-time data from the reservoir, as opposed to data from only the well bore).

With micro-seismic, it is possible, for example, to track a water front before it reaches the wellbore and react to avoid watering out. Such micro-seismic interpretation work has been done for some time with temporarily deployed sensing systems. Drakeley said he sees inclusion of permanent micro-seismic sensing in such systems, as being at least a year away from actual deployment. There are also still two main challenges to overcome in the use of fiber optics for downhole sensing in subsea wells. The first challenge is designing fiber optic subsea connectors for wells with horizontal trees. Another issue is installing the systems in wells that use multi-stage completions and therefore have a need for downhole fiber optic wet connects at the packers. Both of these needs are being addressed.

As the technology continues to advance and the market continues to grow, there should be a subtle drop in price, particularly with increased competition. The greater demand for these systems would help the various service companies recover their initial research and development investments and thus compete across the board at lower prices. Drakeley said that while the market is growing, it has not yet reached this point. In addition to lower prices for the same systems, Drakeley said there will be a wider variety of systems offered in the future.

Pricing schemes based on system availability/functionality over time also are being offered to operators to help overcome concerns over system reliability.

Customer-driven systems

Baker Oil Tools worked through a customer advisory committee when determining the direction to take with its intelligent well systems, according to Director of Marketing and Technology, Intelligent Wells Systems, Jack Angel. The customer input went beyond the system capabilities to include such details as the size tubulars the industry would require (5 1/2-in. valve inside 9 5/8-in. casing), he said. While this was helpful early on, the needs of the industry are broadening. Angel said there are now a number of requests for valve sizes of 3.5 and 4.5-in. Beyond just the sizing of the systems, Angel said the industry appears to be adopting the systems much quicker than BOT had anticipated.

Quick pickup

The assumption was that the operators in the Gulf of Mexico would take a wait-and-see attitude since the region is known as conservative when it comes to adopting what it classifies as unproven new technology. This is not the case, Angel said not only are the GoM operators beginning to adopt the systems, but they also want them for subsea wells. He said the systems are an integral part of the industry's march into deepwater. To make such projects viable requires new technology. In addition, Angel said the operators are watching the bottom line very closely and realize subsea wells are far less expensive than those requiring a surface facility. That is unless they require intervention down the road. The chief benefits of installing the intelligent equipment include eliminating the cost of acquiring an intervention rig, preventing lost production during intervention, and reducing the risk of water cut affecting long-term production.

By using this system an operator can complete all the zones of a well in one mobilization, then either co-mingle production from the different zones or shut in selected zones of the well. All of these activities have an impact on the payback from the well. At the same time, the systems are less likely to damage the formation near the well bore because conventional intervention work is avoided.

In addition, Angel said the healthy price of oil and gas has allowed operators to spend a little more to bring production online sooner. In a way, the intelligent well systems are an investment in future production. Angel said the operators can justify the additional expense up front because it can be covered by increased early production, which will go to market at the relatively healthy prices now in place. Down the road these systems will mean production can be optimized regardless of the price of the commodity since the infrastructure is already in place. This reduction in operating expenditures is a sort of insurance policy against a future drop in energy prices, Angel said.

While it is useful to open and close a zone of a well, Angel said it is much more beneficial to have a choke valve with infinitely variable positions to allow production not only to be opened or closed, but "fine-tuned." This is one aspect of the system application that is lagging in Angel's opinion.

"We thought pressure management would be better embraced by this time," he said.

While these systems exist, so far Angel said he has not come across a production model that optimizes them. He said Baker Oil Tools has the sensors to gather well data and the sliding sleeves to make fine adjustments in the production rate. What is missing is the software to interpret this data and recommend changes in the sleeve settings. The goal is to tie the data directly to the sleeve setting through a program that can make real-time adjustments based on changes in the production rate or composition. This is not yet in place, but Angel remains confident. "It's going to happen," he said.

While advancements in the applications modules involved in this system continue to progress, Angel said most installations are of a much simpler design. These direct hydraulic installations are simple open and close designs with conventional well monitoring systems. Angel said these designs may not be as glamorous as the one described above, but they play an important role in the development of intelligent completions. As more of these basic systems are successfully applied, industry will gain confidence in the technology. As this comfort level rises it will be easier to approach the customer with the more advanced designs. Baker Oil Tools will be ready when the time comes, Angel said. The company's new integrated, all-electric system is capable of monitoring and controlling up to 12 zones in one well while taking pressure, temperature, and mass flow measurements.

Beyond the concepts advanced by the service companies, Angel said he is impressed with novel applications of the simple sliding sleeve designs. In light of all the ways remote controlled sleeves can serve the industry Angel readily admits there will be numerous applications no one sees coming. "We don't know what we don't know about what the future applications will be," he said.

Role of reliability

Dan Johnson, Manager of Completions Technology for OSCA said he believes the high price of initial intelligent systems combined with reliability issues early on left a sour taste in the industry's mouth. While the prices are coming down as more variations of these systems become available, there is still the question of long-term reliability. "Reliability is the big key," he said.

From this perspective, Johnson said customers seem to associate downhole electronics with problems. All-hydraulic systems, on the other hand, are more economical and use technology that date back more than 40 years. This simplicity eliminates the need for redundancy and further lowers the price.

An intelligent completion, even with the simplest direct hydraulic, two-position valve adds substantially to the cost of a completion. Johnson said this cost has to be recovered in either savings down the road in terms of eliminating the need for intervention, production of multiple fields from a common production facility, or in increased early, or overall, production. It would appear that, for a variety of clients, the economics of such a system make sense.

Not just deepwater

While there is an overall industry push into deepwater developments, where the cost of intervention on subsea wells is all but prohibitive, Johnson said his company also is enjoying success in shallow water fields. A number of customers have asked for the all-hydraulic systems in their shallow-water subsea wells.

Johnson said that subsea, in general, will be the growth market for all types of intelligent downhole systems. The key is that a subsea well can be tied back to an existing surface-piercing facility for less than it cost to complete it to a purpose-built facility. The caveat is intervention requirements.

If it is necessary to intervene in such a well to complete a second zone or to move a sliding sleeve, for example, then the cost in terms of rig time and lost production typically negate the savings of a subsea tieback. With intelligent systems, a driller can complete all the zones of a multi-zone well at one time, without the burden of producing all these zones initially.

In addition to these savings, Johnson said wells with distributive temperature sensors and a chemical mandrel can pump production enhancement chemicals to a particular zone to manage production. Because the subsea wells are becoming such a strong market for this technology, Johnson said the Gulf of Mexico appears to be the current hotbed of activity. Prior to this, the North Sea was an early adopter of the more high-end technology. Johnson said he sees applications for future fields offshore West Africa and Brazil.

In the area of sensors, Johnson agrees with the opinion that the future lies in fiber optic technology. Distributive temperature, pressure, and flow can be measured using one fiber, which reduces the burden on designing downhole systems with multiple through paths.

Also, with only one line in the ground, for well monitoring, it is less likely problems will develop. In addition to monitoring well conditions, Johnson said the fiber optics are being tested for use in determining the position of a moveable valve. This is one of the advantages of an electronic system that is lost with a hydraulic design. "I see fiber optics as the wave of the future," he said.

Permanent sensors, valves

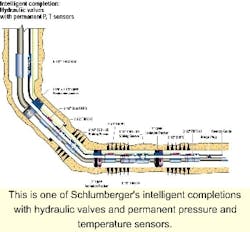

For Schlumberger, the purchase of Camco International in 1998 set into motion many of the systems the company provides today. Marketing Manager for Reservoir Monitoring and Control John Algeroy in Schlumberger's Reservoir Completions group said that some of these technologies were developed in the North Sea for the Norwegian operator Norsk Hydro. Not only does this region have a reputation for adopting new technology, said Algeroy, but there were certain tax incentives that encouraged development of and investment in new technology.

While Schlumberger has been installing permanent downhole gauges since the mid-1970s, the direction the company took after the Camco acquisition was to form an integrated advanced completions group. This brought together all of the company's development of downhole equipment and technologies in one central location.

The result has been that while the company is a leader in downhole gauges, it has also installed a number of control valves with 100% survivability to date. At the same time, Algeroy said, Schlumberger developed an all-electric well with downhole control valves and sensors. There are a number of advantages to such a system, including the ability to:

- Monitor the position of the valve

- Open the valve to an infinite number of positions

- Minimize the number of wellhead penetrations.

An all-electric system may seem more complex than the simple hydraulic system, but in addition to the above benefits, it also allows the control of wells (in the deepwater Gulf of Mexico), from a desktop in Europe or Houston, or anywhere in the world.

Algeroy said he is confident the advantages of such a system will be realized by the market place following BP's example with the world's first all-electric well installed at the Wytch Farm field in England in August last year.

With this system, automation can be introduced into the process. Algeroy said that the integrated sensors in the downhole valve can be set so that at a certain value, the valve position will be adjusted automatically. This means production will automatically remain within an optimal range.

Reservoir model first

While the cost of such advanced systems requires a certain type application to be justified, Schlumberger's approach is to first design a reservoir model then build a custom system to optimize production and enhance recovery.

Several systems may be brought forward from the very complex to the simple. Thus, the client will be allowed to choose based on key issues like risk and return on the investment. In general, these systems will reduce client completion expenses because multiple zones can be perforated up front with the commingling of production, while controlling each zone. Not only is the production rate increased, but also by manipulating the downhole valves, the threat of water cut can be controlled and the gas/oil ratio optimized for the various zones.

Algeroy said once the equipment is installed, it not only helps optimize production, but also allows the operator contingency options for unforeseen events. The downhole sensors can monitor real-time well conditions and identify trends in production that could anticipate the need to make adjustments before, for example, water cut becomes an issue. This allows the operator to take an active role rather than a reactive position.

In any case, Algeroy said Schlumberger's advanced understanding of reservoir modeling allows the producer to weigh the cost and risk of the equipment against the enhanced recovery represented in the model. This data also helps the producer justify the concept internally to his organization, Algeroy said.

Beyond the deepwater and subsea tieback market, Algeroy said there is a growing market for this type of technology in older fields. Wells that already have a surface facility and have been onstream long enough to pay down their infrastructure can see a great benefit from enhanced production technology.

Using this equipment might lead to much improved overall recoverable reserves at a time when the reservoir was thought to be all but played out. Again, this would be handled on a case-by-case basis beginning with an analysis of the reservoir. This study would allow Schlum-berger to design a system that would improve the recoverable reserves and fit into the budget of such a project.

A key to this is the ability to see into the reservoir beyond the wellbore boundaries with specially designed sensors. This allows the operator to monitor the changes in the reservoir and better optimize the well.

Downhole sensors

Focus of efforts by The Wood Group have been on intelligent downhole sensors that can either communicate downhole or with the surface, according to David Blacklaw, General Manager of Wood Group Production Technol-ogy. Wood Group has been installing sensors downhole since the mid-1980s and worked with other companies intelligent completions. "We've been involved in fiber optic (sensors) since 1996," he said.

While other companies have installed fiber optic distributive temperature gauges, Blacklaw said these typically do not go into the production bore. Wood Group has made many installations of sensors with access to the production bore. Blacklaw said these are more complex and difficult to install. "We see our role as taking the basic technology and making it something that will work in the real world," he said.

Anyone can get one of these sensors to work in the lab, Blacklaw said, but once installed in the wellbore, the equipment has to work reliably in a hostile environment for several years, without the possibility of access for maintenance. Reliability is key, and to get that right requires a design that can stand up to the downhole environment.

Heat is the hurdle

Downhole, temperature is the main enemy of electronic systems. In terms of the constraints of the environment, sealing technology is another major concern. Blacklaw said most seals are designed for short-term use rather than the life of the well. The sealing systems for these applications may be subjected to very low temperatures and pressures on the deck of the vessel then experience very high temperatures and pressures inside the well.

"You need to cover all the phases in the system's life in designing your sealing technology," he said. In addition to the seal, the mechanical packaging for the systems has to stand up to temperature, vibration, shock, etc. for a number of years.

Initially there was a lot of noise about the high-end systems, Blacklaw said, "but what we see through our contracts is what tends to work better in practice - that is, a simpler, more robust system." Wood Group has installed a system that combines Baker's hydraulic controlled sliding sleeves with Wood's pressure temperature systems. Such a direct hydraulic system is more robust, Blacklaw said, and costs about a quarter of what the high-end system would cost.

For this lower price, the system has some limitations, but Blacklaw pointed out he was able to save the client the cost of drilling an additional well. "In that case, we were able to put a simple, robust system in that was what the customer was looking for," he said. The companies, which have the full high-end systems, may tend to focus on these solutions, but for many wells a simpler design works well. "In practical terms, the wider market will be for the simple, robust systems that do the job and don't have all the bells and whistles," he said.

There will always be high-end applications where the operator needs finer control of the well, but these sophisticated systems with the high-end requirements will exist side-by-side with the lower end systems, which will see the majority of installations, according to Blacklaw.

While, initially, the industry was a little slow to adopt this new technology, Blacklaw said he believes this was a result of the industry slowdown at the time rather than a lack of faith. Currently, there is a lot more interest being shown in intelligent completions technology; although, it may still be a while before new jobs come on line. Blacklaw said completion contracts typically lag other areas when the industry picks up, so he hopes to see new orders coming in soon.

The lead time for the lower-end systems is shorter since they rely heavily on "tried and true components" where as the high-end systems use specially designed components and must undergo qualification testing of the hardware and the design, which is time consuming.

Down the road, Blacklaw said the industry would see a greater, more widespread use of the intelligent well systems. This will be a "horses for courses" situation, but the range of what is available will be considered for most wells, where as today, someone has to seek this out and make it their mission to include intelligent completions in a well. In the future, the intelligent completion options will be considered on most wells. While the cost of the high-end systems is prohibitive for most wells, Blacklaw said the price should come down in the future, making the technology more accessible across the board.