Offshore staff

SAN RAMON, California – Chevron Corp. has entered into a definitive agreement with Anadarko Petroleum Corp. to acquire all the outstanding shares of Anadarko in a stock and cash transaction valued at $33 billion.

The acquisition consideration is structured as 75% stock and 25% cash, providing an overall value of $65 per share based on the closing price of Chevron stock on April 11, 2019. In aggregate, upon closing of the transaction, Chevron will issue approximately 200 million shares of stock and pay about $8 billion in cash. It will also assume estimated net debt of $15 billion. Total enterprise value of $50 billion includes the assumption of net debt and book value of non-controlling interest.

The transaction has been approved by the boards of directors of both companies and is expected to close in the second half of the year. The acquisition is subject to Anadarko shareholder approval, regulatory approvals, and other customary closing conditions.

Upon closing, the company will continue be led by Michael Wirth as chairman and CEO and will remain headquartered in San Ramon, California.

Wirth said: “This transaction builds strength on strength for Chevron. The combination of Anadarko’s premier, high-quality assets with our advantaged portfolio strengthens our leading position in the Permian, builds on our deepwater Gulf of Mexico capabilities, and will grow our LNG business. It creates attractive growth opportunities in areas that play to Chevron’s operational strengths and underscores our commitment to short-cycle, higher-return investments.”

Anadarko Chairman and CEO Al Walker said: “The strategic combination of Chevron and Anadarko will form a stronger and better company with world-class assets, people, and opportunities. I have tremendous respect for Mike and his leadership team and believe Chevron’s strategy, scale and operational capabilities will further accelerate the value of Anadarko’s assets.”

According to Chevron, Anadarko’s assets will enhance its portfolio across a diverse set of asset classes, including:

- Shale and Tight – The combination of the two companies will create a 75-mi (121-km) wide corridor across acreage in the Delaware basin.

- Deepwater – The combination will enhance Chevron’s existing high-margin position in the deepwater Gulf of Mexico and extend its deepwater infrastructure network.

- LNG – The company will gain another world-class resource base in Mozambique to support growing LNG demand. Area 1 is a very cost-competitive and well-prepared greenfield project close to major markets.

In addition, the transaction is expected to achieve run-rate cost synergies of $1 billion before tax and capital spending reductions of $1 billion within a year of closing. The company said it expects the transaction to be accretive to free cash flow and earnings per share one year after closing, at $60 Brent.

Chevron said it plans to divest $15 to $20 billion of assets between 2020 and 2022. The proceeds will be used to further reduce debt and return additional cash to shareholders.

As a result of higher expectedfree cash flow, the company said it plans to increase its share repurchase rate from $4 billion to $5 billion per year upon closing the transaction.

Analysts were quick to respond to the news.

The acquisition is reflective of multiple trends that are becoming increasingly evident in the global energy market, according to Rystad Energy.

Founder and Chief Executive Jarand Rystad said: “Energy giants recognize that they need to invest more in the shale sector and in renewable energy. At the same time, due also to the lower cost of capital prevalent today, it makes sense for modern E&P companies to favor higher leverage and lower equity share, and instead use debt capital to fund investments and operations, while enhancing shareholder value through share buy-backs and higher dividends.”

He added: “This acquisition represents a golden opportunity for Chevron to achieve a more leveraged capital structure that is better suited for the lower risk energy projects of the future.”

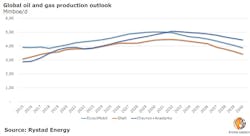

Chevron and Anadarko, which currently rank as the world’s 10th and 41st largest producers of oil and gas, respectively, will climb to seventh place after the merger, according to the analyst. The new entity will jump ahead of Shell and BP in the rankings and will trail only ExxonMobil and the five biggest national oil companies.

The consultant also sees strong synergies between the two companies in the US Gulf of Mexico, where the merged entity will become the largest producer, surpassing current leaders BP and Shell. Synergies are also apparent in East Africa, which is emerging as a vital region in the buoyant global market for LNG. They also have overlapping portfolios in Latin America.

Founding partner and Head of Research Per Magnus Nysveen said: “Despite a 37% premium, we think the deal value price of $50 billion is surprisingly good for Chevron. The implicit oil price in the deal is $60/bbl, while oil price today is $71/bbl. Adding synergies, we see a strong potential for value capture here.”

Roy Martin, senior analyst, corporate analysis at Wood Mackenzie, said: “This is the biggest upstream deal sinceShell and BG in 2015. Chevron now joins the ranks of the UltraMajors – and the big three becomes the big four.”

Once the deal closes, the company will now be the second-largest producing major, in 2019 terms. It was fourth.

Martin added: “The acquisition makes the majors’ peer group much more polarized.ExxonMobil, Chevron, Shell, and BP are now in a league of their own.”

Frank Harris, vice president, LNG consulting, Wood Mackenzie, said: “We do not expect the deal to have any near-term impact on theMozambique LNG project, as Anadarko has indicated that FID is imminent. However, Mozambique offers attractive long-term growth and diversification opportunities for Chevron’s LNG portfolio.”

04/12/2019