Offshore staff

LONDON – The offshore rig market appears to be finally on the road to recovery, according to Westwood’s RigLogix service.

Its October 2018 RigOutlook details likely activity trends between now and September 2019.

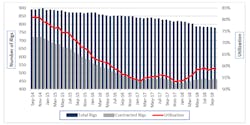

Currently there is a 316-rig gap between supply and demand within the global fleet, not including 118 rigs under construction that cannot find their way into the fleet. Even though retirements have accelerated in the past four years, the market remains out of balance as attrition alone does not resolve the oversupply problem.

Since September 2014, 220 rigs have been removed from the fleet, but use during the same period still fell from 81% to 59%. And over the past 15 months, use of available offshore rigs has only improved by 6%.

However, the new report expects a slower rate of attrition next year, with the improving market making it more difficult for owners to dispose of some rigs if they believe there could be work in prospect, according to Terry Childs, head of RigLogix.

Currently 118 rigs are on order or under construction, only four of which have drilling contracts in place. Many have been essentially finished for two or more years.

Some shipyards have ended up owning rigs after construction contracts were cancelled and they are finally starting to sell some of the units:Borr Drilling spent $2 billion to acquire 14 jackups from Singapore’s PPL Shipyard and KeppelFELS, five of which have been delivered to the contractor.

So far, Borr has only received letters of intent for a few of these rigs, but formalized contracts for at least two should follow soon, Childs claimed.

Next year around 20 further newbuilds should be ready to come on the market.

Demand between now and next September 2019 should pick up for both jackups and floating rigs. There are at present more than 250 rig requirements worldwide where an expression of interest or market survey has been issued to pre-tender or an outstanding rig tender pending award.

While day rates generally have seen little improvement, there are a few sectors where high demand has pushed day rates up substantially over the past year or so, one being Norway, where some harsh-environment semis are commanding $300,000/d or more, in some cases double the rates from earlier in 2018.

And several contracts signed this year have been for work starting in 2019 or even 2020.

Day rates have also risen for jackups in the US Gulf of Mexico, with fixtures for high-end long-legged jackups (375 ft or 114 m and greater) up 23.5% on rates this time last year, at $80,000-85,000.

Shallower-rated units too have fared well, with $65,000-70,000 reported in October. At present, 11 of the 12 marketed units are contracted: eight have at least 90 days of backlog, and six of these are contracted past mid-2019.

In addition, at least one currently cold stacked jackup should be reactivated during the first half of 2019, with up to three more units mobilized to the region from international locations.

11/20/2018