Gene Kliewer - Technology Editor, Subsea & Seismic

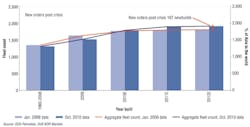

The business side of offshore geology and geophysics in 2009 remained in tune with the generally weak year for the entire E&P industry. The survey which follows shows that the vessel count was 156, down by 17 from last year’s report. Two company names are missing from this year’s survey – Scan Geophysical and Wavefield. Scan closed its operation in mid-2009. Wavefield and CGGVeritas were in the process of merging at this time last year and that is complete. The vessels list for each also merged, as you might expect. One new company, NAUTIC Offshore out of Oslo, Norway, joins the list for the first time.

New vessels are hitting the market in 2010, too. Fairfield has theCarolyn Chouest, Fugro Services Ltd. adds the Fugro Searcher, PGS adds the PGS Apollo, and Polarcus expects the Nalia, Samur, Selma, Asima, and Alima.

Taking a look at some of the seismic survey participants gives a view of how the last year has been and how 2010 looks to be shaping up.

China Oilfield Services Ltd. (COSL) has the largest fleet of offshore oilfield service vessels in China. Pertinent to this survey, eight of them are seismic vessels and four are survey vessels of other types. During the first half of 2009, the changes in the operating volume of geophysical services were as follows:

Surveying operations in the first half of 2009 were down from the same period in 2008 mainly because of a decrease in development projects in Bohai Bay, COSL says.

SeaBird shows indications that action is picking up from the last quarter of 2009 and into this year. Following an increase in the number of 2D/3D contracts and mobilization of all vessels back to work during the 4Q 2009, utilization of the 2D/3D vessels rebounded from 51% to 75% from 3Q to 4Q 2009. The fourth quarter of 2009 showed an improvement in employment prospects in the 2D market, says SeaBird, but mobilization and production rates still are lower than 2008. Globally, SeaBird says volume of work outstanding is high and contracts awarded are starting to catch up.

SeaBird’s 2D/3D vessels have a backlog at the start of this year, with one vessel on time charter to September 2011, four on contract or committed to May-June this year, and two vessels on contracts ending by March.

SeaBird is pursuing ocean bottom node contracts withHugin Explorer and Kondor Explorer to follow completion in the second quarter of this year of current surveys under way in West Africa and the Gulf of Mexico.

With the completion of the CGGVeritas/Wavefield merger, the vessel count for CGGVeritas did not change by much. The merger provided an opportunity to drop vessels from the survey list.

CGGVeritas reports vessel utilization for 4Q 2009 did not consider the decommissioning that quarter of theSearch mid-capacity 3D vessel. In 2009 total, CGGVeritas took four mid-capacity 3D vessels out of service. In addition to the Search, it took down Harmattan, Føhn, and Orion.

During the fourth quarter of 2009, CGGVeritas reports its 3D vessels were allocated 90% to contract and 10% to multi-client programs, particularly offshore Brazil and in the GoM.

New vessels join list

Polarcus Ltd. held a double naming ceremony on Nov. 24, 2009, forPolarcus Nadia and Polarcus Naila at Drydocks World – Dubai. Both are purpose-built 3D/4D seismic vessels incorporating the ULSTEIN X-BOW hull along with features and maritime technologies to minimize the vessels’ environmental footprints, including the risk of accidental pollution.

Polarcus Nadia is at working for TGS on a 2,000 sq km (772 sq mi) long-offset 3D survey offshore West Africa where the survey is being acquired with a 10 streamer seismic array, each streamer being 7,200 m (4.5 mi) long and with 100 m (328 ft) separation between streamers. Polarcus Naila was scheduled to undertake its first contract, of approximately two months duration offshore West Africa as well.

Polarcus says its vessels are constructed to DNV Clean Design standards to help control and limit operational emissions and discharges.

“Operations in extremely sensitive areas, such as the arctic, set the bar for Polarcus’ global fleet,” says Polarcus co-founder Peter Zickerman.

“Efficiency is maximized by ensuring all vessels stay ahead of any environmental legislation, avoiding the need to swap vessels for different areas.

“The green agenda is very important to all employees and crew, making Polarcus’ values more than just corporate statements. Ultimately, green business is good business: it increases efficiency and profitability, creates an exciting working environment, and meets customer requests for sustainability.”