By Bruce Beaubouef, Managing Editor

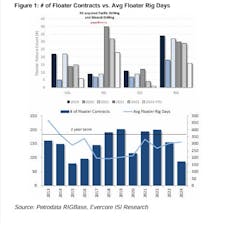

The floating rig contract market has slowed and is expected to remain muted through the end of the year and into the first half of 2025, according to Evercore ISI’s latest Offshore Rig Market Snapshot report.

While the significant increase in dayrates and lengthened contract terms are contributors to the “muted” contracting activity, Evercore noted that the “bearish sentiment built around disappointing Chinese demand and limited OPEC visibility are likely pushing decisions on long-term capital commitments.”

The report also noted that 26 contracts (50% floaters) were announced in September. Average contract terms for jackups and floaters were 684 days and 386 days, respectively. In October, only four jackup contracts have been announced so far with an average of 1,057 days, a number that was “skewed by Egyptian Drilling’s Setty [jackup rig],” the report commented.

While the Setty rig has been under contract suspension since April 2024, Saudi Aramco has extended its contract by 10 years. This is expected to keep the rig busy until September 2034. The report noted that Saudi Aramco has indicated that the unit will not return to work anytime soon, and that it will be marketed internationally for the time being.

The report also said that no floater contract had been announced so far this month, and Evercore said that February 2015 was the last time no floater contracts were announced.

For context, Evercore noted that “contracting activity for floaters took a hard hit in 2020, declining (42.6%) to 116 fixtures, which quickly recovered to pre-pandemic levels in 2021, with contract terms meaningfully lengthening.” The report also noted that 86 floater contracts had been announced year-to-date.

About the Author

Bruce Beaubouef

Managing Editor

Bruce Beaubouef is Managing Editor for Offshore magazine. In that capacity, he plans and oversees content for the magazine; writes features on technologies and trends for the magazine; writes news updates for the website; creates and moderates topical webinars; and creates videos that focus on offshore oil and gas and renewable energies. Beaubouef has been in the oil and gas trade media for 25 years, starting out as Editor of Hart’s Pipeline Digest in 1998. From there, he went on to serve as Associate Editor for Pipe Line and Gas Industry for Gulf Publishing for four years before rejoining Hart Publications as Editor of PipeLine and Gas Technology in 2003. He joined Offshore magazine as Managing Editor in 2010, at that time owned by PennWell Corp. Beaubouef earned his Ph.D. at the University of Houston in 1997, and his dissertation was published in book form by Texas A&M University Press in September 2007 as The Strategic Petroleum Reserve: U.S. Energy Security and Oil Politics, 1975-2005.