The world’s first FDPSO - floating, drilling, production, storage, and offloading vessel - is on course for a new field development in the UK sector. Oslo-based Multi Operational Service Tankers (MOST) designed the concept.

The field is Skipper in UK block 9/21, where the licensees are operator Focus Energy 2%, and consultant Ingen-Ideas 98%. Details of the vessel and an assessment of its environmental impact are included in the environmental statement for the Skipper development, which the UK’s Department of Trade and Industry has accepted. In June, MOST granted the licensees a license for use of the FDPSO and associated equipment. Assuming the DTI approved its field development plan, they aim to achieve start-up in 2008.

MOST’s concept can be applied to a wide range of field conditions, according to Pat Haynes, managing director. Although the company initially has its sights on the North Sea subsea market, the concept should also be relevant to other provinces, including deepwater areas. In addition to supplying the ship, the company’s main business idea is to fund field development, operate production, and sell the oil, paying the licensees a royalty.

In the process, MOST would also take on the reservoir risk, but its exposure would be mitigated by the opportunity to reuse the vessel, moorings, and other capital equipment over a series of fields. An additional benefit, at least in the UK sector, is that as a vessel owner, MOST is liable to pay corporation tax at 30%, while the field operator faces a rate of 40%.

MOST�s FDPSO concept includes both rotary and coiled tubing drilling capability.

MOST’s leading shareholder is well services company Weatherford, which holds a 26.13% stake. Its director of enabling technology, John Boyle, is also a director. Founded in 2002, the company originally developed the concept of a subsea well intervention vessel, but decided to expand the vessel’s capabilities to handle marginal field development when it proved impossible to secure work commitments needed to support investment funding.

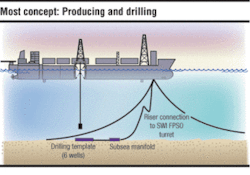

The vessel is moored via an internal turret, like a typical North Sea FPSO, but with drilling capability in the form of a derrick for rotary drilling and coiled tubing (CT) equipment. To enable it to maintain station during drilling operations, it is equipped with a DP3 dynamic positioning system. The vessel could be either a purpose-built ship or a converted Suezmax tanker.

The FDPSO can handle many field development tasks that conventionally require a spread of different rigs and vessels. It can drill and tie back the wells and, using its own 40-ton crane, install subsea templates and manifolds. It can also undertake well intervention. The produced oil is stored on board and offloaded into shuttle tankers. When the field is depleted, the vessel can plug and abandon the wells and retrieve the subsea equipment.

Although key parts of the concept are patented, no new technology is involved. “All the technology is proven,” Haynes says. “It is the package and combination which is new.”

One of the big pluses of the FDPSO concept is that production revenue starts flowing as soon as the first well is brought onstream, unlike conventional developments where income usually starts flowing relatively late in the process. Other advantages include the CT capability, which makes it possible to drill reservoir sections underbalanced, thereby minimizing impact on the formation and possible adverse effects on production, Haynes says.

IHC, SBM Offshore’s engineering arm, performed preliminary engineering for the vessel, and MOST’s intention is that SBM should take on construction management and operation of the vessel. A final agreement has yet to be reached with Focus and Ingen on the exact organization of the project.

Skipper, which was discovered in 1990, is a good example of a marginal field posing development challenges that previous owners, as Haynes points out, failed to overcome. The volume of recoverable reserves is in the 20-40 MMbbl range. The oil is heavy, around 15-20° API, and there are uncertainties over flow performance and fluid properties. Water injection into the reservoir will be needed to sweep the oil toward the production wells, with artificial lift within the wells to help bring the wellstream to the surface.

Such requirements would pose enormous difficulties for a subsea tieback, especially as the nearest installation is 25 km away. But for the FDPSO, the solution looks relatively simple. Hot water will be injected into the reservoir, and artificial lift will be provided via jet pumps powered by hot water from the vessel. With no need for a tieback, there are no flow assurance issues.

The company has assembled an experienced team of contractors and suppliers, including Weatherford (well construction and completion), Petrofac (duty holder), Shell Trading and Transport (oil sales), DrilQuip (subsea wellhead, trees and production manifolds, BOP, and risers), National Oilwell Varco (drilling equipment) and Oceaneering (ROV operations).

MOST has a budget of $580 million for its first FDPSO project. The overall sum breaks down into $410 million for vessel conversion, $120 million for field development, and $50 million for working capital.

It already has its eyes on other opportunities for applying its business model, including a heavy oil find in UK block 28/3 operated by Petrofac.•