Offshore staff

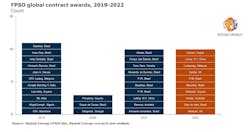

OSLO, Norway – The market for FPSO units almost brushed off the pandemic’s effect in 2021 and is likely to continue apace in 2022, with 10 new awards expected, according to Rystad Energy.

Two lease contracts were awarded in 4Q 2021, bringing the total for the year to 10 – up from just three in 2020 – a strong rebound for the FPSO market.

Brazil accounted for seven of the FPSO contract awards last year. The South American nation is expected to continue driving global awards in 2022, with an additional three FPSOs expected.

Not only is the country delivering more awards, but the Brazilian projects are expected to be the largest in terms of production capability, the analyst said. For instance, the FPSO P-80 will become the ninth in the Buzios area. It will have an oil processing capacity of around 225,000 b/d and a gas processing capacity of about 12 MMcm/d. This is the same size as the FPSO Almirante Tamandare awarded in early 2021.

In 2022, Guyana is expected to contribute one FPSO to the global total, with the UK adding two projects. Angola, Australia, China, and Malaysia are forecast to each award one new FPSO contract this year.

Zhenying Wu, a senior analyst with Rystad Energy, said: “With around 30 FPSO units under construction or queued up for construction, and another 10 expected to be awarded over the next 12 months, the market is set to build on its recent success.

“However, as witnessed in many other facets of the global economy in recent months, supply chain concerns linger and will test the market’s ability to take in new contracts without uncontrollable cost overruns and delays.”

The analyst pointed out the FPSO market saw a strong finish to 2021, with two lease-and-operate contracts, two front-end engineering and design (FEED) contracts and one contract extension awarded in 4Q.

In Brazil, Petrobras awarded Yinson two letters of intent (LOI) to supply the Integrado Parque das Baleias FPSO and for operation and maintenance services under a lease-and-operate agreement lasting 22 years and six months from the day of final acceptance. The FPSO will be deployed at the Jubarte field in the North Campos basin and is scheduled to start production in late 2024.

Enauta Energia issued Yinson another LOI to provide, operate, and maintain an FPSO at the Atlanta field in the Santos basin in Brazil. The job covers the adaptation of FPSO OSX-2 by Yinson through a turnkey engineering, procurement, construction and installation (EPCI) contract, with warranty and operations and maintenance for 24 months.

The FPSO acquisition and adaptation cost are estimated to be around $505 million. Yinson has the option to purchase a unit linked to funding. If the call option is exercised, it will be linked to charter, operation and maintenance contracts for 15 years, which may be extended for another five years, totaling $2 billion for the 20 years. The contract is Yinson’s third project award in Brazil and is subject to a final investment decision during 1Q 2022.

Elsewhere in South America, ExxonMobil awarded SBM Offshore an FPSO FEED contract for the deepwater Yellowtail development in the Stabroek block off Guyana. The FPSO will be designed to have an oil processing capacity of 250,000 b/d, a gas processing capacity of 450 MMcf/d and storage of up to 2 MMbbl. When finished, the FPSO will be the company’s largest producing unit ever built.

ExxonMobil is currently producing from the Stabroek block via the FPSO Liza Destiny. The FPSO Liza Unity arrived in Guyanese waters on Oct. 26, 2021, and ExxonMobil expects both units to produce this year. When the Payara and Yellowtail projects come online in 2024 and 2025, respectively, ExxonMobil will have a total processing capacity of more than 800,000 b/d in Guyana.

In Nigeria, BW Offshore secured a lease extension for the FPSO Sendje Berge, operating for Addax Petroleum Exploration (Nigeria) Ltd., that will run through to 4Q 2022.

In Norway, Aker Solutions received an LOI for a FEED contract from Equinor to supply an FPSO for the Wisting field in the Norwegian Barents Sea. The scope is to provide front-end engineering design for a circular FPSO, which includes an option for EPCI of the FPSO topsides.

If the project moves forward to the execution phase, the EPCI option potentially represents a contract that is estimated to be worth between $960 million and $1.45 billion.

01/06/2022