Floating production market cautiously optimistic

After four years of increasing optimism, sentiment within the floating production facilities market became gloomier following a year of COVID-19 and low oil prices.

The Global Floating Production Industry Survey, now in its eighth year, gauges current market sentiment and the industry’s future direction. In December, Energy Maritime Associates conducted its latest survey in partnership with Offshore magazine. Responses came in from all areas of the industry, and from all over the world.

This year only 61% of respondents expressed positive sentiment (somewhat confident to highly confident) compared to 79% last year. The largest shift was in those expressing high confidence, dropping from 31% to 14%. At the same time those who were somewhat pessimistic rose from 4% to 16%. The number of highly pessimistic respondents increased from 2% to 3%. After remaining almost unchanged at 15% for the past three years, the proportion of those with a neutral outlook increased to 20%. Increasing uncertainty is driven by delays in project sanctions and global economic sluggishness. These results are much like 2017, as the industry was just beginning to emerge from the last oil price crash.

For 2021, some foreshadowed a highly competitive market, requiring cost-effective solutions for operators to justify sanctioning new developments. Others were more bullish, pointing to activity in Brazil and Guyana, which require multiple units to support massive new discoveries.

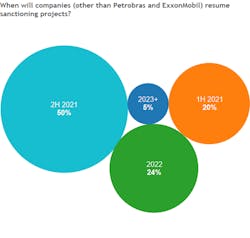

FPS awards ground to a halt following the rapid spread of COVID-19 in 1Q 2020. Most operators slashed spending and deferred FIDs. The exceptions were Petrobras and ExxonMobil, which proceeded with orders for their massive presalt fields. We asked respondents when other operators would resume sanctioning projects.

Some 70% expected more orders starting in 2021, with 20% selecting the first half of the year and 50% anticipating new awards to resume in the back half of the year. Almost a quarter thought that it could take until 2022, while only 5% were even more pessimistic.

Impact of COVID-19

COVID-19 disrupted the entire global supply chain and increased the risk of executing complex capital projects. When asked about the lasting impacts on the floating production sector, the largest group of respondents expressed an expectation that there would be smaller onsite project teams and increased remote monitoring going forward. In addition to keeping staff safe, there are tremendous cost savings. However, some questioned if quality might be compromised in the process.

Other respondents anticipated that COVID-19 would cause further cost and schedule issues; increase collaboration between field operators and contractors; and result in even fewer contractors who are willing to take on excessive execution risk.

A few other responses included trends such as increased digitalization and simplification of the engineering process, which would enable repeatability and greater cost savings.

Reflecting the uncertainty for 2021, the outlook for capex changes was mixed. Last year, 92% of respondents forecast cost increases, but this year the outlook is quite different. Just over half of respondents thought costs could increase, with over 30% expecting 5-10% increases. Driving costs up were COVID-19 measures, as well as allowances for future uncertainties. On the other side, 31% anticipated cost reductions, particularly due to lower utilization and extreme capital discipline by field operators. Just under 15% of respondents did not expect any change in capex costs.

Obstacles and challenges

For the seventh year in a row, the price of oil was identified as the greatest obstacle to offshore project growth. This year, the impact was extreme, as 28% of respondents cited oil price, up from 19%.

Access to finance remained unchanged in second place. More attractive investment options moved up from fourth to third place, driven by increased interest in renewables. Political issues dropped one spot to fourth place.

In addition to challenges for investment from renewables, there is a growing push to reduce investment in hydrocarbons. In line with this trend, ESG issues/investor sentiment ranked in fifth place, followed by environmental regulations.

Reflecting the slowing activity levels, industry capacity was only a concern to 5% of respondents, down from 8% last year. It ranked at the same level as environmental regulations and technical challenges, with 8% of responses.

Costs remain low on the list of concerns with less than 3% worried about FPS, drilling or subsea costs in the next two years.

Potential bottlenecks

Last year respondents expressed concerns in five areas: fabrication yards, offshore installation, project management, FEED engineering, and shipyards. This year, the top response was “no capacity constraints expected,” as was the case from 2017-2019. However, only 15% of respondents believed there were no constraints as compared to 36% in 2017. This suggests that bottlenecks could reappear soon as activity ramps up. The areas of greatest concern are project management, fabrication yards, FEED engineering, and shipyards.

Newbuild versus conversion

Despite the growing number of newbuild hulls and standardized designs by multiple FPSO contractors, respondents are almost evenly divided on the outlook for purpose-built hulls: 35% expect the proportion to decrease; 30% believe it will increase; and 35% think it will remain unchanged.

Of the 24 FPSOs currently on order, 14 (58%) use newbuild hulls. This is above EMA’s forecast for 2021-2025 and supports the feeling that the proportion of these orders may decline slightly.

Leased versus owned

Almost half of respondents expect an increase in the requirement for leased FPS units, up from 35% last year. This is likely driven by Petrobras’ reversal of its plan for build-own-transfer contracts as well as by the renewed capital constraints on field operators.

Contracting strategy

The leading FPS contractors have received a slew of awards and are now executing multiple projects simultaneously. In September 2020, Petrobras announced there was only one qualified contractor with available capacity to execute the Buzios 6 FPSO and began exclusive negotiations with SBM Offshore, rather than proceed with a competitive tender process.

This year, we asked respondents how this constraint will impact contracting strategy, particularly for the largest projects which can cost over $1.5 billion and produce 200+kboe/d. Just over 40% believed that field operators would turn to creative solutions such as redeployed units or taking on the project management responsibilities. Almost one-third thought that companies would follow Petrobras’ lead and directly negotiate with their selected contractor. Over 25% of respondents expected that companies would postpone the tendering process until there was more competition. Other respondents stated that some field operators would expand their list of contractors.

Technology game changers

This year, when we asked which type of technology will have the largest impact on the offshore industry, floating wind was the winner by far, increasing from 19% to 29%. While still in its infancy, there is a great deal of enthusiasm and hope for this energy source. Time will tell if it can live up to the expectations. FLNG was the top ranked technology in this survey until 2019, before dropping off the list.

Unmanned Production Facilities (UPFs) dropped to second place with a quarter of the votes. Several reasons account for UPF’s popularity—the high cost of personnel as a portion of operating costs, application of digital solutions, and increasing comfort with working remotely. While unmanned fixed facilities are common, the technology has not yet been transferred to floaters. However, even if a completely unmanned facility is not realized, reductions in personnel offshore would result in lower operating costs.

In third place with just over 20% of votes, longer distance subsea tiebacks could increase the utilization of existing facilities and follows the trend of infrastructure-led investment. Tiebacks certainly will extend the life of currently installed production units, while the impact of future requirements is yet to be seen. Some stand-alone FPS developments could be replaced by tiebacks, while an FPS hub with tieback of multiple fields could also become economic.

Conclusion

After four years of steady improvement, COVID-19 and an oil price collapse darkened the global FPS industry sentiment in 2020. However, the expectation is for a more rapid rebound than the last cycle, with many companies still managing record backlogs.

The floating production market remains the brightest spot in the offshore industry today, including growing excitement in the nascent floating wind sector. Offshore development costs remain low, fueled by excess drilling and subsea capacity. However, field operators are under increasing scrutiny from investors to balance capital investment, returns, and ESG issues. Activity levels are expected to improve in 2021-2022, but at a measured pace as operators and contractors keep close watch on spending, resources, and execution risk.

The author

David Boggs is the Managing Director of Energy Maritime Associates, which publishes market leading reports on the floating production industry and advisory services for developments requiring FPSOs, FLNGs, FSRUs, Semis, Spars, TLPs, MOPUs, and FSOs. Boggs has over 20 years experience in the offshore oil and gas industry including as General Manager–Commercial for fleet of leased FSOs and FPSOs. David has a BA cum laude from Harvard University and an MBA with honors from the University of Texas at Austin.