Offshore staff

LONDON — Two jackup drilling rigs will depart the North Sea area shortly for new campaigns in the Asia-Pacific region, according to Westwood Global Energy Group subsidiary RigLogix.

Shelf Drilling Perseverance will work offshore Vietnam and Valaris 247 in Australia.

Last year jackups in the North Sea had a total of 4,927 awarded days of work, with the UK accounting for 3,807 days and Norway just 303 days.

North Sea drilling activity has dropped by 50-60% since early 2015, said Westwood senior rig analyst Kathleen Gammack. However, demand for P&A work has risen, masking some of the shortfall in new drilling programs.

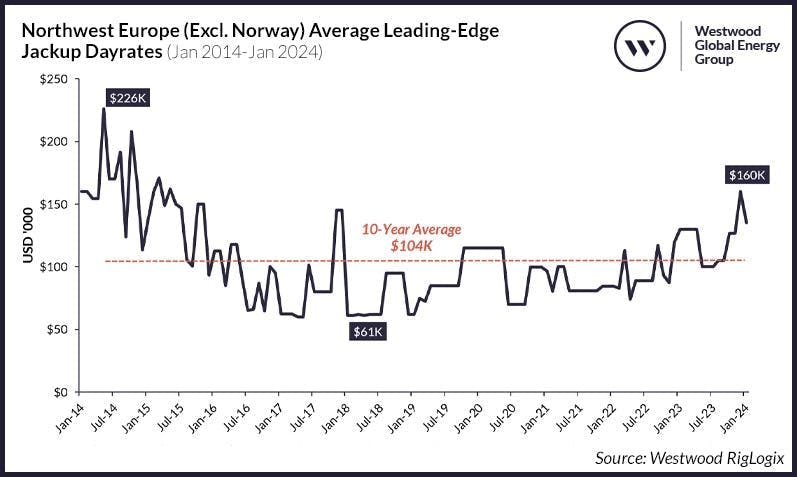

Day rates in the North Sea are lagging those in other regions. This, coupled with harsher tax regimes and a lack of certainty in future North Sea work, has persuaded drilling contractors to bid their rigs in other regions offering longer-duration programs with often higher day rates.

One campaign, however, is now slipping back to 2025 with potentially two more campaigns to follow.

The consultants believe the one jackup that is currently available from late first-quarter 2024 is the leading contender for one of the outstanding 2024 requirements. A further seven jackups could become available in the second half of the year.

RigLogix has identified one tender for work in 2025 and 16 prospects that could provide almost 12 rig years to drill.

But if further rigs leave the sector for multi-year campaigns elsewhere, Gammack warned, there may not be enough capacity to deliver some of the longer-term P&A campaigns that could be ready from 2025 onward.

In addition, the tighter supply and demand balance that would follow could lead to a smaller pool of jackups for North Sea operators rigs to choose from and higher day rates, in which case, some of these campaigns could becoming uneconomic.

02.19.2024