Offshore staff

LONDON – Committed utilization of marketed sixth-generation, harsh-environment semisubmersibles (semis) has jumped 14% over the past six months and is now sold out at 100% utilization, according to the latest Westwood Insight report.

That one-hundred percent number, Westwood notes, is “a figure not recorded for this fleet since February 2014.” Committed utilization includes rigs currently on hire or have an upcoming contract.

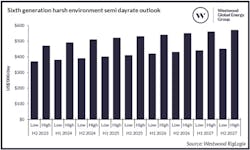

The report also notes that day rates for recent contract fixtures have also risen, with some well above $400,000 – “a phenomenon not witnessed since 2015.”

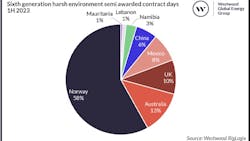

This fleet is currently made up of 27 active rigs, all of which are either on hire or have a contract starting in the future. Although Northwest Europe still contributes the lion’s share of demand, with 68% of contracted days awarded this year, several of these rigs are being continuously confirmed for new work or extensions in other regions.

One of these ‘hot’ regions is now Australia, where Transocean will relocate two of its CAT D assets for three new long-term assignments. Mexico, China and Namibia have also contributed considerable demand thus far in 2023, and all are expected to remain critical for this fleet going forward.

Day rates for these rigs remained strong in comparison to most other rig types during the last oil price crash and the pandemic, especially in Norway. However, the report notes that apart from a few outlier deals, they have struggled to surpass the mid-$300,000s since late 2015, but this is now starting to change, says Westwood.

Sixth-generation, harsh-environment semi average day rates (excluding priced contract options) for contracts fixed year-to-date are now $394,000, which is a 32% increase compared to the full year average for 2022 “and is the highest average reached since 2014,” wrote Teresa Wilkie, Research Director–RigLogix.

“Transocean and Odfjell Drilling have been especially successful at driving day rates higher for these assets this year,” Wilkie added, “securing new deals with rates reported as high as $484,000 (Australia), $457,000 (Australia) and $420,000 (Norway), respectively (note that these rates may include other services).” She noted that these three fixtures do not begin until 1Q 2025, 1Q 2024, 2Q 2024, respectively.

For those operators looking to secure a unit, the earliest availability appears to be late 1Q 2024 when the Transocean Barents comes off hire. However, it is already being bid on follow-on opportunities, as is the case for those units rolling off contract in the second quarter.

“The demand outlook for these high- specification rigs looks very bright,” Wilkie observed, “and recently there has been a wave of multi-year requirements brought to market from the likes of Equinor and Var Energi in Norway, which we believe represents their recognition of shrinking availability, fear of missing out on the right specification assets for drilling campaigns and, most worryingly, rising day rates that can affect overall project economics.”

Westwood says that day rates in this segment are likely to continue their escalation over the coming years as demand for harsh-environment rigs rises, coupled with a lack of newbuild assets or reactivation candidates, which have been a saving grace for the booming drillship and jackup markets.

The firm notes that there are currently only three cold-stacked sixth-generation assets that could be added to the fleet if reactivated, and just four newbuilds in shipyards. One of the latter is the North Dragon, which has been secured for a long-term campaign in Mexico. The remaining three units, the sixth-generation Beacon Pacific and the seventh-generation ex-Awilco newbuilds – Nordic Spring and Nordic Winter – are all being bid on current tenders in the market.

Westwood anticipates that day rates in this sector will continue to increase worldwide over the next five years, “and we will likely see rates secured at or above $500,000 for contracts beginning in late 2024 and early 2025,” Wilkie writes. “The steep economics behind a reactivation campaign or commissioning a newbuild will also add further pressure to commercial terms on a new rig deal. Of course, day rates for these units will continue to vary depending on specific rig capabilities, when the job starts, where work will take place and the duration of the contract, but we expect to see significant increases across the fleet.”

07.05.2023