Analysis: US Gulf drillship fleet could be heading into rough waters

Because the drillships in the region have such high specifications, moving them to other regions would typically result in them not using their full capabilities, thereby lowering the day rate potential they can command in the US Gulf.

Currently, global demand outside the region “does not support an influx of very high-specification drillships for term work,” Edralin noted. “Therefore, we expect most of the units that roll off charter in the US Gulf this year to remain in place for opportunities on the horizon for 2026. Market chatter currently suggests the region may see the departure of one of the lower-specifications units, if new work in the US Gulf is not confirmed.”

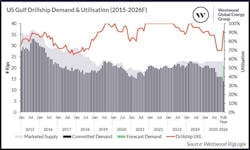

Dip in demand

So, what is contributing to the sudden near-term gaps for so many units? A combination of factors that we are seeing globally and locally have led to what should be a short-term dip in activity in the US Gulf region. These include rising overall project costs (not just rig dayrates) and continued supply chain challenges that mean some long-lead items are taking longer to arrive, resulting in adjusted project schedules to better align development drilling with development equipment installation.

Further complicating the landscape in the US Gulf is the shrinking number of active operators. In 2015, there were 17 active operators that used one or more drillships during the year. By comparison, in 2024, the total number of active drillship operators had dropped to nine. Some of these operators have been swallowed up in various mergers and acquisitions, while others transitioned to onshore portfolios, and others simply are not currently undertaking an offshore drilling campaign.

“Additionally, we should consider 2015 semisub demand, which was 12,” Edralin commented. “Over time, operator preference in the region has shifted primarily to drillships when it comes to floating rig selections. Currently, there is only one active semisub working in the region. When reviewing the list of active semisub operators in 2015, an additional eight companies not previously counted on the drillship list are added, although not all these are surviving entities today.”

While some operators with pending plug and abandonment obligations may see this near-term white space as an opportunity to seek a rig at a more attractive rate, having fewer active operators means a decreased likelihood of several coming forward to take advantage of potentially lower-priced gap-filler slots. Further challenging the 2025 schedule is that operator budgets for this year have already been set, leaving little wiggle room for unplanned drilling programs. Furthermore, most operators are already looking to their plans for 2026 and beyond.

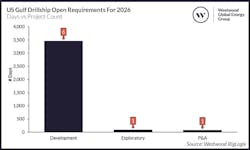

Demand outlook for 2026

With regard to Westwood’s demand outlook for US Gulf drillships for next year, Edralin says that their RigLogix database is currently tracking over 3,600 days of work with target start dates in 2026. The majority of this is expected to be against the renewal of rigs rolling off charter, rather than incremental work.

Because some of the region’s smaller independent oil companies tend to run rig lines of between one and two units per year, Edralin notes that some gaps between assignments are to be expected. However, as noted earlier, having fewer active operators in the region reduces the number of companies that may emerge with unanticipated new requirements.

While the second half of 2025 will be challenging for US Gulf drillships that roll off charter, most are expected to ride out the rough waters in anticipation of more work in 2026 and a return to tight utilization. “Longer term, the US Gulf will remain one of the top locations in the world for drillship activity,” Edralin said.

You may also be interested in...

Semisubmersibles set the standard in the Gulf of Mexico

A new generation of floating production platform is being built and designed for the deepwater Gulf of Mexico. Responding to the needs of a market that has seen two oil price collapses in the past six years, deepwater operators are choosing to deploy a semisubmersible production facility design that is smaller, lighter in weight, with more standardized features than in years past.

This video originally published on Offshore's website on Oct. 14, 2021.

Subscribe to Offshore's YouTube channel to stay updated on the latest trends and insights in the offshore energy industry.