Upstream M&A deals on the rise offshore Southeast Asia

Offshore staff

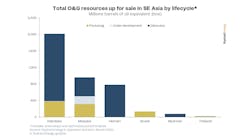

OSLO, Norway — More than $5 billion of upstream assets are available for sale across Southeast Asia, according to Rystad Energy.

Most of the opportunities are in Indonesia, where more than $2 billion of assets on the market, followed by Malaysia and Vietnam with about $1.4 billion and $1 billion for sale, respectively.

Already this year, deals totaling $700 million have been completed in the region, the strongest start to upstream M&A activity in Southeast Asia since 2019.

Rystad found that of the potential assets available, 74% are in the pre-final investment decision (FID) stage, 21% are already in production and the remaining 5% are under development.

Collectively, they account for 4 MMboe of resources and 270,000 boe/d of production with a gas-to-liquids ratio of 63:37.

Prateek Pandey, Rystad's vice president of upstream research, said, “The sheer magnitude of the oil and gas deals in the region will reignite the sector, reducing reliance on national oil companies [NOCs] and major players that has developed in recent decades.”

Fiscal and regulatory framework changes are aiding the process. Administrative reforms implemented in Malaysia, Indonesia and Thailand are said to have boosted interest from energy majors and new regional buyers as these countries capitalize on strong exploration results.

Vietnam and Cambodia are now seeking to enact similar processes to stimulate investments and transactions.

Malaysia is said to lead in terms of producing assets on offer with a 45% share of the regional total, followed by Indonesia with 27%.

As for discovered but not yet under development resources, Indonesia is at the front with 1.6 Bboe for sale followed by Vietnam with 780 MMboe and Malaysia with 460 MMboe. Myanmar and Thailand have discovered resources available for purchase.

Another factor behind the M&A is local NOCs looking to lessen the capex needed to maintain and operate mature blocks by bringing in technical partners to implement EOR projects.

Decommissioning costs, expiring production sharing contracts and the time-to-development for pre-FID opportunities are also preoccupying buyers as they screen M&A opportunities, with a preference for gas resources in countries with fewer policy/regulatory hurdles.

Larger international players and local NOCs may also pursue M&A prospects that could support carbon capture and storage and utilization or facilitate decarbonization initiatives.

03.29.2023