Offshore staff

OSLO/LONDON – Panoro Energy will cut its planned capex offshore Gabon this year by 40% to soften the impact of the recent oil price collapse.

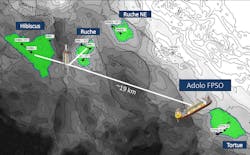

The Dussafu joint venture, led by BW Energy, has decided to temporarily postpone the start of the Ruche Phase 1 development process until conditions improve.

Currently four wells (DTM-2H, DTM-3H, DTM-4H and DTM-5H) are producing into the FPSO BW Adolo at a gross rate of 20,000 b/d. The DTM-6H well, approaching the end of drilling and completion operations, will come onstream by June.

In an attempt to limit the spread of the COVID-19 virus, international travel restrictions currently in place are limiting movements of essential personnel, subcontractors, and equipment to and from Gabon.

These and the increasing global restrictions will likely impact the planned timing of the DTM-7H well and the subsequent firm exploration well.

As a precaution, the Dussafu partners have decided not to exercise options for additional exploration wells.

UK independent Jersey Oil & Gas said it remained fully funded to deliver the concept select work for the Greater Buchan Area (GBA) development in the UK central North Sea.

The company affirmed that it was debt-free and on current plans had sufficient working capital to keep going through the end of 2021. In addition, the company intends to promote a planned sale of part interest of its interest in the GBA later this year.

JOG's estimate for the GBA asset base is over 140 MMboe of discovered and recoverable oil volumes with more than 230 MMboe of exploration upside net to JOG. With further area collaboration across the wider GBA, there is potential to produce more than 200 MMboe of discovered oil and gas resources, the company claimed.

The current workstreams can mostly be completed remotely by the company’s team and contractors and it has therefore set up business continuity measures to allow for work from home.

03/18/2020