Minimal facility production buoys could unlock 'stranded' North Sea resources

Jeremy Beckman

Editor, Europe

Britain needs to find new ways of harnessing its remaining offshore reserves, according to a recent UK government-commissioned report. Author Sir Ian Wood's recommendations included fostering new technologies tomaximize recovery from UK North Sea fields and regional cooperation to allow more tiebacks of smaller discoveries to offshore infrastructure.

The report also noted that the average UK offshore discovery is now less than 25 MMboe, and that many of the undeveloped fields are marginal. There is no shortage of would-be developers of fields in this category. The main problem they face is raising capital because of the perceived risk (due to the region's high costs). Some current 40-MMbbl oil field projects in theNorth Sea based on FPSOs, the standard solution for stranded fields, carry a price tag of more than $2 billion.

One partnership has been working to develop economic solutions for marginal fields even in the 5-10 MMbbl range. This involves use of what they term "buoyant solutions" which can be unmanned, minimal facility production buoys or self-installing floating towers (SIFTs), both suited to rapid depletion of small fields and easily re-configured for service on others. Enegi Oil and ABTechnology, via their joint venture ABT Oil and Gas (ABTOG), are working on a first potential application on the 10-MMbblFyne field in the UK central North Sea, with plans to extend their program to the Irish sector and in the longer term to other parts of the world.

According to executive chairman Alan Minty, "this is not a venture recently set up to take advantage of the current interest in marginal fields, nor is it based on the idea that an economic and appropriate technology can be found to justify investing in a stranded or marginal field. The business model for ABTOG is based on using a real options approach where marginal fields with zero value are identified as candidates for development with an appropriate technology that re-values the field at a significantly higher price. ABTOG, by acquiring exclusive rights to these solutions, can then use the improved returns to make the project economically attractive and extract some of this value for itself alongside the existing licensees."

The basis for the concept was established more than 10 years ago when Minty was working on various development projects offshore eastern Canada, including Terra Nova and Hibernia. "One of my team [members] had the idea that the stranded gas fields lying between Newfoundland and Nova Scotia could be developed using gas-to-wire technology, with a cable run to deliver the power to the northeast US. It sounds far-fetched but this was at a time of severe power outages in the US.

"I didn't know much about marginal fields then and I am not sure that my colleague did either, but the idea of trying to find a way to 'recover lost reserves' intrigued me. I raised some money from Atlantic Canada Opportunities Agency (ACOA) in Newfoundland in order to test the economics using this technology; and the study report was subsequently reviewed by Lloyd's Register. The technology wasn't viable or sufficiently proprietary to justify undertaking further work, but the study showed clearly that if you could lower capital and operating expenditure you could have a huge resource, because there are so many stranded fields that are not being exploited."

In 2008, Minty co-founded Enegi in Manchester, UK, as an independent E&P company initially focused on an onshore "discovery" and a couple of offshore exploration licenses around Newfoundland's Port au Port Peninsula. Developing these proved more problematic than initially anticipated so Enegi's board decided that a better strategy might be to reduce risk concentration by building a portfolio of more highly appraised fields. "We devised a plan to find a way to acquire marginal field assets and proprietary but proven technology to generate the required economics. We secured exclusive rights on the unmanned production buoy and in 2011 Wood Group PSN agreed to become a strategic partner in the production buoy solution, following studies which determined that there were no major engineering barriers to prevent development of marginal fields using this concept."

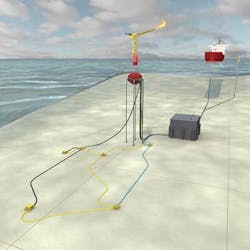

Minty describes the unmanned production buoy as "effectively a fifth-generation and unmanned FPSO operating within certain defined parameters." It is best suited to remote offshore oil fields in water depths to 600 m (1,968 ft), with production risers and flowlines linking the facility to subsea production and water injection wells. The buoy is a semi-submerged structure around 70 m (229 ft) high and up to 30 m (98.4 ft) in diameter, and is taut-moored to the seabed. There is a helideck and access tower above the water line for maintenance visits, and a submerged buoyancy chamber underneath housing process, power generation, and control equipment.

All functions that the buoy provides are performed using proven processes and technologies. A typical buoy might include a two-stage water/gas separation system, processing up to 20,000 b/d of liquids; an autonomous control and shutdown system; power generation equipment fuelled by associated gas, with excess gas flared; and facilities for remote intervention using microwave, radio, or satellite communication.

Processed crude is sent to a storage tank on the seafloor (with typical capacity between 100,000 and 300,000 bbl) and offloaded to shuttle tankers.

Displaying 1/2 Page 1,2, Next>

View Article as Single page