Editor's note: This Data section first appeared in the May-June issue of Offshore magazine. Click here to view the full issue.

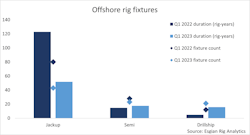

Slower jackup contracting activity

For jackups, both the contract duration and number of fixtures announced in first-quarter 2023 are down from first-quarter 2022. Most of the jackup work booked in 2022 was for the Middle East. Operators in the region are working to get many of these rigs up and running, which has slowed contracting activity so far this year. For semis, the number of fixtures in first-quarter 2023 was a little below the year-ago period, but the duration was up as charter terms are lengthening, notably for Norway, the UK and Mexico. Drillships saw the most increase in duration over the year-ago quarter and were the only rig type to record more fixtures. Drillship time booked in first-quarter 2023 was triple that of first-quarter 2022 mainly due to multiple awards for Brazil and new work in the US Gulf.—Esgian

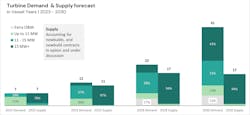

Vessel supply will fall significantly short of demand

Spinergie analysis predicts 200 GW of offshore wind demand by 2030, a sevenfold increase. One of the key challenges in meeting this demand, however, is insufficient supply of installation and maintenance vessels. While the jackup (WTIV) fleet will see three to four units enter the market by 2027, the floater fleet will see the older O&G legacy fleet bolstered by newbuilds and conversions. Nevertheless, more vessels are required to meet demand for offshore wind installation and maintenance. Spinergie suggests the market requires the building of small O&M jackups, or alternative solutions, to reduce pressure on installation-capable vessels. Without such measures, reaching 2030 global offshore wind energy targets may be impossible.—Spinergie

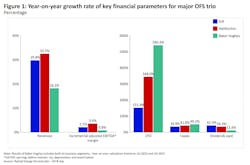

OFS revenue growth, margin improvement

SLB, Baker Hughes and Halliburton are on course for strong financial performances in the coming quarters after the trio of oilfield services (OFS) giants all posted a sparking set of results for the first three months of the year. All three posted improved topline numbers, margins and cash flow in the first quarter as against the comparable period a year earlier. The trio has focused on returns to shareholders and increasing dividends, with two hatching a share repurchase plan for the year. With energy security being a priority for most countries and supply chains remaining capacity constrained on many fronts, Rystad Energy believes market fundaments necessary for OFS players to boost their financial performance will remain strong for the rest of the year. This aligns with its previous analysis highlighting the revenue growth potential and margin improvement trend expected for the OFS sector as a whole in 2023.—Rystad Energy