Evercore sees continued upturn in upstream spending in 2023

Offshore staff

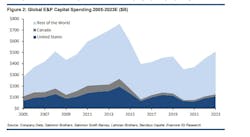

NEW YORK CITY – Global E&P spending is set to increase by at least 14% in 2023, decelerating from 20% in 2022, according to the 2023 Evercore ISI E&P Spending Outlook.

The report said that E&P spending “is poised to increase in both North America and internationally for a second straight year in 2023,” although it noted that North American E&P spending would not be quite as high as it was in 2022.

The report found that “excluding Russia, E&P spending is accelerating for a third straight year internationally, while North America NAM slows after near record growth in 2022.”

With energy security, surety of supply, and production capacity additions key drivers for cyclical spending growth, “service availability is becoming a real source of concern,” the report said.

Further increases in service pricing are expected in 2023, with operators anticipating higher pricing for fracturing/stimulation, drilling services, and completion equipment. The report noted that subsurface completion and production, as well as enhanced oil recovery, “are areas in need of greater technology innovation, with E&Ps more likely to test and adopt new technologies while the growing interest in ESG may be peaking.”

The report also noted that some companies are beginning to increase their capex allocation to renewables and low carbon resources, “with some also willing to pay a bit more for a services or technology that lowers carbon emission.”

Evercore said that its spending outlook is the culmination of continuous data collection from a variety of sources, including data obtained from approximately 290 oil and gas companies. The firm noted that operators have lowered their oil price outlook, and are now using $78/bbl WTI and $5.10/MMbtu Henry Hub decks for their 2023 budgets.

“We remain convinced that traditional oil and gas companies will be fundamental to the success of the energy transition and are encouraged by a confluence of events that are driving digitalization of the oilfield and the energy transition,” the report commented.

12.14.2022