$50 billion capex by 2030 extends potential windfall across supply chain

Stephanie McClellan, University of Delaware

There is very good reason to be bullish about the forecast for America’s emerging new offshore wind power (OSW) industry. Even more reason to be buoyed by the new business opportunities it will generate for suppliers and developers across the US offshore energy sector.

On Dec. 14, 2018, the Bureau of Ocean Energy Management (BOEM) concluded 32 rounds of bidding for its auction of three offshore wind lease areas off the coast of Massachusetts, which stunned observers by generating record winning bids totaling more than $405 million. Equinor Wind, Mayflower Wind Energy, and Vineyard Wind paid more than $1,000 per acre to develop 390,000 acres south of Martha's Vineyard and Nantucket, six times the $/acre bid of the most recent US offshore oil and gas leases.

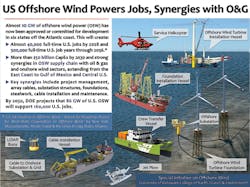

Six East Coast states – Massachusetts, New York, New Jersey, Rhode Island, Connecticut and Maryland – are proceeding with firm plans for almost 10 GW of OSW by 2030. Analysis shows it will require close to $50 billion in capex to bring this new capacity online, which will supply steady, market-priced OSW power to light up boardwalks and boardrooms for consumers and businesses up and down the Atlantic seaboard.

Importantly, building it means we will be able to leverage the offshore expertise and synergies of the US oil and gas sector, with a supply chain that stretches from the East Coast into the central US and the Gulf of Mexico. Industry experts estimate 70% of the capex to install and operate these new offshore wind farms can be delivered by the US supply chain.

SECRETS TO US OSW SUCCESS

It has been a long time coming. But the roadmap is now defined and progress well under way to build a new US heavy industry to supply America’s vast market for OSW power. The early focus has been the Atlantic coast, which put the first US OSW “steel in the water” with the 30-MW wind farm off Block Island, Rhode Island, and has policy commitments and market impetus to develop 10 GW more by 2030.

And we expect this number to grow. Several states – including Massachusetts, New York, and New Jersey – are taking steps to advance their OSW progress and goals. Others – including Virginia, North Carolina, and California – are making pledges and plans to join the leaders. The Department of Energy (DOE) reports the project pipeline for US OSW has reached 25.5-GW potential capacity, with 37 projects in 13 states on the East and West Coasts, Great Lakes, and Hawaii. By 2050, DOE says 86 GW of OSW will support 160,000 US jobs.

Offshore wind turbines near Block Island, Rhode Island. Source: Deepwater Wind

Policy certainty from this commitment to scale by states has been a critical factor in kick-starting the US OSW industry. It has given market visibility and a future order book to spur competition, encourage institutional investors, and drive down costs, as occurred in Europe where OSW now produces almost 20 GW of cost-competitive power. In Massachusetts, contracts for its first 800 MW of OSW with Vineyard Wind came in at a remarkable $65/MWh for the final project phase, significantly below expectations and saving consumers as much as $1.4 billion.

For US OSW, “going big” is essential to generate necessary economies of scale and reduce levelized cost of energy (LCOE). This was confirmed in research by the Special Initiative on Offshore Wind (SIOW) into key drivers for OSW success. In 2015, a study for the state of New York quantified the role of scale in cutting costs for ratepayers and raising benefits for the state. In 2016, a study for the state of Massachusetts found the best way to lower LCOE was clear commitments to a big OSW market.

OUTLOOK FOR POWER, SUPPLY CHAIN CONTRACTING

Two years later, US OSW is on a roll – with policy support from state houses to the White House, robust market confidence, and burgeoning activity to build a supply chain and infrastructure at key US ports.

To continue cutting costs, the size of OSW turbines is also growing along with the scale of total GWs to be installed. New OSW turbines are being tested or planned that reach or exceed 10 MW of power and stand taller than San Francisco’s Transamerica Pyramid. Advances in OSW turbine cost-efficiency and size are remarkable feats of technology and may be the most visible elements of new US OSW farms (though barely, given the distance from shore of most new US projects). But turbines represent only a fraction of the total capex required to operate and install 10 GW of OSW off America’s shores.

This is where OSW synergies with America’s offshore energy sector come in. When Deepwater Wind installed OSW turbines off Block Island, it contracted with Louisiana’s Gulf Island Fabrication, which constructs oil rigs, to build the foundations. Liftboat operator SEACOR Marine, also based in Louisiana, transported them by barge to the wind farm site. And a number of US companies, including vessel operators, are forging partnerships with experienced OSW suppliers to ensure the US OSW industry has the Jones Act compliant vessels it needs.

By the end of 2018, signed power contracts for US OSW were expected to total 1.6 GW. New York and New Jersey have issued solicitations, respectively, for 800 MW and 1.1 GW more OSW, which will increase total expected power contracts to roughly 3.5 GW by 2020. Through 2030, capex opportunities will continue to expand as more contracts are signed, to nearly $50 billion for 10 MW of US OSW. The primary initial spend through 2020 will be for support vessels to install and operate the growing fleet of US offshore wind farms. In 2020, we expect to see additional work packages signed, with steady and continuous growth for the US supply chain between now and 2030.

CREATING PARTNERSHIPS, REGIONAL POWERHOUSES

It is clear that US OSW supply chain opportunities have reached utility-scale and are accelerating rapidly. In response, smart suppliers and developers, as well as states, are scaling up their partnerships and regional OSW teams.

In October, Danish OSW leader Ørsted purchased Rhode Island-based Deepwater Wind, marking a consolidation of European and US OSW industry expertise and willingness to partner for scale and reach.

When Massachusetts and Rhode Island announced their first utility-scale OSW contracts, they did so jointly – Connecticut signed on soon after. Together, they have committed to almost 3 GW of OSW. Their joint action signals a desire to coordinate on key decisions about supply chain, port assets, and procurement to enable a robust New England OSW capability.

New York and New Jersey have the makings of a formidable OSW team. Together, they have pledged nearly 6 GW of OSW and share an ocean resource in the New York-New Jersey Bight. They also share the Port of New York & New Jersey, including New York Harbor, one of world’s largest and a potential OSW staging area. Both are on parallel OSW procurement tracks.

Looking to 2019, the stage is set for US OSW and offshore energy leaders to leverage their synergies and work strategically for benefits and scale they cannot achieve separately. The results in growth, jobs, and low-cost power make it well worthwhile.

The forecast for America’s OSW future is booming and bright – driven by US know-how across sectors and policies that unleash the power of the marketplace. Winners will be the best regional teams and industry leaders with vision to tap this vast resource. Contenders are sizing up the competition, scaling up their GWs, and sprinting out of the gate. Let the competition begin. •

The Author

Dr. Stephanie McClellan, Director, Special Initiative on Offshore Wind, University of Delaware