Brazil, West Africa rank as top growth areas

David Boggs, Energy Maritime Associates Pte Ltd.

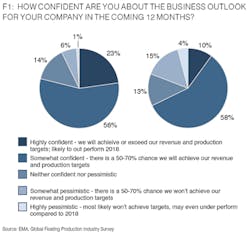

The floatingproduction market outlook continues to strengthen, making this the third year in a row that more than 50% of survey respondents expressed positive sentiment (somewhat confident to highly confident), according to EMA’s annual Global Floating Production Industry Survey. The percentage of respondents who are highly confident rose from 10% last year to 23% this year. The number of respondents expressing somewhat pessimistic and highly pessimistic outlooks dropped from 19% to 7%. Interestingly, while the share of pessimistic outlooks decreased, and the share of high optimism increased, the proportion of those cautiously optimistic and neutral remained almost unchanged. This suggests that while strong oil prices have improved confidence, the vast majority of respondents see gradual improvements with about a quarter expecting strong growth. A few key quotes are highlighted below:

“We have factored a very slow rate of recovery into our business plans - so we expect a limited uptake in our offshore sector in the next 12 months…” – International Classification Society

Expectations for the floating production market recovery proceeded in line with last year’s results (with a shift by one year). Almost two-thirds of respondents believe the offshore industry will recover in one year or less. Furthermore, 14% of respondents now believe that the current pace of activity has recovered to pre-oil price crash levels.

“We believe that the bottom of the market was realized in mid-2018.” – Leading Mooring Contractor

“The FPSO sector has just passed its bottom ... and is just about to start a slow recovery.” – International Classification Society

However, some respondents still believe the FPS market is not out of the woods yet. Nineteen percent still think it will take another 2+ years for the market to improve.

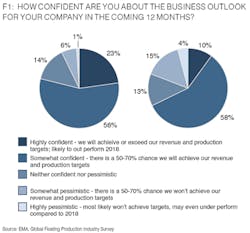

IMPACT OF THE DOWN CYCLE

Two years after the worst period in the FPS industry, the survey asked how the industry has changed. The survey asked respondents whether the cost savings and efficiencies achieved during the downturn will be sustainable and make a lasting change on how the FPS industry operates. The largest proportion, 40%, felt that less than a quarter of the savings would be sustainable. Twenty-seven percent of respondents believe a significant portion (25-50%) will be sustained, while 29% of respondents are optimistic that a 50%+ of cost savings will continue in the long run.

Most respondents believe that while there may be some long-term savings, many costs will increase as activity picks up. A few key quotes are highlighted below:

“As far as we can see as a supplier, a good chunk of the current cost savings are related to squeezing the supplier in price without simplifying the requirements.” – Major Equipment Supplier

“I foresee the contributions of technology and project execution strategy as sustainable going forward.” – Strategic Oil & Gas Consultant

“If the oil price spikes … the industry will be critically short on capacity and experienced personnel. In that case all the ‘savings’ will be thrown out the window. If the price stays stable, the cost savings and processes will continue unchanged.” – Project Developer

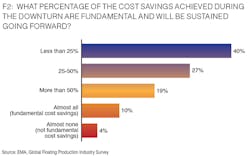

GREATEST GROWTH OBSTACLES

For the fifth year in a row, the price of oil was identified as the greatest obstacle to offshore project growth. Most respondents are concerned with the volatility in oil prices rather than the overall level. However, other concerns are shifting in priority. This year, access to finance rose from third position to second with political issues moving up to third. This reflects overall political and trade instability and new leadership in key markets such as Brazil and Mexico. Macroeconomic concerns over risk naturally lead to tighter financing as investors and banks remain cautious. Environmental regulations moved from last place up the sixth, reflecting a larger impact in design, operations, and decommissioning. Costs remain low on the list of concerns with drilling and subsea costs in the last positions this year.

POTENTIAL BOTTLENECKS

For the third year in a row, most respondents do not see any capacity constraints in the next 1-2 years. However, this year FEED engineering and project management moved up to replace drilling and subsea as the second and third ranked potential bottlenecks. This new ranking reflects the current stage of recovery as a number of projects are now in the early development stages where engineering and management are critical. Fabrication yards moved up to fourth position from eighth last year as orders resume at experienced yards, all of which have downsized.

“The main capacity constraints will be personnel driven rather than materials, hardware or asset driven. A lot of good people have left the industry and they are not being replaced.” – Independent Oil Company

Drilling and subsea dropped down to the eight and tenth positions reflecting substantial availability in 2019-2020. These two industries have undergone significant consolidation and although activity has picked up, there is still plenty of uncommitted capacity in the near term.

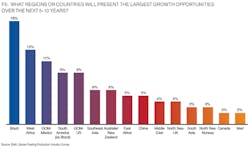

MOST ATTRACTIVE GROWTH REGIONS

Brazil and West Africa ranked as the top two growth regions again this year, as they have been since the beginning of the FPS Market Sentiments Survey. Brazil improved its standing as Petrobras has resumed ordering FPSOs and other operators are progressing new developments.

The biggest changes this year are the attractiveness of the countries after the top two. South America (ex-Brazil) jumped from ninth place to fourth place this year, driven by the opportunities in Guyana as well as other frontier regions. Respondents are optimistic about the Gulf of Mexico, moving up one spot to third. The US leaped up to fifth position buoyed by recent deepwater discoveries such as Whale and Ballymore.

TECHNOLOGY GAME CHANGERS

The survey asked which type of technology will have the largest impact on the offshore industry. The results were unmanned production facilities (UPF) and long distance subsea tiebacks as a close first and second.

A number of the reasons may account for UPF’s rise in popularity—the high cost of personnel as a portion of operating costs, re-thinking current practices to develop cost-effective solutions, and the increasing application of digital solutions. While unmanned fixed facilities are common, the technology has not yet been transferred to floaters. Even if a completely unmanned facility is not realized, reductions in personnel offshore would result in lower operating costs.

Longer distance subsea tiebacks could enable development of marginal fields, with shorter payback while increasing the utilization of existing facilities. Tiebacks certainly will extend the life of currently installed production units, while the impact of future requirements is yet to be seen. Some stand-alone FPS developments could be replaced by tiebacks, while an FPS hub could be made economic by tieback of multiple fields.

FLNGs dropped from first to fourth place as financing troubles have delayed sanction of new FLNG projects.

FIVE YEAR FORECAST

The results of this survey are taken into account when compiling EMA’s outlook for floating production orders. In the base case scenario, EMA expects 127 awards for FPS units worth just under $100 billion in the next five years. This year, the firm has increased the projected number of FPSO awards by 9%, as investment returns to deepwater projects. FPSOs will account for 40% of the orders and 75% of the capex. In terms of spending, Brazil will remain the largest market by far, followed by Africa and the US Gulf of Mexico. Orders are expected to resume for Australian developments toward the back end of the forecast period. South America (other than Brazil) will see $7 billion of capital spent for FPSOs in frontier areas such as Guyana.

SUMMARY

The sentiment for the global FPS industry has continued to improve since 4Q 2016. Awards have returned to levels last seen in 2013-2014, prior to the oil price crash, and are projected to remain steady. However, certain sub-sectors and specialist contractors are busy, while most continue to look for additional work. Development costs remain low, fueled by excess drilling and subsea capacity, but offshore project sanctions continue to be delayed as operators cherry-pick the best opportunities in their global portfolios. Activity levels are expected to increase, but at a measured pace as operators keep a close watch on costs and spending.

ABOUT THE SURVEY

EMA’s Global Floating Production Industry Survey, now in its sixth year, gauges the current market sentiment as well as where the industry is heading in the future. This year EMA partnered with Offshore magazine and the survey had a record response rate from all areas of the industry and from all parts of the globe. The respondents come from a mix of oil companies, engineering firms, financial institutions, equipment providers, construction yards, and asset owners/operators. Respondents are from a range of executive-level positions — senior executives to mid-level and front-line managers — providing an industry-wide perspective. Respondents also come from a wide range of functions, including strategy/planning, sales/business development, engineering/technical, project management, and commercial/finance. •