Jackup market expected to recover in 2019

Oddmund Føre, Rystad Energy

The offshoreindustry weathered the storm of low oil prices by cutting costs and sanctioning fit-for-purpose scopes. The industry also reduced unit price reductions, sought efficiency gains, and reduced the scope of projects to push down breakeven costs for both deep and shallow water fields by over $30/bbl from their 2013-14 levels. Now with the worst of the downturn behind, the industry appears ready to start a new wave of project sanctioning.

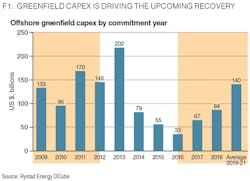

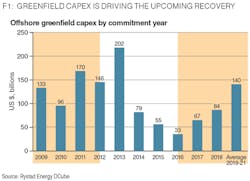

In fact, greenfield project commitments have risen every year since 2016. The year 2018, for its part, is likely to close with over $85 billion of greenfield project commitments. While that represents a 25% increase over 2017’s commitment levels, it could have been even higher. Sanctions between the USA and Iran, contract delays and operators deferring investment decisions led to a delay of over $20 billion of potential commitments.

Over the next three years, the industry looks poised to sanction at least $100 billion of greenfield projects per year (on average). These projects have breakeven prices below $60/bbl and are expected to reach a final investment decision by the end of 2021. In the near-term, all eyes will be on Qatargas’s North Field Expansion mega-project. This three-train steel platform development will require over $26 billion of capex to reach a mid-2024 start-up of the first train. While an investment decision is expected by year-end, Qatargas has already started to engage potential contractors. In addition, ExxonMobil’s work in Mozambique and Guyana could result in over $15 billion in sanctioning alone next year.

However, these will not be the only offshore projects garnering attention. An additional $25 billion of yearly commitments is being held hostage by unattractive $60+ per barrel breakeven prices. The Ghasha and Hail shallow-water assets under the Hail and Ghasha Sour Gas project could generate over $10 billion in capex. However, their current breakeven price of over $60/bbl merits more caution as they head to a sanctioning decision mid-2019.

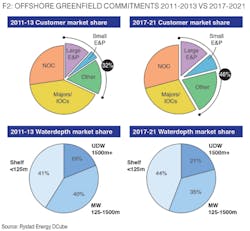

In the new wave of offshore sanctioning, shelf developments are expected to strengthen their position in the offshore market. During the period prior to 2014, greenfield commitments for shelf developments made up approximately 41% of total greenfield investments, but this is likely to grow to 44% in the period from 2017 to 2021. Similarly, the new offshore investment cycle is set to be more dependent on commitments from smaller operators, which are expected to take up 46% of total greenfield commitments from 2017 to 2021 compared to 32% prior to 2014. The change in dynamics can be related to the trend seen during the downturn, where big oil companies divested their offshore exposure in favor of shale, illustrating the tremendous competition for investment dollars that confronted the offshore market by the shale industry.

After the oil price started to recover back in 2016, investments in the short-cycled shale industry gained momentum very quickly. In contrast, offshore greenfield investments failed to show growth reflective of the uptick in the oil price. The greenfield commitments materializing in the offshore space during this period was skewed toward further development of existing infrastructure, where more than 40% of all greenfield commitments in 2016 were related to subsea tiebacks, showing that the short-cycle focus was also present in the offshore market.

Going forward, it is not only the amount of greenfield investments that speaks for improved market conditions in the offshore space. Operational expenditures are also set to increase by 10% per annum toward 2021, driven primarily by the large demand for oilfield services in shallow waters, which are set to grow from approximately $100 billion in 2018 to $130 billion on 2021. The Middle East, Western Europe and North America are driving this growth.

This is very good news for drillers waiting for utilization and rig rates to bounce back up to sustainable levels. After some tough years in the wake of a market collapse, the tide has turned and the market is seeing substantial improvements in the rig market with the shallow water space no exception. Several key markets have started to see a considerable uptick in utilization this year, and some are expected to be close to sold out in 2019.

While the Middle East is still the main driver of jackup demand, the regional markets in West Africa, Southeast Asia, the North Sea and the US Gulf of Mexico have all seen positive development in utilization levels in 2018, and some of these markets are already registering higher day rates. Furthermore, we know that contract lead times are increasing, tendering activity is improving and rigs are being reactivated – all indications that the market is in the midst of re-setting itself.

Rig rates for the US Gulf of Mexico have been on the rise for the past two years. In the same period, the number of rigs on contract doubled in order to keep up with the growing demand on the shelf. Looking ahead there is reason to believe that the drillers can look forward to a further increase in utilization and rig rates as demand is picking up due to increased investments driven largely by brownfield activities. The reform of the fiscal regime in the US Gulf should also be favorable for the shallow waters in the region and we have already seen growing numbers in lease rounds over the past couple of years.

The Norwegian continental shelf (NCS) is another market expected to have very few rigs available to take on additional work due to the country’s stringent spec requirements and the need for an Acknowledgement of Compliance. As such the NCS market is already sold out when looking into 2019. The tightening of the NCS market has been visible through increasing rates lately. For example, theMaersk Intrepid signing off at $266,000 with Equinor. This is double the rates signed for drillships so far in 2018. The CJ70 design has typically been earning a premium in the region.

West Africa is also a region where we expect a substantial uptick in demand going forward, and we have already seen this starting to materialize in the number of rigs on contract. Accordingly, we expect utilization to increase on the assumption of no further retirements of the fleet. We therefore believe that there will be a need for new capacity as well as a call for newbuilds into the 2020s.

On the whole, we expect the jackup market to recover next year with a steady stream of work from greenfield and brownfields projects and decommissioning work. With utilization and rig rates on the mend for several markets around the world, there is some potential uplift if the industry retires more units. If this is done, then we would expect a fundamental increase in rig rates thereby unlocking some of the capacity sitting in Chinese shipyards which would be needed in order to meet the growing demand we see in the future. •