New methodology helps reduce carryover work, improve project performance

Approach can be particularly useful during execution phase

Shawn Saadipour, David J. Taghehchian, Chevron U.S.A Inc.

Carryover workis an unfinished construction and/or commissioning scope of work from one contractor transferred to a different location to be executed by a different contractor. As a general practice, most risk analysts model the carryover work as a discrete risk in their risk analysis. However, treating carryover as a discrete (or independent) risk may not be the best approach. Since carryover is a function of incomplete work prior to a constrained work-transfer date, it is not an independent event and should not be modeled as a discrete risk in risk analysis.

The goal here is to demonstrate a methodology that can be used to develop probabilistic distributions of the first oil milestone date based on various constrained sailaway dates and the resultant carryover work. This can then be used to develop a risk-based cost-benefit tradeoff model to find an optimal sailaway date to maximize project value. Furthermore, the value of mitigation plans can be assessed (cost vs. schedule improvement) accordingly.

Carryover work has always been a major schedule risk to the success of offshore projects. This work is usually completed at a lower productivity rate which drives up cost and schedule growth. Although it is logical not to develop a base-case plan to have carryover work, it has become a fixed part of executing offshore projects. Carryover work is created due to one or both of the following:

• Unsatisfactory progress or performance at original location by the original contractor

• Imposed constraints such as weather conditions or a requirement to achieve a milestone (i.e. sailaway date).

Although carryover work can help a project satisfy a short-term objective such as achieving an announced sailaway milestone date, it can greatly impact project value in the long term via first oil slippage or cost growth due the increased offshore labor cost. It is important for project managers to analyze and manage the risk of carryover by preparing adequate mitigation and contingency plans.

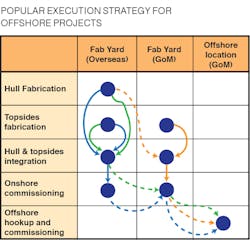

Fabrication, integration, hookup, and commissioning of offshore facilities varies depending on type of facility, execution strategy, and contracting strategy. The first chart depicts common execution strategies used for offshore projects. Each color shows a different execution strategy; dotted lines depicting where carryover can potentially occur.

Carryover is a risk that is quantifiable if progress and performance can be reasonably forecasted. Carryover risk can be managed by:

• Schedule-based optimization of the sailaway call-down window with the objective of achieving the earliest possible project completion milestone (i.e. first oil). This assumes an earlier first oil date equates to project value preservation/improvement.

• Assessing the value of mitigations (increasing workforce, adding a work shift, paying for a second transportation contract, securing supplemental contractors in the original work location, utilizing accommodations barges offshore, etc.) to maintain the project completion date (i.e. first oil) or to minimize the delay.

When using a Monte-Carlo simulation-based analysis tool, each case within the simulation should calculate carryover work as a function of unfinished work beyond the constrained sailaway date independent of the other cases in the simulation. On the other hand, using a discrete risk allows for cases where there should be no carryover work to have some carryover impact and vice versa. Moreover, discrete risks typically do not penalize the completion milestone heavily enough due to a reluctance to be appropriately pessimistic in range of impact and probability of occurrence.

It is important to note that this analysis must be conducted early in the fabrication when the project still has flexibility in selecting and narrowing down a call-down window. As a decision-making tool, while the project is progressing, the analysis must be repeated with up-to-date inputs impacting the result.

Case study

The case study features a deepwater production facility which both hull and topsides are fabricated, integrated, and commissioned overseas. The FPU is towed to a shore base for final preparation for installation. Finally, the FPU is transferred to the final location for installation and hookup and commissioning. For assessment, assume that this project is at the early stage of fabrication and that all carryover work is planned to be liquidated at the shore base.

Communicating major project milestones to management in a probabilistic fashion has become a standard practice in the industry. Consequently, almost all major capital projects develop a schedule risk model based on their deterministic plan.

All calculations here are based on “Loadout” date since all construction and/or commissioning work must be stopped prior to the loadout and remaining work (if there is any) considered as “Carryover.” However, sailaway date can be easily identified from loadout date.

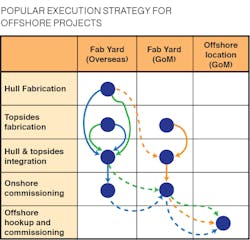

The potential carryover work from fabrication yard to shore base location is measured to be the delta between constrained loadout date and: 1. end of onshore commissioning and 2. end of construction (MC). Using the schedule risk model, we can identify the probability distribution of carryover work categorized whether it is construction or commissioning carryover. Carryover work scenarios are depicted in the following charts.

Once the carryover work is identified, the next step is to penalize the first oil milestone for carryover work at lower productivity.

To calculate the adjusted first oil with carryover work, the risk model needs to be run in a risk analysis tool (i.e. Pertmaster) and “Risk Data” needs to be exported into an Excel workbook for all individual cases/iterations for the following activities and milestones:

• Facility ready for loadout milestone

• End of modules integration and topsides mechanical completion

• First oil milestone (Base case – No carryover)

After exporting the data to the Excel workbook, the following parameters needs to be added to the workbook:

• Constrained loadout date

• Construction carryover multiplier (penalized at rate 1: x)

• Commissioning carryover multiplier (penalized at rate 1: y)

For each case/iteration, the following fields are calculated:

• All carryover

• Only construction carryover

• Only commissioning carryover

• Waiting for loadout/transportation

• First oil date adjusted with carryover.

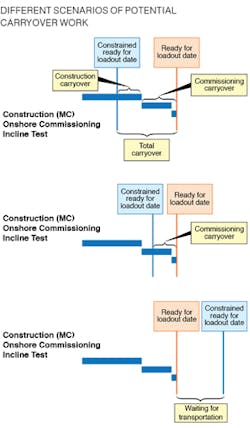

Ultimately, the S-curve for the first oil date adjusted with carryover field can be calculated. If the process is repeated for multiple constrained loadout dates, a comparison chart/table for all S-curves can be developed to determine which loadout date (and consequently sailaway date) will minimize the schedule risk to first oil.

Decision making analysis

Selecting a later date for loadout reduces the risk of delay to first oil significantly, but there is still some degree of impact. The decision comes down to a tradeoff between risk reduction and opportunity cost. The analysis is very sensitive to the risk profile of each activity in the schedule risk model as well as carryover multipliers.

The schedule risk model and this analysis should be repeated frequently to account for actual performance in the fabrication yard.

Once the analyst has confidence in the calculated first oil date adjusted with carryover and potential delay in project completion, it is possible to conduct a cost-benefit tradeoff analysis. The value degradation of delaying production can be compared against the cost of actions to mitigate the delay.

Project teams should consider:

• How many days of delay can be saved by implementing mitigation plans?

• What is the cost of mitigations?

• What is the net present value associated with delaying production by one day?

These mitigation plans can be communicated to management on a value driven probabilistic basis for review and approval well in advance of sailaway.

Conclusion

Although the methodology presented here is a more accurate way to model the impact of carryover work, the current practice which applies carryover work as a discrete risk can be a reasonable approach for FID/phase gate decision making. Project teams should be cautious about underestimating the potential impact of carryover work to the project throughout all phases of development. This methodology is particularly useful during the execution phase of the project when carryover risk is being actively monitored and managed during fabrication activities. Finally, this method can be extended to determine the value of project performance improvement opportunities. •