David Paganie • Houston

Recent industry analysis suggests that a boost in upstream capex is forthcoming, providing a signal that operators are gaining confidence in the market outlook. Evercore ISI’s global E&P mid-year spending outlook and survey finds that upstream spending will increase next year as long as oil holds above $50/bbl for the balance of this year. Many industry analysts predict that the price will rise well above this level into 2017 as global oil supply and demand tightens. Supporting this premise, 73% of its survey respondents expect to increase spending in 2017, while 28% expect to keep spending flat at 2016 levels and none plan to lower spending next year. Of those that plan to increase spending, one-third plan to increase 2017 capex by more than 25% relative to their 2016 spending levels, while 20% plan to increase capex by up to 5%.

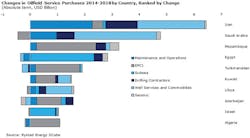

In the meantime, it is the emerging markets that are offering a healthy dose of new and prospective offshore opportunities for the oilfield services sector. Analytics firm Rystad Energy expects the largest growth in demand to come fromIran, which is expected to increase its purchases by more than $6 billion from 2014 to 2018. Rystad forecasts that approximately half of the $100 billion of investments for Iran’s upstream sector from 2016 to 2020 will be allocated to its offshore market. See page 10 for more on the opportunities in Iran.

Offshore Egypt is another market that is gaining momentum. Rystad expects about $3 billion in spending growth in Eqypt from 2014 to 2018, led by the development of the Zohr, West Nile Delta, and Yolotan fields. The majority of this expenditure will be allocated to the subsea sector.

Meanwhile, BP and the Egyptian Natural Gas Holding Co. (EGAS) have sanctioned development of theAtoll Phase One project in the North Damietta Offshore concession in the East Nile Delta. The project calls for an early production scheme involving the recompletion of the existing exploration well as a producer, the drilling of two additional wells, and the installation of the tie-ins and facilities required to produce from the field. BP said at the time of sanctioning that its growing confidence in the potential of the area led, in part, to the final investment decision. The Atoll field is estimated to hold 1.5 tcf of gas and 31 MMbbl of condensate. First gas is expected in 2018.

BP also recently announced with partner Eni a discovery in the Baltim South Development Lease in the East Nile Delta. The discovery is a new accumulation along the same trend of the Nooros field. BP plans to use existing facilities to expedite first production.

Meanwhile, Guyana is emerging as a major frontier market, highlighted byExxonMobil’s Liza deepwater discovery. The US Geological Survey ranks the Guyana-Suriname basin as the second most prospective, underexplored offshore basin with an estimated 13.6 Bbbl of oil and 32 tcf of natural gas yet to be discovered, writes Jessica Tippee, Offshoremagazine assistant editor. In May 2015, ExxonMobil hit more than 295 ft (90 m) of high-quality oil-bearing sandstone reservoirs with the Liza-1 exploration well. The operator is reportedly moving the discovery into the pre-front-end engineering design phase. See page 30 for Tippee’s Guyana upstream outlook report.

To respond to articles inOffshore, or to offer articles for publication, contact the editor by email ([email protected]).