Nearly 90 greenfield, brownfield project FIDs expected this year

Editor's note: This feature article first appeared in the January-February 2024 issue of Offshore magazine. Click here to view the full issue.

By Mark Adeosun, Westwood Global Energy Group

Global energy demand continues to ramp up as the world economy emerges from the constraints of the COVID-19 pandemic. According to the US EIA, liquids consumption has grown by 10% over the past three years, averaging 101 MMb/d in 2023.

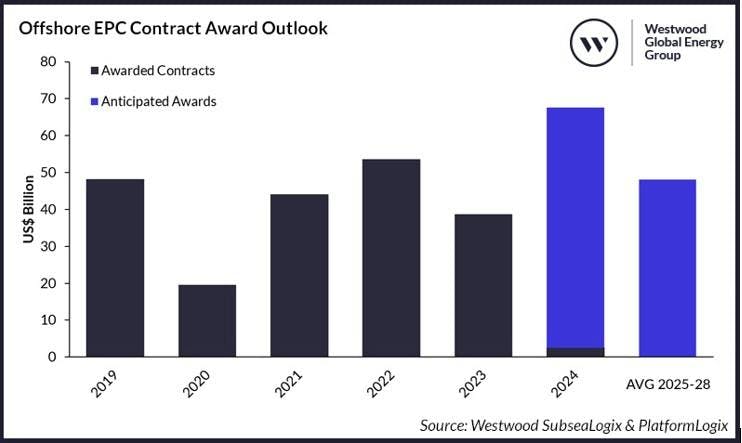

The rebound in oil demand to above pre-pandemic levels continues to spur investments in oil and gas (O&G) projects, with upstream engineering, procurement and construction (EPC) contract award value in 2023 totalling approximately $39 billion (excluding letters of intent). This represents a 98% increase compared to the 2020 EPC award value but a 28% decline on 2022 as the inflationary cost environment and global supply chain crunch led to project delays.

Overall, Westwood recorded a total of 275 subsea tree unit awards in 2023 – a four percent increase compared to our January 2023 outlook. EPC-related activities for floating production systems (FPS) sanctioned in 2023 accounted for 1.2 MMboe/d of O&G throughput capacity and 2.7 MMtpa of LNG capacity, driven by 13 units (four newbuilds, three conversions and six upgrades/redeployment), with an EPC value of $11 billion. This represents a 45% decline in recorded EPC award value, compared to our January 2023 outlook, due to delays to bid submission deadlines for Petrobras’ floating production, storage and offloading (FPSO) units such as the Albacora replacement FPSO, the P-84 and P-85 units. Given these delays, the Brazilian NOC did not sanction any FPSO construction project in 2023, compared to four units sanctioned in 2022.

A total of 99 fixed platforms were sanctioned in 2023, with sanctioning activities in the Middle East accounting for 80%, driven by Saudi Aramco’s contract release and purchase orders (CRPOs), including 87 and 102, 97, 117, 118, 121, 122 and 125. North Oil Company’s Ruya (Gallaf phase 3) project and QatarEnergy’s ISND Phase 5 project, both in Qatar, also contributed to fixed platform EPC-related investment in the region. Over 3,400 km of subsea umbilicals, risers and flowlines (SURF) and over 2,600 km of line pipe was sanctioned last year.

Outside of brownfield expansion projects in the Middle East, major projects sanctioned in 2023 include ExxonMobil’s Uaru project (Guyana), Woodside’s Trion (Mexico), Shell’s Sparta (US GoM), TPOA’s Sakarya Phase 2 (Turkey), Equinor’s Rosebank (UK) and its Raia fields (Brazil), as well as Azule Energy’s Agogo (Angola).

EPC activity outlook

Looking ahead to expectations for the offshore industry in 2024, Westwood forecasts global offshore O&G-related EPC contract award value to total approximately $68 billion, driven by 89 greenfield and brownfield project FIDs over the next 12 months. This represents a 74% increase on the EPC award value recorded in 2023. Contracting activities in 2024 will be driven by demand for over 320 subsea tree units, 22 floating production units (including seven FLNG units), over 130 fixed platforms, 4,500 km of SURF and approximately 3,900 km of line pipe. It is pertinent to state that while there has been historic optimism about the FLNG market, it has failed to live up to expectations in the past. This year, however, could be the time for the faltering FLNG industry to fully bloom, with an expected EPC award value of approximately $15 billion, of which Samsung Heavy Industries already announced the award for a newbuild FLNG unit valued at $1.5 billion, believed to be related to the Cedar FLNG project offshore Canada. FLNG EPC award value for 2024 will be driven mainly by projects that have historically experienced delays but are now prime to reach a final investment decision. This includes at least one unit for Delfin Midstream’s FLNG project off the coast of Louisiana (US), Nisga’a Nation’s Ksi Lisims FLNG project (Canada), Genting Oil and Gas’ AKM FLNG unit (Indonesia), Eni’s Coral Norte unit (Mozambique) and UTM Offshore’s Yoho FLNG project (Nigeria). Should they all go ahead this year in their current stipulated capacity, these projects will account for 24.4 MMtpa of additional liquefaction capacity.

In the Middle East, investment offshore from members of the Gulf Cooperation Council (GCC) will lead to a major production boost, with GCC offshore production forecast to reach 14.9 MMboe/d by 2028, up 30% on 2023. Saudi Aramco’s Safaniya brownfield project driven by CRPOs 104 to 113 and CRPO 88, as well as QatarEnergy’s delayed North Field South (NFS), North Field Compression project and ADNOC’s Lower Zakum Long Term Development - Phase I development will represent key offshore EPC contracting opportunities in 2024. Energean’s Katlan development offshore Israel, for which TechnipFMC was awarded an integrated FEED contract, will also represent a key award in the region.

Beyond 2024, continued investment in Petrobras’ presalt basin, ExxonMobil’s Starbroek block (Guyana), the East Mediterranean, deepwater Namibia, and the East African gas basin represent significant EPC contracting opportunities. Westwood anticipates strong levels of EPC contracting activities over the 2025-28 period sustained by oil prices (estimated to average over $65/bbl), favorable project economics and robust hydrocarbon demand. Given this, an annual O&G-related EPC award value is forecast to average $48 billion. Overall, potential upside remains, as Westwood has also identified EPC and modification contracting opportunities related to the offshore carbon storage (CS) industry, which remains vital for the energy transition. Identified CS projects requiring new infrastructure that have progressed to or beyond the concept phase will account for over $9 billion over the 2024-28 period, driven by approximately 65 subsea tree units, 3,200 km of subsea line pipe and 10 newbuilt fixed platforms.

The expected high levels of investment in 2024 will help increase global offshore production, even as most shallow water-focused areas outside of the Middle East continue a long-running decline trend. Overall, offshore production is expected to reach 56.4 MMboe/d by 2028, up from 48.3 MMboe/d in 2023.

About the author: Mark Adeosun is currently the Research Director for Westwood Global Energy Groups’ SubseaLogix and PlatformLogix market analytic tools. Since joining Westwood in 2013, he has worked directly with as well as advised several clients within the oilfield services supply chain, as part of both analytic and commercial advisory projects.