Offshore industry enters new year with renewed optimism

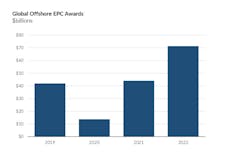

After navigating one of the worst years in its history in 2020, the offshore oil and gas industry enjoyed a sharp correction last year. As the global pandemic took a 30 MMb/d bite out of global oil demand, pushing Brent oil prices briefly under $10/bbl, offshore investment in 2020 fell to its lowest levels in over two decades with just $13.7 billion of new EPC awards and just 48 new projects sanctioned. This represented a year-on-year drop of 67% and 47% respectively compared to 2019 with the average EPC spend per FID also dropping by 40%. The largest five projects accounted for half of the 2020 spend.

In 2021, as global economies cautiously emerged from strict lockdowns and limitations on international mobility, the subsequent improvements in demand as well as the impact of OPEC+ intervention on the supply side saw a dramatic rally in oil prices which improved from $55/bbl in January to $84/bbl by October – their highest monthly average since 2014. E&Ps benefitted greatly from this surge in realized prices, posting excellent cashflows which promptly allowed them to revisit capex plans previously put on hold during the peak of the pandemic. Last year, a total of 62 offshore FIDs were recorded as well as $44 billion in offshore EPC awards. Although this is just a 30% increase in the number of offshore projects sanctioned, the average EPC spend per FID increased dramatically by over 200%. In this case, the top five projects accounted for 25% of total spend, including Equinor’s Bacalhau development offshore Brazil.

Regionally, offshore investment was concentrated in Latin America in 2021, which accounted for 33% of spend including (in addition to Bacalhau) Petrobras’ Buzios 6,7, and 8 and Mero 4 presalt developments; and in the Middle East, which accounted for 30% of spend, including Qatar’s North Field Sustainability project, ADNOC’s Lightning subsea project, and Farzad-B offshore Iran. Australia also saw some significant new gas projects get the greenlight including Santos’ Barossa in March and Woodside’s Scarborough in November.

As we enter 2022, the offshore industry finds itself in robust health and with renewed optimism. We expect up to 100 projects could be sanctioned with an associated $71 billion of potential offshore EPC awards. Much of this includes projects deferred during the pandemic, and the market has already gotten off to a fast start with QatarEnergy awarding the first half of a reported $3.5-billion EPC contract for its NFE/NFS development to McDermott in early January. The Middle East will likely continue to be a major contributor to EPC tendering activity, accounting for 21% of expected spend in 2022. This included Saudi Aramco’s giant (and delayed) Zuluf Incremental Project, which could see up to $6 billion of EPC awards given out over the course of the first quarter of the year. However, Latin America should take pole position with 26% of expected 2022 offshore EPC investment. Brazil will continue to account for the majority of regional spend but will be joined by Guyana where ExxonMobil is expected to sanction its Yellowtail prospect in the prolific Stabroek basin; and Mexico, where BHP’s Trion development is expected to receive the greenlight.

This uptick in investment creates significant opportunity for the offshore energy services supply chain. After a slightly lackluster 2021, this year is expected to see the highest level of floating production system awards in recent history with up to new 18 units (excluding upgrades and redeployments) up for grabs, compared to just nine last year. This includes six additional units offshore Brazil as well as Suriname’s first-ever award to support TotalEnergies’ proposed Black Oil Development Hub, which includes its Sapakara and Keskesi prospects. However, the average value of FPS orders is expected to drop significantly this year from $1,500 to $715 million per unit as greater mix of geography and E&P comes into play. All in all, 2.3 MMboe from new FPS throughput capacity (oil and gas) will be sanctioned this year compared to 1.9 MMboe last year.

The subsea industry followed a similar trend last year, with order intake for subsea trees ultimately falling short of early year expectations largely due to project delays. Last year, 173 trees were awarded, representing a 9% drop sequentially, but still significantly above the 2016 nadir. The new year is now expected to see a major uptick with a potential of 355 tree awards in the market which would be the most activity since 2013. At the time of writing, 53 of these trees had already been awarded pending project FID. The SURF segment fared better in 2021, largely due to a major ramp up in Petrobras’ requirements, including a 500-km (311-mi) flexible pipe frame agreement with TechnipFMC in December and a 370-km (230-mi) flexible pipe contract to Baker Hughes in July. Although Brazil’s SURF requirements will likely now be lower in 2022, global demand is expected to grow to 5,400 km (3,355 mi) – an 18% increase year-on-year.

Perhaps the single biggest challenge facing the offshore oil and gas industry continues to be the growing influence of the ESG investment narrative and public perception. Shell’s decision to pull out of the Cambo development offshore the UK amid significant public backlash around new hydrocarbon project sanctioning sent shockwaves across some parts of the oil and gas sector. Although not necessarily a death knell for the project, Cambo’s future now appears in limbo, casting doubt on future projects in the UK and beyond.

The energy transition and shift to a low-carbon future is also opening up significant new opportunities for the energy services supply chain. The oil and gas industry will play a key role in reducing the GHG intensity of global economies, and while the rapid growth of the offshore wind industry has rightfully gotten much attention over the past couple of years, the emerging offshore carbon capture and storage (CCS) segment will also contribute greatly. Over the next five years, we currently estimate around $1.5 billion of offshore EPC orders to support CCS projects, including seven subsea trees and over 1,000 km (621 mi) of pipelines and umbilicals. With CCS expected to become a more regular feature of new field developments, these figures are expected to grow substantially over the coming years. This will provide the offshore oil and gas supply chain with a new, ESG-friendly growth opportunity in line with their core expertise.

The authors

Thom Payne is a director based in Westwood Global Energy’s offices in Singapore, where he leads the firm’s offshore energy services research & analytics. He has provided market, commercial and strategic advice to support over $15 billion USD of M&A and debt-raising activities across the global energy sector over the past 15 years.

Mark Adeosun is currently the Research Manager for Westwood Global Energy Groups’ Subsea Research & Analytics business unit. Since joining Westwood in 2013, he has worked directly with as well as advised several clients within the oilfield services supply chain, as part of both analytic and commercial advisory projects.