The past two years have been challenging for the offshore oil and gas industry, with the collapse in oil prices and global pandemic followed by an intense push for the energy transition. But the new year seems to have brought recovery for the offshore oil and gas marketplace, and we are seeing further growth in the renewable energy sector as well. As we move into 2022, Rystad Energy expects overall energy investments to grow by 7% but, as in 2021, the way in which this will happen will not be quite as expected.

We expect that the coronavirus and its new variants will continue to impact the industry in the new year. The pervasive spread of the virus in the first quarter will inevitably lead to restrictions on movement, thus capping energy demand, and slowing recovery in the major crude-consuming sectors of road transport and aviation. Rystad Energy estimates that this will have a negative impact on demand for 1Q 2022 of around 230,000 b/d of oil, with overall demand for 2022 likely to be in the region of 100 MMb/d.

Under our worst-case demand scenario, strict lockdowns could wipe out 4.3 MMb/d of demand in 1Q 2022 and 2.3 MMb/d over the course of 2022. Importantly, full demand recovery to 2019 levels would be pushed into 2023. With downside risk of demand and limited growth, it all comes down to the supply side. With oil prices hovering around $60 to 80/bbl, some 61,800 wells have been drilled and completed globally. This is a growth of 7,000 wells compared to 2020. We expect that this, plus planned production increases by OPEC+, will grow liquids supply by 7 MMb/d, which will lead to an oversupply of at least 1 MMb/d. As a result, Brent oil prices are likely to weaken from $71/bbl in 2021 to $64/bbl in 2022.

Even though oil prices are likely to soften, natural gas prices are set to increase this year, partially compensating for a decline in oil prices in terms of activity. The net impact on upstream oil and gas investments for 2022 will be an overall growth of 9%. In terms of where oil and gas companies choose to invest, there is further growth of around 18% expected for the global shale industry, and 7% and 8% for offshore and conventional onshore sectors, respectively. Australia and the Middle East stand out in terms of the regions likely to see the largest growth in investment in 2022. Australia will likely grow investment by 33% as it spends on greenfield gas developments. In the Middle East, investment will grow by an anticipated 22% next year as Saudi Arabia and Qatar increase their oil and liquefied natural gas (LNG) export capacity respectively.

Growth in investment during 2022 is very much pre-programmed by the $140 billion worth of greenfield projects sanctioned in 2021, up from $80 billion in 2020. Next year’s sanctioning activity is likely to follow suit with roughly the same amount of project spend to be unleashed over the short to medium term.

Surge in field sanctioning

Sanctioning activity is set to rebound in North America especially with over $38 billion worth of projects due for sanctioning in 2022. As many as four LNG projects are expected to receive the green light, three in the United States and one in Canada. Offshore projects will also provide ample opportunities for contractors as TotalEnergies’ North Platte project enters the final stage of its tender process, and LLOG Exploration’s Leon and Chevron’s Ballymore projects in the US Gulf of Mexico proceed with their field development plans. For Africa, however, 2022 is expected to be another quiet year with projects worth a comparatively small $4 billion set to get sanctioned.

When it comes offshore field sanctioning, there are around 80 projects worth a total $75 billion in the approvals pipeline for 2022. Of these, 10 are floating production storage and offloading units (FPSOs); 40 involve subsea tiebacks; and 30 are grounded platforms. Latin America and Europe will be responsible for around 24% each of the total offshore sanctioning spend this year with deepwater expansions expected in Guyana and Brazil; as well as Norway following recent tax changes.

In terms of numbers, offshore sanctioning is expected to increase this year while remaining at the same level in terms of capital commitments. But even with increased project sanctioning, there are still pandemic-related challenges to staffing and operations; and increased inflationary costs in steel and other input factors. These are likely to make operators a tad cautious when it comes to major capital commitments. On top of this, a number of major offshore operators are rethinking their portfolio strategy as the energy transition unfolds; many of these have already directed their investment budgets to low-carbon energy sources.

Transitioning to offshore wind

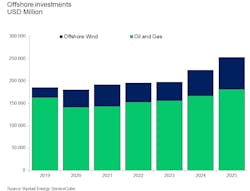

For offshore contractors, the energy transition could end up being advantageous when it comes to wind power developments. Spending in the offshore wind sector topped $50 billion this year, a doubling of 2019 levels. By 2030, we expect that offshore wind spending will reach $120 billion as demand for clean energy rises. By contrast, the offshore oil and gas industry is set to face a tough energy transition period. Oil demand is likely to peak in the next five years, which will cap offshore investment somewhere between $140 billion and $180 billion within this decade.

Several countries and regions are expected to see the offshore wind market outgrow that of offshore oil and gas in terms of investment. Both China and the United Kingdom – the two largest offshore wind markets in the world in terms of operational capacity – have already reached this crossing point in 2017 and 2020, respectively. For Europe, which is expected to be the largest regional offshore wind market by 2030 with 119 gigawatts (GW), the crossing point is expected to be reached by 2026. Among the countries and regions analyzed by Rystad Energy, the US offshore wind sector is expected to see the fastest growth in investment, albeit from very low levels. By contrast, China is presently experiencing a massive surge in offshore wind activity and will see investments decline toward 2030 as feed-in-tariffs are phased out from 2022 onwards. Nevertheless, significant ongoing investment is expected to make China the single-largest offshore wind market (as a country) with 58 GW of installed capacity by 2030.

The author

Audun M. Martinsen is Partner and Head of Energy Service research at Rystad Energy. In that position, he manages the energy service research team and also serves as the Product Manager for the supply chain databases ServiceCube. His fields of expertise include the global offshore and onshore energy service market, cost analysis, and supply and demand studies. He holds a Master of Science in Marine Engineering from the Norwegian University of Science and Technology and University of Berkeley, California, and an Executive Master of Management Program within finance from BI Norwegian Business School.