Offshore oil and gas capex expected to reach $63.1 billion

The first half of 2021 is now in the rear view and there is a positivity and optimism across the offshore energy sector that seemed almost impossible twelve months ago. This positive market sentiment is underpinned by a resurgent Brent oil price that has settled above $70/bbl in June and reached its highest daily average since October 2018. Compare this to the second quarter of last year when the Brent barrel averaged $30/bbl and fell to a daily average low of just $9/bbl in April as the compounded effect of pandemic-related demand destruction and OPEC+ discord conspired to cause an 8 MMb/d supply glut. Since then, continued OPEC+ intervention and adherence to production quotas, combined with China’s appetite for crude imports and more recently the resurgence of US gasoline demand are all thought to have now eroded excess stockpiles. In fact, these factors appear to have been so successful that agencies such as the IEA and major consumers such as India are now calling on OPEC+ to allow more crude into the market to alleviate rising petrol prices and facilitate domestic economic recovery.

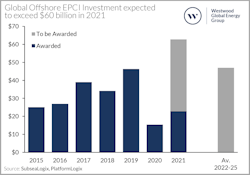

One group that is certainly not complaining about this trend are oil and gas producers. Increased revenues from higher realized prices and 2020 capital discipline are widely expected to see E&Ps post some of the most impressive cash flow results on record in 2Q 2021. Although E&P companies remain cautious and focused on deleveraging and shareholder returns, improving sentiment has led to an uptick in offshore capital investments. In the first six months of this year, we estimate $23.3 billion of offshore EPCI value (excluding LOIs) has been awarded which includes spend associated with subsea equipment, floating & fixed platforms and pipelines. This is already a 50% increase over the total amount awarded over the entirety of 2020, which saw $15.4 billion of awards with just under 50% of this coming from just four projects – Woodside’s Sangomar offshore Senegal, Petrobras’ Mero 3 & Marlim Revitalization FPSO offshore Brazil, and ExxonMobil’s Payara offshore Guyana.

Key projects awarded year to date in 2021 include Equinor’s Bacalhau offshore Brazil; Petrobras’ Buzios 6-8 also offshore Brazil; Qatar Petroleum’s North Field Sustainability project; Santos’ Barossa offshore Australia; and NIOC’s Farzad offshore Iran. These seven projects account for just over 62% of total EPCI value and also reflect the current focus on the deepwater Latin America, Australian gas, and shallow-water Middle East markets.

Over the balance of 2021 we expect this momentum to pick up further (assuming an average Brent price of at least $60/bbl) with an additional $39.8 billion of EPCI value to be formally awarded, resulting in a total of $63.1 billion for the year – the highest since 2013. The aforementioned markets of Latin America, Australia, and the Middle East will account for around two-thirds of this activity including major awards anticipated at Petrobras’ Mero 4 offshore Brazil; Qatar Petroleum’s North Field Expansion; Woodside’s Scarborough and Shell’s Crux both offshore Australia; and North Oil Company’s Al-Shaheen/Gallaf III offshore Qatar. Elsewhere, the US Gulf of Mexico is expected to see a recovery with the sanctioning of TotalEnergies’ previously shelved North Platte, Shell’s Whale, and Beacon Offshore’s Shenandoah developments also expected by year end. All in all, 2021 is expected to see a total of 15 Floating Production Systems, 220 subsea trees, 3,670 km (2,280 mi) of flexible SURF lines and 5,340 km (3,318 mi) of rigid pipelines awarded to the market.

Assuming oil prices remain above $60/bbl, this level of investment is expected to be maintained, with an average of $53.5 billion of EPCI value awarded annually over 2022-25. Some 25% of this is considered “firm” and associated with large developments in Latin America and the Middle East; 33% is considered “probable”; with the remaining 33% considered “possible.” Projects in this latter group are focused across Africa where regulatory and geopolitical factors are threatening the viability of projects across the Gulf of Guinea and East Africa; perhaps most notably in Mozambique where political unrest in the Cabo Delgado province has led TotalEnergies’ to call Force Majeure at existing LNG facilities. Higher risk, “possible” projects are also concentrated across Northwest Europe and Australia where increasing pressure on carbon emissions is forcing operators to reassess development plans. Woodside’s giant Browse prospect offshore Australia is amongst the largest (by capex) projects in our five-year outlook and is expected to enter FEED in 2023. However, the high carbon dioxide content of the gas reserves (estimated at 10% according to Woodside) is leading the operator to evaluate carbon capture and storage options which may challenge the project’s economics. Similar concerns over emissions management are also becoming an increasingly important factor in future project sanctioning across Europe.

Looking across the offshore oil and gas value chain, the floating production segment has arguably been the brightest performer and greatest beneficiary of this recent surge in offshore investment. In addition to the 15 units already referenced this year we expect a further 55 FPS contracts to be awarded over 2022-25 – this represents $71 billion of EPCI value and around 6.8 MMboe/d of new oil and gas throughput capacity. Perhaps unsurprisingly, around 50% of future FPS activity will be accounted for by the Latin American markets of Brazil, Guyana, and Suriname, where TotalEnergies is expected to sanction the country’s first deepwater development within the next 12 months.

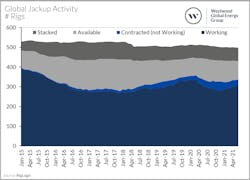

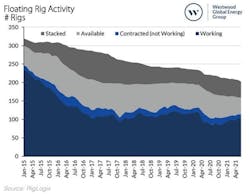

Conversely, the offshore rig market appears to be lagging. Contracted mobile offshore drilling units (MODUs) fell to a low of 430 in November 2020 due to combination of lower oil prices but also severe logistical challenges associated with the Covid-19 pandemic. Although counts have climbed steadily since then to reach 450 by June 2021, this is still well below the 1Q 2020 average of 487. At a global level, contracted counts for both the jackup and floating rig fleets are both depressed relative to pre-pandemic levels but there is a greater nuance regionally such as in the Middle East (excluding Iran) where development of shallow-water reserves has seen the local rig count reach 110 in June – the highest number on record. Similarly, floating rig counts across Latin America reached 36 in June, which although a massive 50% discount relative to 2013/14 levels, represents the highest contracted count since 2016. The continued investment into these two geographies is expected to continue to drive contracted rig counts over the next few years but the rest of the market has also benefitted from an acceleration of fleet rationalization over the past 18 months. Since January 2020, an estimated 65 rigs have exited the fleet, with around 40% of this accounted for by semisubs, 46% by jackups and 14% by drillships. This attrition has allowed total utilization levels to improve significantly with the global fleet averaging 63% in 2Q 2021, which is in line with 1Q 2020, despite a significantly lower contracted count.

The majority of rigs leaving the fleet have been sold for scrap and according to GMS, the world’s largest buyer of ships and rigs for recycling, there are more than 20 offshore rigs in the recycling market, either being marketed or already sold to cash buyers, which is an historical high for the offshore recycling industry. But we have also seen some assets move into secondary markets including offshore LNG production, deepsea mining and even offshore rocket launch pads for SpaceX (Valaris’ Ensco 8500 and Ensco 8501 deepwater semisubs). Perhaps one of the most interesting (and under the radar) rig transition projects has been SinoOcean’s conversion of its Jade and Faith jackups into wind turbine installation vessels. The assets, now known as the Guoxuan and the Guoxin and managed by Powerchina Guizhou Engineering, are expected to commence turbine installation work at the 500-MW Huadian Yangjiang Qingzhou 3 wind farm located offshore Guandong in July of this year.

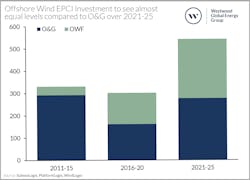

If 2020 is widely considered as an “annus horribilis” for the oil and gas industry, the opposite is true for offshore wind energy. That market experienced a record level of global EPCI awards (covering turbines, foundations, cables and stations) estimated at $42.8 billion. Around 49% of this spend came from Mainland China which has dominated global investment over the past few years as developers rush to bring capacity online prior to the expiry of federal feed-in-tariffs at the end of 2021. Over the first half of this year, Mainland China has become the world’s largest offshore wind market ending 2Q 2021 with an estimated 10.9 GW of fully commissioned capacity vs the UK’s 10.4 GW. We also believe Mainland China is on track to potentially bring a staggering 11 GW of new capacity online over 2021 with 16% of this already operational and the remainder in advanced stages of construction. This surge of activity has seen construction assets of all shapes and sizes mobilize from the Middle East, Europe and Asia, including the Guoxuan and Guoxin conversions mentioned above, to support the build out of this highly ambitious target.

Elsewhere, the European market saw $16.5 billion of offshore EPCI spend in 2020 (7.9 GW) with notable awards at the 2.4-GW Dogger Bank A&B development offshore the UK and the 1.5-GW HKZ 1-4 developments offshore the Netherlands. This year is off to a slower start with just $6.9 billion (2.1GW) awarded in the first half of the year, including RWE’s 1.4-GW Sofia development offshore the UK. This project is notable as the first confirmed use of 14-MW-rated turbines. We expect things to pick up in 2H 2021 with a further 3.4 GW of capacity reaching FID and $7.4 billion of EPCI investment followed by an average of 12.7 GW and $29.2 billion per year over the 2022-25 period as new markets such as Poland and Ireland emerge onto the scene. The first half of 2021 also saw significant progress for the US offshore wind market with first the formal confirmation of a 30-GW federal target in March and then the announcement of a “record of decision” for the long-awaited 800-MW Vineyard Wind development off the coast of Massachusetts. With a large and well-developed pipeline of projects across the eastern seaboard, we believe these milestones will trigger a wave of investment which could see the US installed capacity reach in excess of 22 GW by 2030.

With over 10,000 turbines and foundations, 30,000 km (18,641 mi) of cables and 180 offshore stations to be awarded between July 2021 and the end of 2025, the offshore wind energy market is fast becoming not just an opportunity for offshore oil and gas contractors, but a critical and necessary step in their evolution. The opportunity is there for offshore oil and gas contractors throughout the supply chain.