Norway set for further boost to offshore development following tax changes

Offshore staff

OSLO, Norway – Rystad Energy has identified 36 projects that could benefit from the Norwegian government’s recently introduced temporary tax relief package for the country’s petroleum industry.

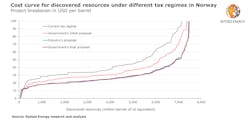

Analysis suggests the measure will improve E&P companies’ short-term liquidity and reduce breakeven prices for future development projects by on average around 40%*.

It should also help boost demand for harsh-environment floaters in the sector this year and in the years to come.

E&P companies can now deduct costs faster, resulting in on average 40% lower breakeven prices for yet-to-be sanctioned projects. This should lead some to fasttrack new projects on the Norwegian continental shelf over the next two years.

However, the increase in uplift implies that the tax neutrality - intended to make any investments equally profitable for the state and the companies - is no longer present in the petroleum tax regime.

Marius Kluge Foss, principal at Rystad Energy’s Consulting department, said: “Moving away from neutrality will effectively increase the Norwegian state’s risk associated with the relevant investments.

The potential 36 new projects - mostly subsea tiebacks or electrification schemes - are operated by Equinor, Aker BP, OKEA, Lundin Energy, Vår Energi, Wellesley Petroleum, OMV, Gassco, Shell, PGNiG, and ConocoPhillips.

According to the consultant, global demand for harsh-environment floaters looks set to return to 2017-2018 levels, due to the lower oil price and the supply chain consequences of COVID-19, only recovering from 2023 onwards.

Rig demand in the UK sector of the North Sea looks set to take the biggest hit in 2020, but Norwegian activity should hold steady through the downturn, thanks to the temporary tax changes.

The backlog in Norway is driven by Equinor’s long-term contracts for Transocean’s Cat-D semisubs, and Vår Energi’s contract for the semisubmersible West Phoenix for the Balder X redevelopment project.

Although three contracts have been canceled for work offshore Norway this year, the situation is better than in the UK sector, where production costs are higher.

Here eight rig contracts have been canceled in the UK so far this year, four final investment decisions on new project have been delayed, and only seven exploration wells are now likely to go ahead, way down from 32 in 2019.

Until market conditions improve more contract cancellations or delays to exploration wells could follow, Rystad said.

Operators in Norway have so far postponed 14 exploration wells to reduce 2020 capex.

* Provided a plan for development and operations is handed in to the governments before the end of 2022.

06/26/2020