Riser, injection configurations supporting high-output wells

Petrobras has won this year’s Offshore Technology Conference Distinguished Achievement Award for Companies for its innovations at the deepwater Búzios field development in the presalt Santos basin. Production started in April 2018 through the FPSO P-74, and output has continued to grow as further platforms have come onstream over different parts of the field. Over the past few years the company has developed and applied new downhole, subsea, and seafloor technologies to address conditions including ultra-deepwater, sub-salt reservoirs, high reservoir pressures, and large volumes of carbon-dioxide (CO2) in the wellstream.

Petrobras discovered the field (then known as Franco) in the Cessão Onerosa Transfer of Rights (TOR) region in 2010. Búzios is a giant, extending over an area of 850 sq km (328 sq mi) and in water depths ranging from 1,700-2,100 m (5,577-6,890 ft), 180 km (112 mi) from the Rio de Janeiro State coast. The oil is relatively light, in the range 26-28° API. The company submitted its proposal for the Declaration of Commerciality in December 2013 to Brazil’s National Petroleum, Natural Gas and Biofuels Agency. At the time, this estimated total recoverable reserves at 3,058 Bboe.

Following start-up, production rose rapidly as Petrobras brought online three more FPSOs within the space of 11 months. Like the P-74, the P-75, P-76, and P-77 are all conversions of former VLCCs, each with an oil production capacity of up to 150,000 b/d. Petrobras has since commissioned MODEC to construct a fifth floater which is due to enter service during the second half of 2022. Production should continue to climb through the remainder of the decade as more floaters are added, due to the company securing a 90% operated stake in additional volumes at Búzios under Brazil’s latest Transfer-of-Rights area auction, in partnership with China’s CNPC and CNOOC.

Offshore spoke to Petrobras’ project team about the challenges associated with a development of this scale.

Offshore: Following the initial exploration and drilling campaign were the size of the in-place reserves and the field’s areal extent in line with the company’s expectations, and what is Petrobras’ current estimate of the recoverable resource?

Petrobras: Since the Declaration of Commerciality (2013), with the drilling of new appraisal wells and new acquisition and processing of 3D seismic covering the entire field, the estimates of the areal extension and the volume in place have not changed significantly. However, the total recoverable volume is estimated to be much higher than the original contracted volume, which makes Búzios the world’s largest deep and ultra-deepwater field to date.

Offshore: Why did the government/ANP create the TOR regime?

Petrobras: The Cessão Onerosa Transfer of Rights (TOR) is a legal regime regulated by a contract signed with the federal government in 2010, by Law 12.276. According to the contract, Petrobras acquired the right to produce up to 5 Bboe in the areas assigned, equivalent to a $42.5-billion capital increase subscribed by the government of Brazil.

Offshore: How does the composition of the oil and gas, the subsurface setting and the quality of the reservoir compare with other giant presalt Santos basin fields, and how many wells are currently in production at Búzios?

Petrobras: In terms of reservoir quality Búzios and Libra have similar porous thicknesses, greater than those noticed in Lula. We are currently producing 16 wells, four connected to each floater, with well productivity of up to 60,000 b/d. Total production from Búzios is currently around 600,000 b/d and all the produced gas that is not used as fuel gas is reinjected into the reservoir. Our forecast is to start exporting gas in 2020, at a rate of 3.5 MMcm/d.

Offshore: Is the company considering further 3D seismic acquisition over the field to take advantage of the latest developments in subsurface imaging techniques? And does it plan any further drilling?

Petrobras: Yes. Petrobras is continually looking for new seismic imaging technologies, mainly with azimuth richness and broadband technology, aiming to a better characterization and monitoring of Búzios’ reservoirs. A well campaign has been planned in the Búzios field area where new production development projects will be implemented.

Offshore: Can Petrobras cover all the operating costs associated with the currently operating wells and production facilities, and what could future development phases entail?

Petrobras: The two Chinese partner companies will only participate in the consortium after the production-sharing contract becomes effective. The implementation of seven more FPSOs is under evaluation for the Búzios field. If all are installed, there will be total of 12 FPSOs.

Offshore: On which parts of the field are the four existing FPSOs, and has production so far been in line with expectations?

Petrobras: Three FPSOs were installed in the central area and one in the southwest area of the field. The productivity of the wells is similar among the four modules and is confirming the estimated production curves for the projects.

Offshore: Has the company made any requests for changes to MODEC for the fifth FPSO, based on experience to date? And does Petrobras envisage a standard design for the future platforms?

Petrobras: No. The FPSO for Búzios 5 was already contracted with the design adjustments that Petrobras considered necessary. The contracting strategy and project design to be adopted for the field’s next FPSOs are under evaluation.

Offshore: Petrobras has highlighted five major technical advances in its development of the field to date. Can you supply some background, starting with what the company claims to be the first-ever application of an optimized, 20-line torpedo mooring system for FPSOs in ultra-deepwater?

Petrobras: This development involved reducing the number of mooring lines per FPSO from 24 to 20, shortening the mooring radius and using the largest torpedo piles ever deployed by the industry. Each pile is anchored by its own weight, through gravitational force, launched from a certain height from the seabed to ensure a sufficient (minimum) penetration for resisting FPSO lateral movements. Petrobras developed the design in partnership with Brazilian universities.

Optimization of the mooring system reduced the radius by around 15% and raised the angular clearance between the bow and stern mooring clusters by around 15% as well, allowing connection of additional risers at preferential points closer to wells (i.e. portside for wells on the east of the platform, headed to the south in the Santos basin).

Through early engagement with our suppliers we achieved on average a reduction of 37 mi [59.5 km] in flexible and umbilical lines per module for the full life-cycle needs: in other words, this number is related to wells already in operation and to future tie-in opportunities. A higher reduction came when mooring optimization allowed positioning of the FPSO closer to the wells, or through altering the point of connection of certain risers and significantly reducing the length of their associated flowlines. These situations depend on the wells’ positions and on seabed characteristics, such as geological hazards. Our suppliers’ participation was of paramount importance in re-designing the riser configuration and reducing both the risers’ length and the amount of buoyancy modules, thereby saving material and installation costs.

Offshore: Another reported technical first is the application of 8-in. flexible production risers in ultra-deepwater to manage hydrogen sulfide (H2S) and carbon dioxide (CO2) in the field’s gas. Is this an in-house design, and can you explain how it works?

Petrobras: This is a technology developed by TechnipFMC that involves interconnection of the annular flexible riser sections. And with a vacuum and monitoring system installed on the platform, it allows continuous suctioning of the annular, thereby mitigating condensation of water vapor, and can also identify potential annular flooding.

The Búzios field is also the first development to employ large-scale flexible lines of 8-in. ID (risers and flowlines) for oil production installed in ultra-deepwater, allowing flow rates above 60,000 b/d, representing a new world record for offshore wells. These high production rates allow for a full FPSO ramp-up with only three wells. The solution has since been applied to other ultra-deepwater projects for high-productivity wells.

The system facilitates the integrity management of the flexible line along its entire length, from the top to the well, allowing verification of the annular flooding at different stages of life of the flexible line (handling, installation and operation). In addition, it allows access to the annular flexible line from the topside, lessening the need for ROV interventions for inspection of the annular flexible line.

Offshore: Another reported highlight of the project is the first use of simultaneous Water-Alternating- Gas (WAG) manifolds to receive oil and gas independently from the FPSO, and distributing these to selected wells to increase recovery.

Petrobras: The WAG manifold is being used at Búzios and on some of our other projects for water or gas injection. The innovation is the possibility of simultaneous injection of both fluids (water, gas) by the manifold. As one of the interconnected wells manifold injects gas, the other well can inject water simultaneously.

Offshore: Can you explain what is meant by “the first intensive use of intelligent completions in a ‘total fluid loss’ scenario”?

Petrobras: The scenario is only applicable to the well construction phase, when the intelligent completion system can be installed while having major fluid losses to the formation. The solution developed to overcome this situation includes the use of a lower completion system that is compatible with MPD (Managed Pressure Drilling) techniques and is capable of delivering downhole remote control and monitoring of the production (intelligent completion).

This new solution can be used in other presalt projects that might require the installation of intelligent completions in wells prone to heavy fluid losses.

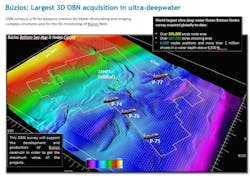

Offshore: Finally, Petrobras highlighted what it claims was the world’s largest 3D ocean bottom node (OBN) survey in deepwater in order to acquire an accurate image of the Búzios reservoir.

Petrobras: The NODES survey began in October 2018 and lasted one year. It will contribute greatly to improved reservoir characterization, also serving as a base survey for future 4D acquisitions, with a tremendous potential to add value to the field, both for implementation of new projects and for and production management. Furthermore, it will play a major part in definition and managements of the future Surplus of Rights projects. This and the other four technological breakthroughs are readily available to other players in the offshore industry. •