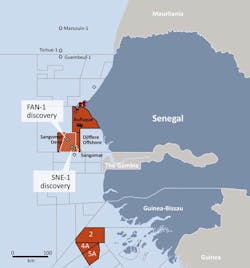

FAR credit lines under pressure for Sangomar project offshore Senegal

March 30, 2020

Offshore staff

MELBOURNE, Australia – FAR has issued an update on the impact of COVID-19 on its global offshore E&P operations.

The fall in the Brent oil price of more than 60% since January 2020 has hit the global availability of credit, the company said, compromising its ability to close debt arrangements for the deepwater Sangomar oil project offshore Senegal.

The lead banks to the company’s senior facility have now confirmed that they cannot complete the syndication in the current environment, and in addition, neither the junior nor mezzanine facilities that were being arranged will likely be completed for the foreseeable future.

At the end of February FAR had A$150 million ($91.9 million) cash and no debt.

Last week, Sangomar operator Woodside said the partners continue to assess options for sustaining the project.

Following the ICC arbitration in the International Court of Arbitration between FAR and Woodside Energy Senegal, the two parties have agreed to a settlement of their dispute.

The arbitral tribunal has now been invited to terminate the arbitration with immediate effect

03/30/2020