Offshore staff

PERTH/MELBOURNE, Australia – Woodside Energy is taking steps to respond to the oil price downturn.

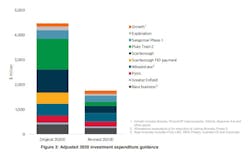

The company has cut its forecast overall expenditure for 2020 by around 50% to $2.4 billion. Further reductions should follow a review of all non-committed programs to support growth activities.

Woodside will push back final investment decisions for the Scarborough gas project off Western Australia and Pluto Train 2 on the North West Shelf to 2021. The offshore Browse gas project too will be deferred.

However, investments will continue in the Sangomar Phase 1 field development off Senegal, and the Pyxis Hub and Julimar-Brunello Phase 2 off Western Australia.

Most proposed exploration will be postponed, although some seismic acquisition will continue, reducing overall exploration spending by around 50% to $75 million.

Another Australian independent, Cue Energy, said its Oyong and Wortel fields in the Sampang PSC offshore Indonesia, continue to produce gas at normal levels for delivery to the Indonesia Power power station at Grati.

In New Zealand, however, a nationwide lockdown took effect at midnight on Wednesday. OMV, the operator of the offshore Maari oil field, is working with NZ regulators to determine how the field can continue to meet all regulatory requirements relating to safe operations.

Two of Maari’s production wells, MR6A and MR2, recently developed technical issues and have been shut-in. The operator is assessing the potential for repair and re-start of these wells, but that could be complicated by the current restrictions.

Cue and operator BP continue planning for the Ironbark-1 exploration well off northwest Australia, due to spud in late 2020. The contracted semisubmersible Ocean Apex is currently operating in Australian waters for another operator on a multi-well campaign.

Final timing of Ironbark-1 will depend to an extent on progress of the current drilling program.

03/27/2020