Offshore staff

OSLO, Norway – The Dogger Bank wind farm in the UK North Sea will not only be Equinor’s largest project through 2026, it will also rank as the sixth largest offshore development project in the world during this period, according to Rystad Energy.

Last week UK authorities chose Equinor and joint venture partner SSE to develop the world’s largest offshore wind farm, Dogger Bank, with an expected $11 billion in capital investments from 2020-2026.

The Dogger Bank wind farm will consist of three projects, Creyke Beck A, Creyke Beck B and Teesside A, with a total installed capacity of 3.6 GW.

Audun Martinsen, head of oilfield services research at Rystad Energy, said: “Equinor’s mega offshore wind investment promises hope for a deflated service industry. An 11-digit investment program - a rare occurrence within the offshore oil and gas industry - is entirely unprecedented in the offshore wind space.”

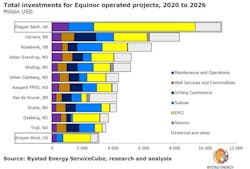

To put the investment into context, Rystad ranked all offshore development projects globally by total investments. For Equinor’s current portfolio, Dogger Bank will rank as number one for the period from 2000 to 2026, above the yet-to-be-sanctioned oil projects Carcara in Brazil and Rosebank in the UK.

In addition, the Dogger Bank investments will rival key Brazilian deepwater oil projects such as Mero and Lula.

The total value of awarded offshore greenfield oil and gas contracts to EPCI – engineering, procurement, construction, and installation – and subsea providers in 2019 is expected to be around $60 billion, a number that could fall to $43 billion in 2022, the analyst claimed.

“The influx of offshore wind contracts worth billions of dollars will be welcomed with open arms by marine contractors. Many anticipate challenging times ahead given the uncertain outlook for offshore oil and gas developments. Order intake is expected to struggle in the early 2020s due to the increasing market share of shale and OPEC oil, and the consequentially reduced oil prices,” Martinsen said.

Equinor hopes to become the world’s largest offshore wind operator, according to Rystad. In July, it won a major project offshore of New York, Empire Wind, which represents another $3 billion of potential investments. Four more projects, totaling around 7.4 GW in capacity, are also up for sanctioning in the 2020s.

“Equinor’s offshore wind master plan could hold the key to reversing this trend, as other operators rally behind the standard-bearer to put wind in the sails of the offshore industry,” Martinsen said.

09/27/2019