Offshore staff

TOKYO – Inpex has signed a heads of agreement (HOA) with the Indonesian authorities on a revised plan of development (POD) for the Abadi LNG project.

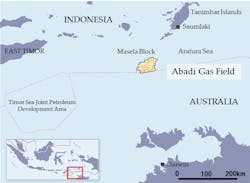

This will involve developing the Abadi gas field in the Masela block in the Arafura Sea, which Inpex operates in partnership with Shell.

The HOA outlines the terms agreed to following completion of pre-front-end engineering design for the revised POD.

Inpex has included a cost estimate for construction of an onshore LNG plant, gas pipeline, and offshore facilities, which is said to be sufficiently economically competitive.

The company will now start the process of submitting the revised POD for approval and of amending and extending the Masela block production-sharing contract.

Inpex said it would draw on its experience gained operating the Ichthys LNG project offshore northwest Australia.

Abadi will be the Japanese operator’s first large-scale integrated LNG development in Indonesia and should deliver around 9.5 MMt/yr of LNG.

The field offers strong reservoir productivity and has one of the world’s largest gas reserves, Inpex added, with the prospect of stable long-term LNG production.

Wood Mackenzie research director Andrew Harwood said: “After several setbacks it is a positive step for the project, which is of national strategic importance given its size and potential contribution to Indonesia’s oil and gas supply outlook…

“The proposed PSC terms are confidential, but we understand that the Indonesian government and Inpex have agreed terms that improve the project’s economic viability.”

Wood Mackenzie estimates that more than 90 MM metric tons/yr (99 MM tons/yr) of new LNG supply capacity globally will undergo final investment decisions (FID) in 2019-2020.

This could mean spending of more than $200 billion on LNG projects between now and 2025.

With this high level of activity, Harwood claimed, LNG operators will be under pressure to avoid the cost and schedule overruns that previously beset the industry.

There are two key risks that Inpex and Shell will have to consider, he added. First, with Abadi set for FID by 2022, the partners will be dealing with crowded construction and engineering markets.

Secondly, the project will come onstream around 2027, at which point the environment for marketing LNG offtake to buyers may be less favorable as other LNG supply will by then have entered the market.

However, having ramped up output from Ichthys, Inpex should have strong cash flow to carry a second LNG project.

The Abadi PSC term will expire in 2028 following approval of the extension term.

The contract area spans 2,503 sq km (966 sq mi) in a water depth of 400-800 m (1,312-2,624 ft). The field location is 150 km (93 mi) offshore Saumlaki in Maluku Province.

Inpex forecasts natural gas output (LNG equivalent) of 10.5 MMt/yr, with up to 35,000 b/d of condensate.

06/17/2019