Offshore staff

NEW YORK CITY – Evercore ISI has issued its “Offshore Rig Market Snapshot” for April 2018. While the findings indicate a slight dip in the offshore drilling rig contract market in March, the Evercore report also pointed to a number of hopeful signs for the near term.

The report noted that contracting activity slowed again last month.A total of 23 contracts wereconfirmed in March, just one contract shy of 24 contracts confirmed in March 2017. Evercore says that this marks the third time in 15 months where the month-to-month comparison was negative for the industry, and the trend could extend for a third straight month with only nine contracts confirmed thus far versus 20 at this point a year ago.

However, with Saudi Aramco believed to be close to awarding several multi-year tenders, and Brent oil prices continuing to strengthen, the firm says that it expects contracting activity to re-accelerate over the next few months.

Meanwhile, contract terms appear to have lengthened a bit with three floater contracts averaging 386 days, the highest monthly average in almost two years. Eni contracted thePacific Bora for six wells or an estimated 540 days offshore Nigeria, making it likely one of two rigs that will be used in the development of the Zabazaba field.

Elsewhere, Statoil has extended Odfjell’sDeepsea Atlantic for six wells or 540 days offshore Norway. The reported $296,000/day rate for the 10,000-ft harsh environment semi is fairly flat from its prior $301,000/day rate (signed June 2015) but it will keep the sixth-generation rig contracted through August 2020, with an unexercised option to February 2021.

In addition, the report notes that theNoble Paul Romano has been extended by Hess for 2.5 months at the same $115,000/day rate in the US Gulf of Mexico. The 6,000-ft fourth-generation semi has been working for Hess in the Gulf since September 2015.

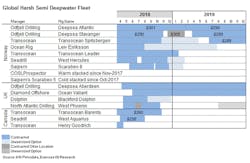

Meanwhile, Evercore notes that the harsh environment rig market is “tight and getting tighter,” especially in the North Sea as highlighted by Statoil’s extension of Odfjell’sDeepsea Atlantic. While the new $296,000/day extension rate is generally flat from the prior $301,000/day rate, it is up slightly from recently signed $288,000/$289,000/day rates seen offshore Norway.

Notably, the $289,000/day rate for theTransocean Spitsbergen is for a 6,500-ft sixth-generation semi, and with only three other sixth-generation semis have availability in 2019 (West Hercules, Scarabeo 8, COSLProspector), Evercore says it expects Lundin to exercise the options on the Leiv Eiriksson. The firm also notes that it “would not be surprised if the Transocean Barents and West Phoenix return to Norway with new contracts in hand.”

04/18/2018